‘Are you working with an agent?’

‘Well, sort of…but I didn’t want to bother them…your site is so good I just tend to search here’ or ‘Yes, but I am doing my own research and your site had a lot of info’ or ‘well yes (lie) but I, uhhh, wanted some information on this house.’

We get a version of these comments frequently and, honestly, we find it both wonderful (it is an endorsement of the value on the site) and frustrating (in that many are using an agent whose market knowledge is not sufficient to truly serve their client.) I guess everything has a yin and a yang. Knowing that we provide value feels great but knowing we often times provide it to another agent’s benefit is what sometimes gives us a little bit of heartburn.

Look, we knew that when we made the conscious decision to put our thoughts out there for the market to read, we were giving away our knowledge for free. And while giving away products for free is not the best way to run your business, we realized that Google’s mission is to identify the most valuable sites in any arena. In order to rank, we needed to offer the most value.

We also hoped, by putting ourselves out there, it would allow the marketplace to see the depth of our knowledge. Google measures value through the public’s engagement with your pages, the time spent on your site, the number of pages viewed and the number of other sites which link to you…as well as about 200 other factors. For the most part, it has been a very successful endeavor for us as we have developed a loyal following online and helped many folks transact a piece of real estate all over Richmond…which is rewarding.

But what we have yet to figure out why so many people use our site, register to receive updates and otherwise willingly engage, despite a relationship with another agent.

The rules of engagement for the agent community are gray, even in the eyes of those who know the rules (Realtors.) The rules of engagement for the buyers and sellers of the world are far more murky in that who represents whom and at what point is a client bound to an agent is complex and subtle, even when explained and expressly written. Suffice it to say, we understand the frustration felt by the market when trying to decipher the confusing world of Realtor representation. We can only assume that the lack of clarity is partially to blame for the marketplace using our site for value and then their own agent for execution.

So…generally speaking, we have found the following are the most common scenarios for folks who use our site:

The ‘Actually Committed-to-an-Agent’ Buyer – We get many who call/e mail/register for our sites but are actually committed to an agent…which is fine. For a myriad of reasons a buyer or seller may feel obliged to use a specific agent:

- family/friend/colleague

- former relationship

- met them at an open house and they send me stuff

- I looked at house with them

- my buddy recommended them

Some of these reasons are pretty legitimate (we have actually several registrations from Realtor’s kids looking for a house!) and some are not. Regardless, we offer the following question, ‘Why can they not provide this information or guidance to you?’ If they cannot, I would ask why their are involved at all.

Ultimately, if the bond is so strong, then get your agent involved now. They need to know you are looking and they need to help guide the search. Don’t feel as if you are bothering them, you may be committing transgressions you are unaware of.

Otherwise, if you do not feel they are the right person for the job, remove them from the equation. Lingering or uncertain representation relationships are a recipe for trouble.

The ‘If I TELL Them I am Committed to an Agent, They Won’t Harass Me’ Buyer – We get it. Nothing is more annoying than a salesperson who seeks to accelerate YOUR buying process to accommodate THEIR schedule. That being said, a good salesperson is more advisor than ‘pressure-applier’, especially in today’s informational intense environment, and can clarify and offer pointed guidance about the market, the process or strategy. We have worked with buyers literally YEARS BEFORE THE TRANSACTION OCCURRED!

Do not feel as if you need to tell us you are working with an agent to keep us at comfortable distance, just tell us where you are in the process. The goal in early stages is to structure the search/research in such a way as to offer the most value. We have many tools at our disposal that you do not…allow us to help you use them.

The ‘I was trying to reach the LISTING agent’ Buyer – It is frustrating when you try to call a listing agent and get someone other than the listing agent. The rules which allow brokerages to display listings other than their own on their sites makes discerning who has what for sale quite confusing…we get that.

Ultimately, using a listing agent as your primary source of information may not always (think – RARELY!) be the best strategy. It is the listing agent’s job to make the subject property seem like a qualifier for ‘Deal of the Century.’ Having your buyer’e agent call the listing agent is a far better strategy.

The ‘I Had a Bad Experience with a Realtor’ Buyer – Yep, that sucks. We have all had a bad experience with a service provider at some point. It turns you off of the entire industry. What we offer to all those who do have the courage to call and engage is the following…lets chat and see if we strike the correct tone of respect for your search.

You should know that we can provide our resume and a long list of clients who you can ask about our ethical behavior, market knowledge, availability and overall skill. Most don’t realize that not only are you allowed to ask for these references, you should. Vetting us as your potential representative, in our opinion, is one of the most important aspects of our business. We choose to operate in a transparent manner, and this site is only one such example. When we can offer references from architects, bankers, many of Richmond’s most talented developers, business owners as well as a host of hard working individuals, we feel as if our track record of successful and impactful relationships is our greatest assets. Research us, we invite it.

Summary

Whether you fall into one of the categories above or just don’t fully understand the rules of representation, just let us know where you are in your search, what questions you have and how we can help. We will act accordingly and at your pace. Remember, you have the right to demand value from your representative, whoever it may be, and you have the right to work with who you choose. Just know that a good agent will know:

If we offer the most, then we will earn your business, and you deserve the most value in your representation.

If you want to know more about what a Buyer’s Agent does, read more here…

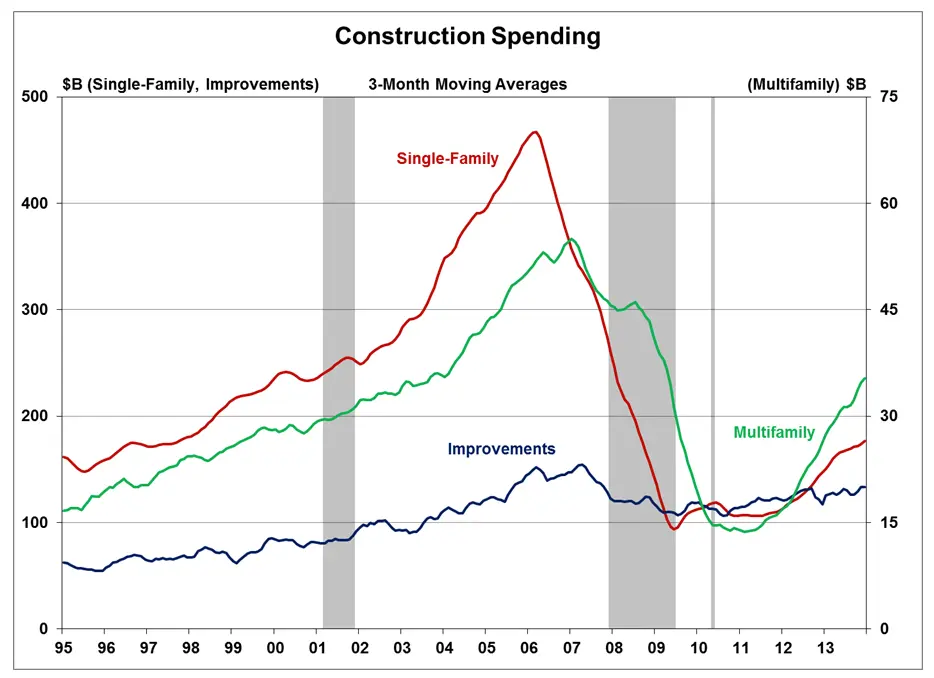

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.

Good loan officers will ask the right questions and determine which process is best for you, but since in many cases, you have no idea of the skill or experience of the person you may be talking to about Pre-Qualification or Pre-Approval, my desire to arm you with the information to know which one is best for your success. When in doubt…never be afraid to ask your loan officer and go over your situation. Also, always be up front and honest about your circumstances. Gone are the days where lenders will not find out about any financial skeletons. Your loan officer is working to help navigate you thru the right process and the ultimately the right mortgage. Full disclosure is critical to his or her ability to provide that service. Rule number 1 for any great loan officer…always put your borrowers in the best possible position to succeed with their purchase transaction and ultimately in homeownership!

Good loan officers will ask the right questions and determine which process is best for you, but since in many cases, you have no idea of the skill or experience of the person you may be talking to about Pre-Qualification or Pre-Approval, my desire to arm you with the information to know which one is best for your success. When in doubt…never be afraid to ask your loan officer and go over your situation. Also, always be up front and honest about your circumstances. Gone are the days where lenders will not find out about any financial skeletons. Your loan officer is working to help navigate you thru the right process and the ultimately the right mortgage. Full disclosure is critical to his or her ability to provide that service. Rule number 1 for any great loan officer…always put your borrowers in the best possible position to succeed with their purchase transaction and ultimately in homeownership!

Typically lenders do not want to fill a pipeline full of active loans without real property addresses or fully ratified purchase agreements. It would force them to devote valuable human resources to borrowers who may or may not ultimately purchase a home or even use that lender for actual mortgage transaction once a purchase agreement is executed. It would raise lending costs due to the increased resources and slow the process down for “live” loan applications. Instead, they will tag you as “lead” or some other similar category, do all of the necessary ratio calculations, produce the Pre-Qualification letter and move on to the next call or email while you are completing your home search and /or negotiating your transaction.

Typically lenders do not want to fill a pipeline full of active loans without real property addresses or fully ratified purchase agreements. It would force them to devote valuable human resources to borrowers who may or may not ultimately purchase a home or even use that lender for actual mortgage transaction once a purchase agreement is executed. It would raise lending costs due to the increased resources and slow the process down for “live” loan applications. Instead, they will tag you as “lead” or some other similar category, do all of the necessary ratio calculations, produce the Pre-Qualification letter and move on to the next call or email while you are completing your home search and /or negotiating your transaction.