Why is the assessment so high (or low)? Why does Zillow say my house is worth so little (or so much)? Is that the same as my home’s Market Value? And why is the appraisal different from the assessment?

It can be confusing to say the least.

Agents are asked a version of this question with regularity and often, time does not allow us to fully explore the subtleties of the answer. The summary answer is that each ‘valuation’ is estimating a different value, using differing data and for differing purposes.

Market Value (or Fair Market Value)

Any discussion of the different valuations begins with the definition of Fair Market Value (FMV). Fair Market Value is the measurement which most closely reflects the value of the asset at any given point in time. The simplest definition of FMV is: the price at which both a rational buyer and a seller would exchange the asset neither under undue pressure.

Two key points to remember :

- FMV is established by the market

- FMV measures a specific moment in time

Stated differently, FMV is NOT established by a third party at a point in the PAST. While there may be additional interested parties to the transaction other than the buyer and seller (lender, mortgage insurer, title company, assessor’s office), they are not the ones who set the FMV. FMV is set by the market and all other valuations SHOULD be driven by this fact.

Alas, it is not always so. FMV is under attack by the other parties in the transaction and in order to make an informed decision, a buyer or seller needs to understand the intent of each of the other forms of valuation.

Below begins a discussion of the other common valuations and how they are established.

The Assessment (Tax Assessment)

Each year, property owners get a piece of paper from their local City (or Town) Hall asking them to remit payment to the treasurer for their property tax. We all open the bill with curiosity to see where our ‘assessment’ is and generally, it is met with a grunt, nod or gasp. Sometimes we feel it is so egregiously incorrect we place a call to the local assessor’s office to argue that the value is either too high (meaning you are paying too much in tax) or too low (meaning that you wish to pay more in tax…not sure I understand why people wish to argue their values UP, but I digress…) Regardless, the assessment value is what your property tax bill is based on.

Now, how is the assessment established? Much like Realtors, assessors use a combination of factors including size, age, beds, baths and location, as well as sales price of other ‘similar’ properties…and establish a value. A city or county does not have to be right, they just have to be ‘close enough.’ In reality, the perfect assessment is one which generates the most revenue without making its residents vehemently complain. As the actual bill is computed by taking the tax RATE and multiplying it by the tax ASSESSMENT, so a county is better off to lower assessments and up the rate…which they do with regularity.

So how accurate are assessments? A word that comes to mind is ‘somewhat.’ The assessment uses the least current information (tax assessments are generally adjusted on an annual or bi-annual basis) and it uses the least accurate information. Since the assessment department does not see the information in MLS and rarely (if ever) visits the home, an assessors office will likely not know if a home has been improved or unfinished areas are completed (think 3rd floor or basement.) The assessors office will likely not know (or really care) about the condition of a property (unless it is in need of condemnation) or if deferred maintenance has been kept up with and if the grass is cut regularly…despite all of these factors impacting FMV.

Accuracy Level – 85% at best and generally below the FMV, unless the market is falling dramatically.

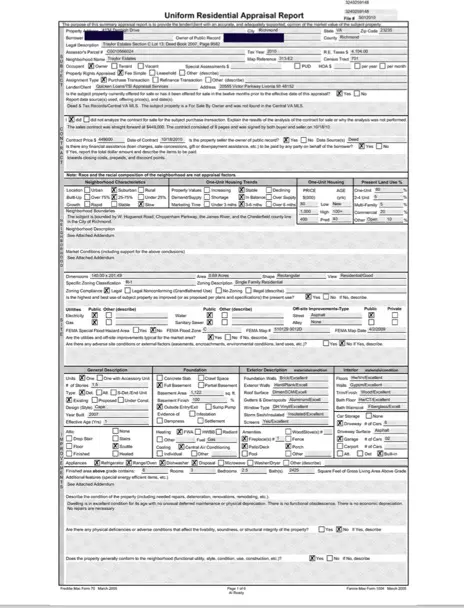

The Appraisal

If you have recently gone through the purchase process and used a mortgage as a part of your purchase, you are familiar with the appraisal.

So what is an Appraisal? An appraisal is a valuation process required by almost every lending institution when a buyer is using debt (a mortgage or loan) to purchase a home.

It goes like this – a bank contracts a professional appraiser to examine the property and offer an unbiased opinion the value. An appraiser (generally) has access to the most accurate information (MLS data), the most recent sales and actually visits the property to confirm measurements and condition. (*** It should be noted that appraisers are licensed and required to attend continuing professional education and many seek additional designations in order to help value more and more complex properties. In addition, all appraisers use standardized forms to help guide the process ***)

How do appraisers establish values? While the appraisal process notes the three primary methods of valuation (comparable sales, income approach and replacement cost) the comparable sales method is the most common when establishing value of single family homes. It is the job of the appraiser to compare the subject property to 3 of the most applicable (and recent) sales in the immediate marketplace and make adjustments for any differences. Simply put, an appraisal on a 5 bedroom home in Salisbury should be compared to other 5 bedroom homes of similar size and age in Salisbury with small adjustments for differing features (garage size, lot size, new roof, etc.) The houses being used for comparison purposes should be substantially similar…thus the term ‘COMPARABLE sales.’

What is the purpose of the appraisal? The appraisal is used by the bank or mortgage company to establish the maximum loan amount. Typically, the effective interest rate increases (and this is a gross over-simplification) the more debt is applied to the value of the home. Stated differently (and another incredibly gross over-simplification), a bank might give you an interest rate of 5% if the loan is 80% of the value of the home but closer to 6% if the loan is 90% of the home’s value. The bank uses the appraisal (and NOT THE SALES PRICE) to establish the ‘loan to value’ ratio for the home. If the appraisal is less than the sales price, then either (and alert, my last gross over-simplification is coming) the buyer must make a bigger down payment or accept the higher rate. Needless to say, a great deal hinges on the appraisal, especially when maximum loan amounts are sought, and many deals have failed to consummate due to an appraisal coming in lower than the sales price.

Then how do appraisals differ from FMV? In many minds (including appraisers, underwriters AND many Realtors) an appraisal and FMV are one and the same…which is unfortunate. An appraisal is measuring value at a past point of time to establish a value in the present under the assumption past and present market conditions are effectively constant. Using recent history as an example, the rapidly accelerating (or decelerating) markets of spring 2013 (or summer of 2008), the appraisers were being asked to value properties whose values were literally shifting several percentage points each month and thus, no longer accurate.

And remember, the appraiser did not see what the buyer saw during their home selection process. A buyer can easily look at 20 homes during their search and select the best option given the available homes at the time. The appraisal seeks to compare the subject decision to one made during a different time period and by different people who saw an entirely different set of homes. Far too little attention is paid to this hugely important fact.

Regardless of the arguments presented above, the appraisal is USUALLY accurate enough (in most instances) and while not perfect, is probably the most accurate of the measurements of Fair Market Value.

Accuracy Level – 95-98%

The Zestimate (or other Automated Valuation Models…sometimes called AVM’s)

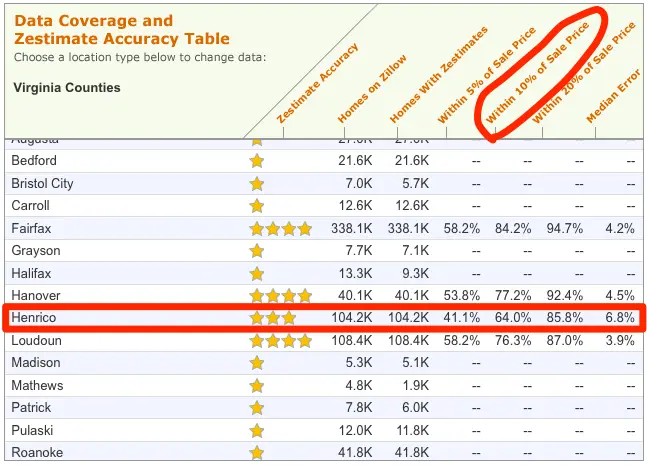

A lot has been written about the issues with Zillow’s estimate of value. They are far from the accurate estimates the market feels they are.

In Henrico County, for example, Zillow offers the following disclaimer – a Zestimate of $400,000 means a computer in Palo Alto has estimated that the ultimate sales price be +10% in 64% of the cases. The other 36% of the time, the value is less accurate than that.

Use the Zestimate at your own risk.

Accuracy Level – see the chart that Zillow publishes

Summary

If there is any takeaway from this post, it is the measurements of value are all measuring different things for different parties. Do not mistake any of the varied measurements for FMV. If you and your agent take the time to do the correct homework and to structure the search correctly, then the correct outcome will occur. Before you allow a Zestimate or Assessment to cloud your view of a home you are considering, take a good look at the methods used to establish the valuation and ask yourself who is doing the measuring and how they came to their conclusion. If you do your own homework and strive to understand the forces that drive the market, your own estimate will be far more valuable than anyone else’s.

As the snow melts, the flowers begin to bloom and the birds (and bugs) emerge, so do For Sale signs. The spring market is when the large number of homes in our marketplace will transact. Sometimes it is January and sometimes March, but once the weather breaks and summer vacation seems almost reachable, the buyers and sellers emerge and begin their mating dance to see who sells what to whom and for how much.

As the snow melts, the flowers begin to bloom and the birds (and bugs) emerge, so do For Sale signs. The spring market is when the large number of homes in our marketplace will transact. Sometimes it is January and sometimes March, but once the weather breaks and summer vacation seems almost reachable, the buyers and sellers emerge and begin their mating dance to see who sells what to whom and for how much.