It depends.

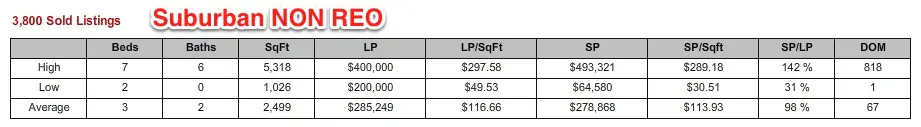

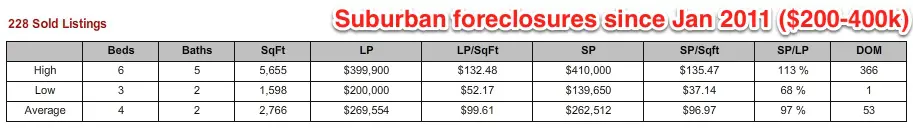

According to the statistics below, since 2011, in suburban Richmond, the REO market (Real Estate Owned by banks) accounted for roughly 5.6% of the market (228 of 4,028 sales) and traded at an average of nearly 15% lower ($114/SF to $97/SF), respectively.

If this $16/SF difference is viewed in the context of a 2,500 SF home, then the average price difference is $40,000.

Is that enough?

It has always been a buyer tendency to over-estimate the cost of repairs. People that walk into a home that is in need of paint, flooring, appliances and light to medium drywall repair and feel put off by the repairs. “If the naked eye can see the items in the home that are in need of repair (they reason) then what CANNOT be seen is something that will bite them later.” It is a legitimate fear but one that is often over-estimated and thus, REO property gets discounted more heavily than non-REO property.

Does that mean that you should seek REO property? This doesn’t suggest that you should or shouldn’t but it does suggest that REO property is treated differently than non-REO property. It also gives insight to the bank’s view of the property they own and their expectation of the value at which they should sign an offer.

The following list contains primarily suburban REO property that is priced between $200 and 800k. The information on this site may lag up to 48 hours as do all IDX search sites.

Contact us at 804.201.9638 (our call policy) for an up to the minute/real time list of all distressed property.