We are firm believers in studying market statistics.

We subscribe to some of the most advanced statistical analysis packages available in order to help us communicate market conditions to our clients and to let it help guide decision making.

Many firms focus their pricing models exclusively on comparable sales (a more in depth discussion can be found here) and ignore many critical inputs to pricing.

We do not.

We are firm believers in studying market statistics.

We subscribe to some of the most advanced statistical analysis packages available in order to help us communicate market conditions to our clients and to let it help guide decision making.

Many firms focus their pricing models exclusively on comparable sales (a more in depth discussion can be found here) and ignore many critical inputs to pricing.

We do not.

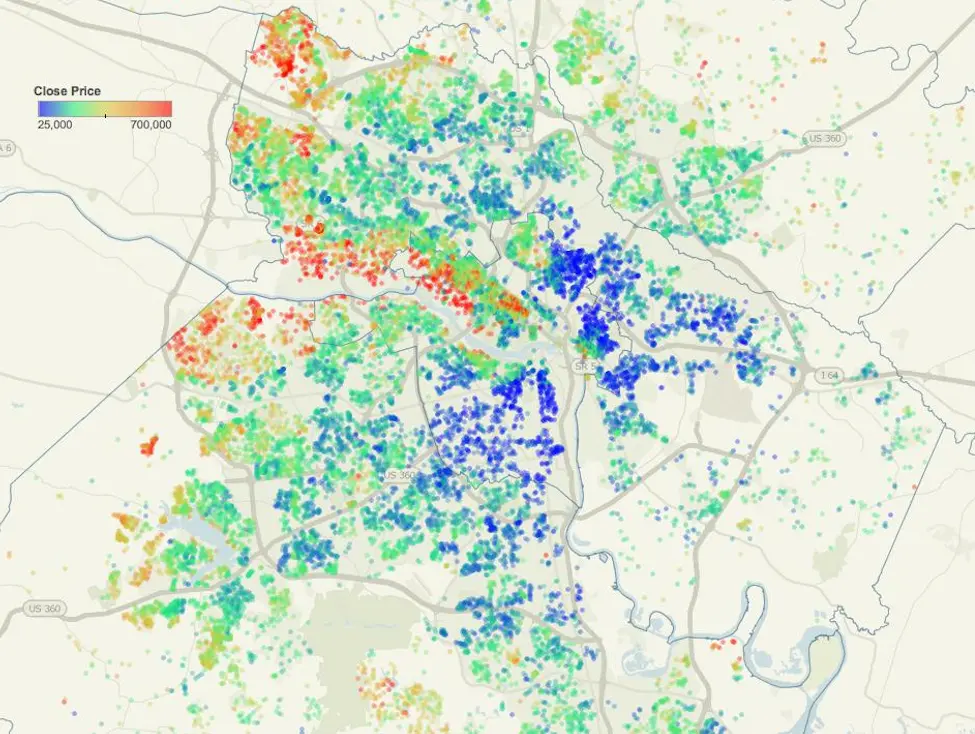

Market Stats

We are firm believers in studying market statistics.

We subscribe to some of the most advanced statistical analysis packages available in order to help us communicate market conditions to our clients and to let it help guide decision making.

Many firms focus their pricing models exclusively on comparable sales (a more in depth discussion can be found here) and ignore many critical inputs to pricing.

We do not.

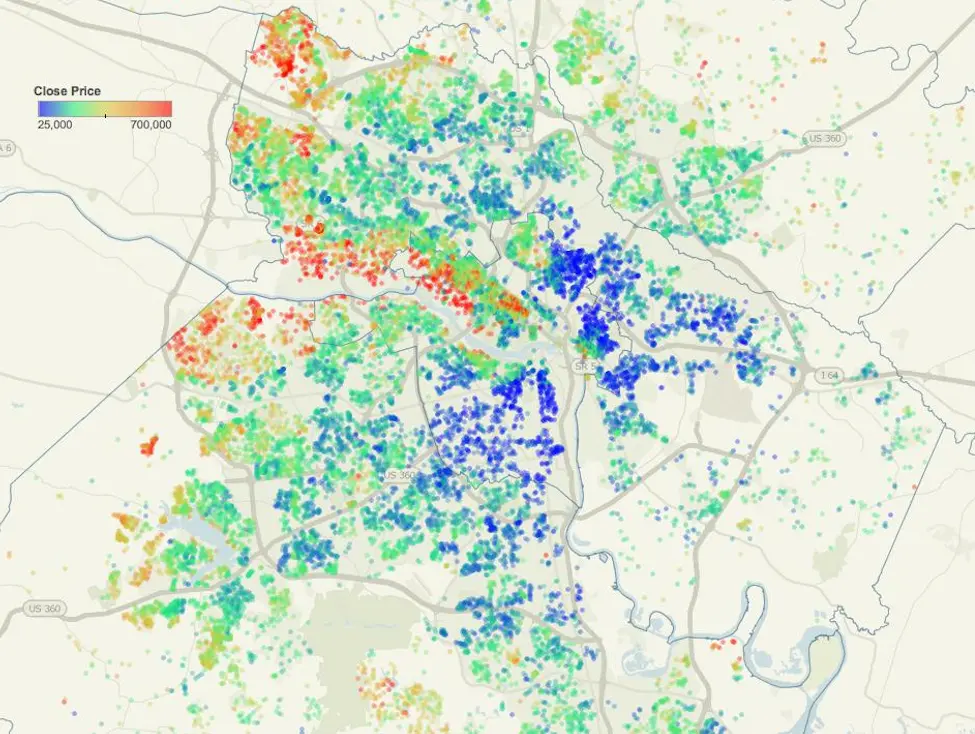

We are firm believers in studying market statistics.

We subscribe to some of the most advanced statistical analysis packages available in order to help us communicate market conditions to our clients and to let it help guide decision making.

Many firms focus their pricing models exclusively on comparable sales (a more in depth discussion can be found here) and ignore many critical inputs to pricing.

We do not.