Each year, we try to push out our thoughts about the housing market in the coming year.

2022 is no different.

The presentation we did this year we feel is one of the most important ones we have ever done.

Why?

Because the market conditions are quite frankly, unprecedented.

At no time in our history have we had so many extreme inputs to the market –– from inventory to stimulus to mortgage rates to inflation to migration –– everything.

To offer you a taste of what is in the presentation, here is a sample of what we see coming:

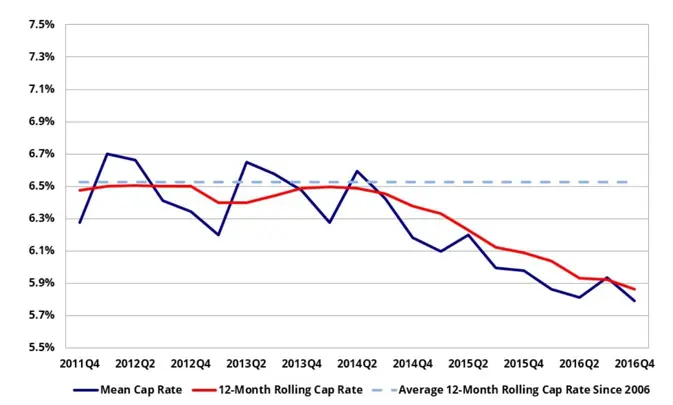

- prices should continue to increase –– even possibly spike again

- mortgage rates should rise

- inventory conditions will continue to be near historic lows

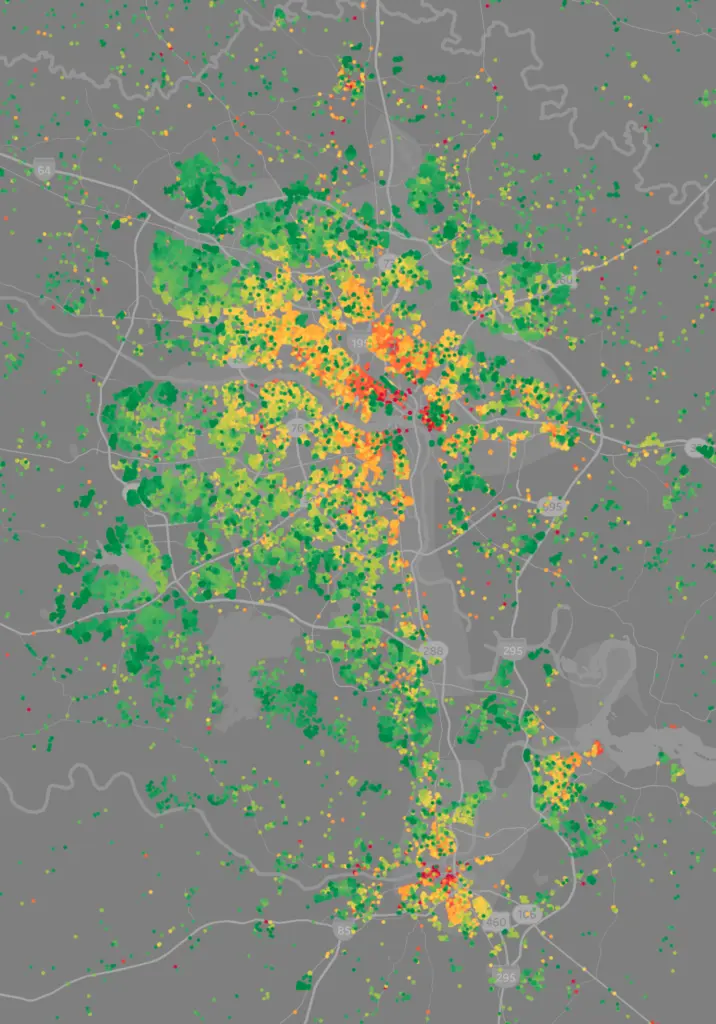

- migration to our region has never been higher

- 2008 vs 2022 price analysis

- new housing difficulties

And so much more…

Enjoy!

And in doing so, it gave us time to reflect back on what we had done in our first decade:

And in doing so, it gave us time to reflect back on what we had done in our first decade: