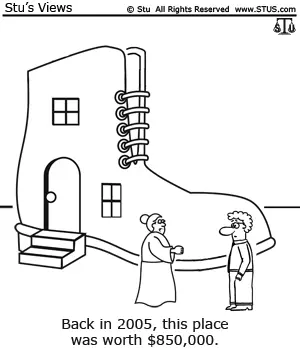

What is Your Home Worth???

Great question…pricing a home is hard. It requires looking backwards AND forwards and looking at not just what the 3 homes nearby sold for, but understanding trends and all of the different inputs to value.

Zillow and Trulia have tried and proved that they cannot really answer the question with any reliable degree of accuracy. Besides the fact that they have never actually SEEN your house, their algorithm cannot accurately interpret the dynamics that drive your specific market nor do they understand how to account for inaccuracy in the data.

If you want to get an accurate price for your home, you need to use far more advanced techniques than what Realtors are taught including inventory count and absorption rates.

Here is how we do it…

- Establish the per foot range that all comparable properties trade in.

- Establish neighborhood highs and lows for both aggregate price and ‘per foot.’

- Check AVM models to assess accuracy and anticipate market reaction to ‘estimates.’

- Establish 3, 6 and 12 month absorption trends to see if the market is accelerating, stagnant or slowing.

- Analyze inventory levels in terms of ‘Supply Months.’

- Examine comparable sales to establish appraisal maximums (the link is a Client Gateway direct from MLS.)

- Examine pending sales to judge market velocity.

- Examine national indexes such as Case Shiller.

Realtors are taught to find the three most comparable sales and use those to establish a value. This is akin to driving a car by looking in the rear view mirror. At One South, we believe that pricing in a marketplace changing as rapidly as the one we are in means that looking forward and predicting behavior is far more important then looking backwards.

While one is far easier than the other, the harder of the two is far more accurate.

Let us show you how.

Sarah Jarvis // Principal Broker

Rick Jarvis // Founder

One South Realty Group