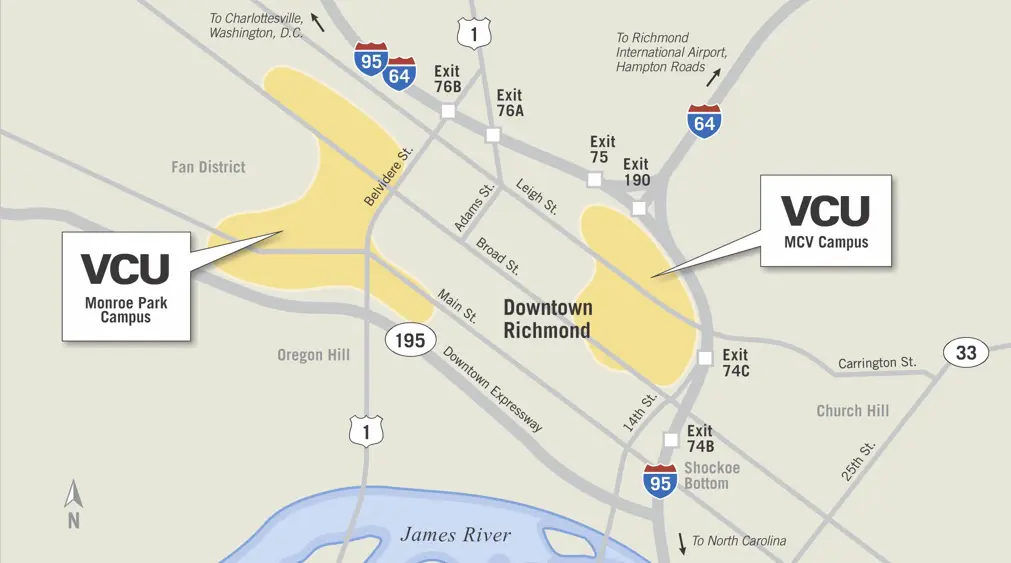

Several years ago, we wrote a blog about buying a small house or condo for your child attending VCU. That article has always been popular and carried significant traffic on the web.

And Now… We Have a VCU Student!

Since the first article is now a bit outdated and we’re currently in the works of purchasing a home for our own child headed to VCU, we think now is the perfect time to take a deeper look at the concept.

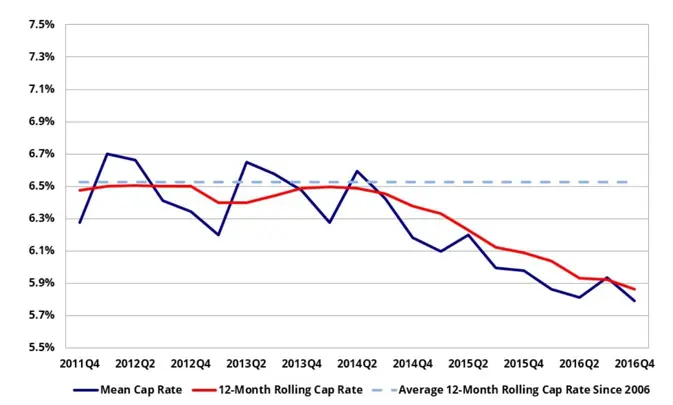

First, let’s look at some pricing statistics for the past several years.

| Year | Median Sales Price | Median Price/SF |

| 2015 | $187,000 | $147 |

| 2016 | $210,000 | $159 |

| 2017 | $227,000 | $179 |

| 2018 | $238,000 | $182 |

| 2019 | $255,000 | $191 |

| +/- % | +36% | +29% |

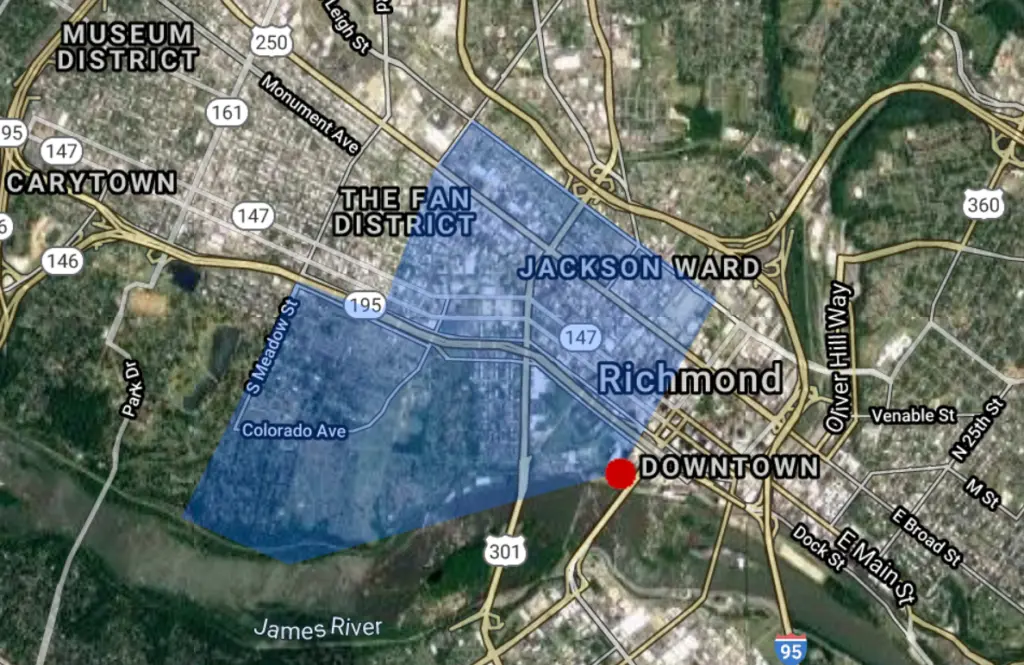

For the area that surrounds VCU’s Monroe Park Campus, you can see that pricing has been rising –– by about 30% over the last 5 years.

That could pay for a lot of college tuition.

Here’s Some Context:

The cost of a VCU dorm in 2020 is $11,506 (up from $7,800 in 2018)

- Per our rental managers, the average cost of rent is anywhere from $600-700 per bedroom in a standard house.

- To rent a 1 bedroom studio apartment, the number rises closer to $1,100 to 1,200 per month

- To rent a 2 bedroom/2 bath apartment, you are likely to pay anywhere from $1,600 to $2,000 per month

The Numbers

So imagine the following scenario ––

Purchase the home for $350,000 and sell it 4 years later for:

- $409,000 given only a 4% annual appreciation rate

- $425,000, given a 5% annual appreciation rate

- $441,000, given a 6% annual appreciation rate

- Instead of paying $11,000 in rooming costs to VCU, you received $1,300 in rent per month from two roommates

- And you paid down your mortgage balance by roughly $20,000 to $40,000 depending on loan type, interest rate, etc.

(As a small disclaimer: The past does not guarantee what the future will look like and the type of loan you choose and interest rate you receive will impact how quickly you pay down the mortgage balance.)

Loan Possibilities

Though there are some navigable hurdles, you can co-sign for your child and use a Maximum FHA loan that requires a very low down payment. There are also loan programs for non-owner occupied co-borrowers for less than 20% down. And finally, there are investor loans that allow you to purchase without requiring 20% down.

So all that said, you have options and not all of them require substantial amounts of cash.

So depending on what loan type you choose, we can help you find an originator who knows the market for investor and co-borrower loans.

But Aren’t Prices Going to Stop Rising?

Maybe if we solve the inventory problem or everyone decides to leave the city.

To solve the inventory issue, all we have to do is figure out how to build another, say, 3,000 or so houses per year around VCU (which if you aren’t detecting my sarcasm, is near impossible).

So while past performance is no guarantee of future returns, but, of all of the segments that offer value protection, it is housing that surrounds a 30,000 student university –– especially an urban one where the ability to add additional housing is essentially nil.

Furthermore, the fact that VCU’s housing need is largely supplied by the private sector means that the dorm life element of VCU is far less important than it is at other comparable institutions.

To back this statistic up, as we entered into the 2020 market, there was less than 2 months of inventory –– and that is as low as it has ever been.

Summary

So is purchasing for you? Not necessarily, but for many it makes a lot of sense.

The inventory issue is not really solvable and owning property next to perhaps the most important economic engine in the region has proven to be a great hedge against market downturns.

We can help.