‘How much a foot?’

‘How much a foot?’

‘What is the per foot on that home?’

‘Feels like a lot per foot!’

‘Dollar per Foot‘ is probably the most used of the comparative statistics in the valuation of housing today. Every buyer references it at some point during the home buying process — as do most sellers. And so do Realtors, architects, appraisers, developers, builders and your local tax assessor.

And while we are all guilty of using $/SF at some point, we need to be extremely careful to make sure we are using it correctly.

Dollar Per Foot is (Unfortunately) the Main Comparison Metric

The name itself suggests that the measurement is the ratio of the price of the home relative to its size.

Stated differently, if you were to buy one square foot of the home, how much would it cost?

But it isn’t quite that simple because the $/SF metric does not account for anything other than the FINISHED amount of square feet in the home relative to its price.

Do you what factors are not considered to be in the $/SF measurement?

- garages

- unfinished basements

- oversized lots or extra lots

- water frontage

- fencing

- screened porches

- exterior hardscapes/landscaping

- other outbuildings

- roof decks

- views

- age of systems

- poor floor plans

- beds/baths

Do you know what else $/SF doesn’t adjust for?

- finished 3rd floors are given the same credit as the first two levels

- finished basements are give the same credit as the first two levels

- finished bonus rooms or other finished rooms over garages or outbuildings

So as you can see, the $/SF is a metric with many flaws.

So is $/SF Worthless??

Far from it.

$/SF can be a great measurement when the following conditions are met:

- the homes being compared are similar in age

- the homes being compared are on similar lot sizes

- the homes being compared have the same amount of unfinished space

- the homes being compared have similar materials

When you are comparing two homes in the same neighborhood, with similar characteristics, then using $/SF as a measurement is fine.

However, far too often, the $/SF is used far too broadly and without any consideration for the many factors that can skew the results. I cannot tell you the number of times I have heard a client say that Home A is a better $/SF than House B — and thus a better deal — without making any adjustments for a finished 3rd floor or far better lot.

Some Great $/SF Applications

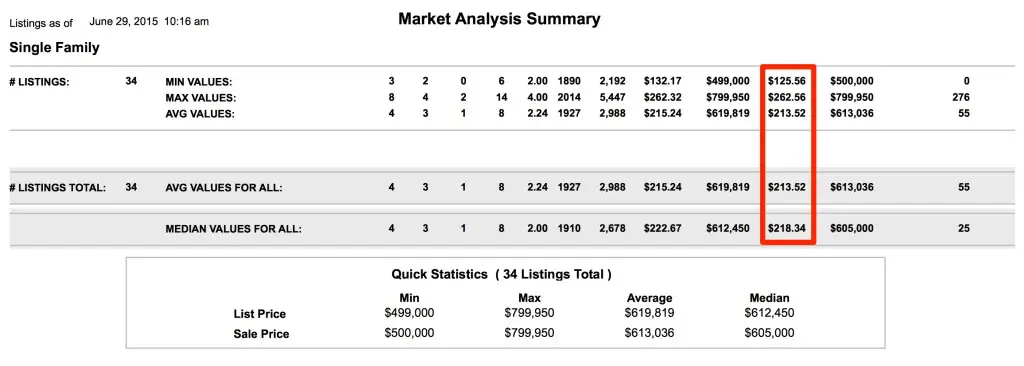

One the best applications for $/SF is seeking the neighborhood highs and lows.

In every neighborhood, properties will trade in a range where no home’s value rises above or sinks below. Finding these data points can be extremely helpful when trying to establish pricing, especially when pricing unique properties.

The more narrowly the homes in the data are defined, the more valuable this feature becomes in establishing the limits for the values. Agents familiar with this feature will be able to help a buyer or seller understand where the subject property fits into the range of values.

Using $/SF as a Time Machine

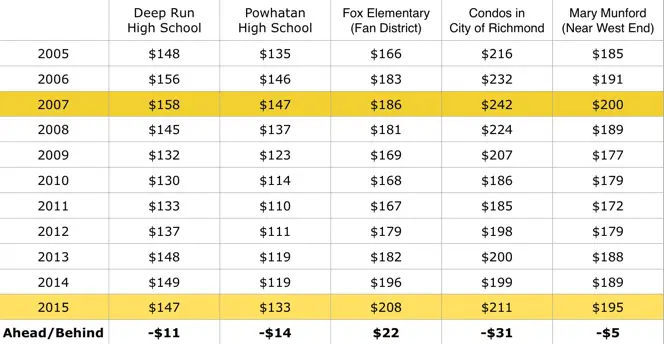

In case you missed the memo, 2008 – 2012 was a rough stretch.

Almost every market was impacted — equities, banking, real estate, manufacturing, retail — no asset (and no individual) was spared its wrath. The financial crisis was a wholly unpleasant adjustment in values and real estate arguably led the way.

As we continue to put that ugly period further in the rear view mirror, many who made purchase decisions at or near the apex (2006/7) wonder if the 20-30% loss has recovered enough to now sell. Using $/SF as a measurement is one of the best ways to tell.

As you can see from above, a yearly breakdown of $/SF vividly illustrates the relative health of different marketplaces. Using the same geographic data but changing the time periods measured is a fabulous application of $/SF and can lead to some great strategy decisions.

Using $/SF in Reverse

Often times, we recommend to our clients to look for HIGH $/SF to find underpriced housing.

Wait … what??

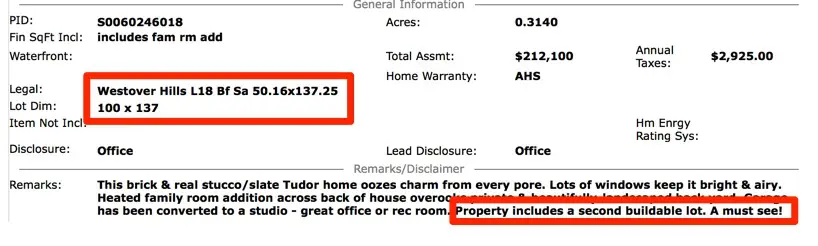

In certain cases, $/SF values considered higher than the neighborhood averages may indicate that the improvements on a piece of property are low and might be a good spot for an addition or lot split. Having a situation where the value of the land is at or near the value of the improvements often times means opportunity for the shrewd investor.

As an example, decades ago, it was a fairly common practice for an owner to purchase the adjacent lot to give their home extra privacy. Over the ensuing decades, these unimproved lots were often merged with the improved ones and simply sold as a package. As pressure to create more housing closer to the city center continues to increase, a growing number of builders are looking for infill lots and will pay a premium for the opportunity to build a home upon them.

Similarly, it is fairly common to see a small ranch or colonial-styled home nestled in amongst larger homes, especially in the neighborhoods of the 1930’s to 1960’s. If market values within the neighborhood exceed the cost of construction by a wide enough margin, these undersized homes present opportunities to add space to the home and create value.

Knowing how to set search parameters in MLS to identify possible opportunities for the contractor/developer/flipper can be of great service to the investment-oriented client. Mastering this application of $/SF will help an agent identify these ‘value-add’ scenarios and create both loyal clients and repetitive income streams.

Condos and $/SF

In case you haven’t noticed, condos tend to trade a higher $/SF than single family homes. Far more often than not, the $/SF for a condo in the city of Richmond is anywhere from $5 to $20 higher than comparable single family.

Likewise, the $/SF for condos can vary wildly not only from project to project, but often times within the same building.

Why is this?

- Condos compute square footage differently. They generally measure floor space while single family measures from the outside of the walls — thus condo $/SF tend to be higher than single family homes.

- Condos tend to be more valuable on the upper floors or where the views are best. A condo on the 2nd floor looking at the parking deck should have a different price than a 10th floor condo looking at the River

- Condo A might include more in the dues than Condo B and thus trade a premium.

- Larger condo units sometimes include more parking than smaller condos — even in the same building.

So when applying the $/SF measurement to the condo market, you really need to makes sure the external factors influencing values are taken into consideration before any decisions are made.

Summary

Beware of the overuse of the $/SF metric as many sound decisions have been undermined by the misuse of the statistic.

As we continue to speed towards the era where more and more data is more and more available, we need to remember that access and analytics are two different things. The creation of new and complicated statistics is easier than ever before, but it does not necessarily mean they are relevant, accurate or applied correctly.

At the end of the day, the $/SF statistic is one of many and tells only one piece of the overall story. Make sure to understand its application and relevance before you make your decision.

Someone should write a condo app. The app wouldn’t sell anything or make sounds or track anything. It would simply be an app that brokers could point their clients to once the litany of questions about condo dues comes up.

Someone should write a condo app. The app wouldn’t sell anything or make sounds or track anything. It would simply be an app that brokers could point their clients to once the litany of questions about condo dues comes up.