Agent: “I don’t mean to brag … but I’m awesome.”

Agent: “I sell soooo much real estate, and all of my clients love me. Look at this awesome review someone just left me on Zillow. Did you see it? Did you?!? Here it is again.”

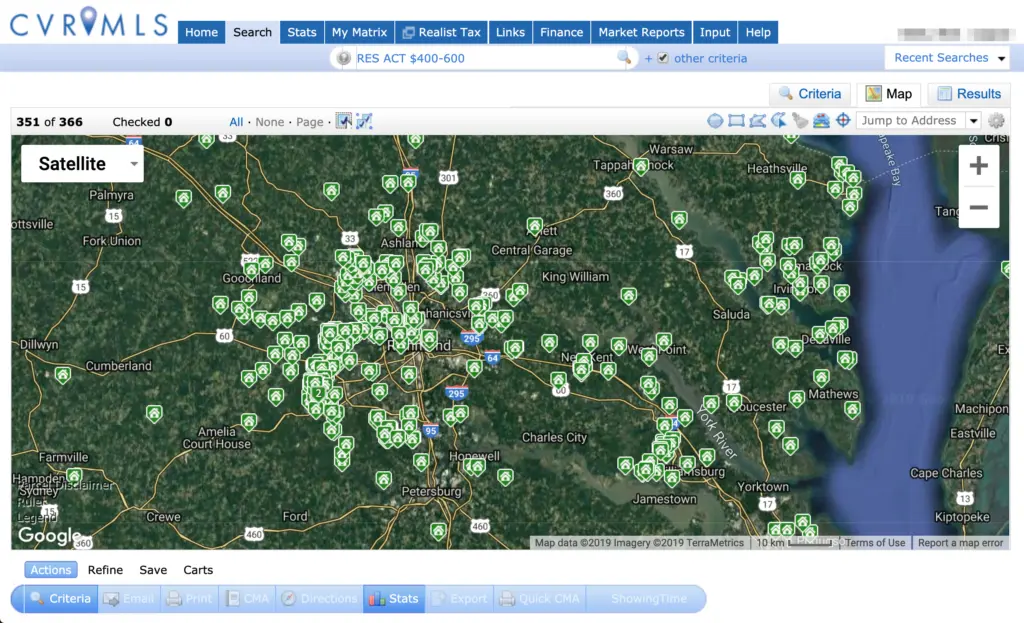

Agent: “And just so you realize, I am an expert in your neighborhood, as well as the one just down the road. And, the one next to that one, too. As a matter of fact, I am an expert in Chesterfield, Henrico, Hanover, New Kent, Petersburg, Ashland, Short Pump, Goochland, and Chester. “

Agent: “And in case you weren’t aware, I am also an expert in condos, luxury housing, land, foreclosures, relocation, first-time homebuyers, and commercial property, too! Oh, and new homes. And waterfront property. And historic homes.”

Agent: “I’m really good.”

Agent: “And I really don’t want to toot my own horn too much, but did you know that I sold millions of dollars of homes in my career? Like Multi-Millions. Like Multi-Multi-Millions…”

Agent: “Oh, and I love people. And houses. And pets. And Richmond.”

Realtor Marketing Sucks (Usually)

As an industry, we do an absolutely terrible job of communicating our value proposition. What we call marketing is generally nothing more than bragging about our sales numbers (or even worse, the dreaded ‘HUMBLEbrag’) instead of explaining how our industry works and what is actually going on.

In lieu of debunking myths, offering true analysis, or identifying trends, we choose to thump our chests in a ‘look at me’ manner, tell everyone who will listen how many homes we have sold and put our face all over everything imaginable.

Sad…

The Realtor Award

Words like Platinum, Ultra, Mega, Master, and Million are the typical categories of ‘achievement’ –– which sounds more like a superhero convention or the latest scratch-off ticket from the lottery, if you ask me. So why is it shocking that we (as agents) brag about sales levels to the public? Somewhere along the line, our industry made the nonsensical assumption that those who sell the most properties are also the best Realtors. Realtor Award Ceremonies sound more like superhero conventions or the latest lottery game … Mega, Ultra, Platinum … Sorry, but that simply isn’t true. Yes, getting things sold is an integral part of the job, but the manner in which you do so is equally as important –– if not more so –– and unfortunately, it goes largely unrecognized. So guess what we are going to do? Yep, we are going to take a look at some of the metrics that matter far more than just sales volume. As we have stated many times before, MLS is a phenomenal database. Odds are, if you ask MLS an interesting question –– and if you are remotely fluent in database management –– you can make it spew out some fascinating answers. MLS Data can be used to analyze agent and brokerage performance, not just housing and neighborhood values … These answers can range from something simple like ‘what was the average sales price in a community last year’ to the far more complex, ‘what is the premium attached to new infill construction in an area whose average home is 100 years old?’ So yes, we can ask MLS some quite interesting and powerful questions about housing and neighborhoods, but we can also use the data to analyze individual agent (and brokerage) performance, too. Wait, what?!? You can look at individual agent and brokerage performance?? Yep. MLS offers the ability to examine both agent’s and brokerage’s historical performance when it comes to protecting their sellers, marketing times, how many of their listings require price reductions, as well as how many of their listings never actually sell. MLS tracks a lot of groovy data. So, without calling out anyone in particular, we thought we would just look at how we are doing relative to the rest of the market, and let our results speak for themselves. Did you know that Realtors may ‘occasionally’ tell you that your house is worth more than it actually is in order to get you to list with them? Why? Because telling a seller that their house is worth more than it actually is means likely securing the listing. Conversely, telling a seller their home is worth less than what the other agent says likely means losing the listing to the other agent. As an agent, there is nothing more frustrating than when you tell a seller a realistic asking price and see them list with another agent at a higher price –– and watching the house sell later at the price you suggested after several price reductions… Most agents know that listing a home at an unrealistic price isn’t overly problematic since you can generally convince a seller to reduce the price later. The problem is when you don’t win the listing and thus, inflating the listing price –– with the disingenuous intent of asking for a reduction later –– is a strategy some agents employ in order to secure as many listings as possible. The practice has been going on since the dawn of time –– it is called ‘Buying Listings.’ As an agent, there is nothing more frustrating than when you tell a seller a realistic asking price and see them list with another agent at a higher price –– and watching the house sell later at the price you originally suggested. But the good news is that MLS tracks which companies and which agents reduce the price most often. No, we are not going to say who the most frequent offenders are –– but we are going to see how One South compares to the rest of the market. One South’s listing prices are reduced at roughly half the rate of the overall market. We took a sample of 1,000 of the most recent sales in the City of Richmond (949 to be exact) and counted the number of instances where a seller had to reduce their price before selling the property. The bottom line is that One South agents don’t tell our clients what they want to hear in order to get the listing with hopes of reducing the price later, we tell them what they need to hear to get it sold the first time. Without trying to sound like one of those personal injury ads that talks about how they will fight for you, we are about to do exactly that by saying –– ‘We fight for our clients!’ How can we realistically say that and it not be hyperbole? Because we can measure it. Since One South opened in 2008, we have substantially outperformed the market when it comes to seller discount. In other words, our sellers capture a higher percentage of their asking prices than the rest of the market captures. So, not only can we say that we fight for you, we can actually tell you by how much. One South’s clients have saved over $4M since 2008 by capturing a larger percentage of their asking prices … The chart below shows what percentage of the ORIGINAL Listing Price the seller received. In our decade of existence, we have beaten the market average by nearly a full point (.9% to be exact)! When you apply that to all of our listings, we have literally saved our clients well in excess of $4M since opening a little over a decade ago. Not too shabby. Pricing homes correctly is certainly helpful, but so is market acumen and process knowledge. Being able to defend a home’s value by understanding construction, the competitive landscape, zoning, development trends, architecture, history, and builder reputation (to name a few) means the seller benefits. The chart above demonstrates this fact well –– regardless of which way the market is moving –– the agents at One South have consistently driven more value for our sellers than the competition has for theirs. So, the naysayer would question the statistic above and say that we tend to price properties lower and thus, get a higher percentage of the asking prices. We outperformed the market at our greatest rate when the market was in its worst conditions. The facts don’t exactly bear that out. Take a look at the per foot prices for One South versus the market. We generally sell homes anywhere from 20% to 40% higher on a per foot basis than the overall market. So, not only do we get a higher percentage of the asking price –– we are getting higher percentages of asking prices at some of the more expensive price points in all of the Metro areas. And, do you know what really stands out to me? During the darkest depths of the Great Recession (2009 to 2013), we outperformed the market by our widest margins. In other words, when the market was at its worst, we protected our client’s property values the most. I think that is pretty cool. So, did we just violate our promise not to brag by telling you about how great we are? Yeah, probably. Sorry, it had to be done. But, note that we didn’t brag about how much we sell, rather we chose to highlight the manner in which we sell –– and how it benefits our clients. Know that we will stay focused on helping our clients gain a professional’s feel for the market while counseling them through an opaque and fluid process –– so that they develop the best strategy possible. If we do that and do it well, then we don’t need to brag.Measuring Success Correctly

Tracking Agent Performance

Price Reductions and How Realtor’s ‘Buy’ Their Listings

Tracking Price Reductions

Measuring the Discount Sellers Take

$4 Million Dollars …

Primary

YearSeller Yield

(Market)Seller Yield

(One South)Difference 2009 97.1% 97.7% +0.6% 2010 94.1% 96.5% +2.4% 2011 93.3% 93.2% (0.1%) 2012 95.1% 96.4% +1.3% 2013 96.7% 96.6% (0.1%) 2014 96.9% 97.8% +0.9% 2015 97.6% 97.6% +0.0% 2016 98.0% 98.5% +0.5% 2017 98.6% 100.0% +1.4% 2018 98.8% 100.0% +1.2% 2019 98.4% 100.0% +1.6% Our Pricing

Year $/SF

Market$/SF

One SouthDifference 2009 $124.00 $170.00 +37.1% 2010 $114.00 $157.00 +37.7% 2011 $108.00 $150.00 +38.9% 2012 $111.00 $153.00 +37.8% 2013 $114.00 $161.00 +41.2% 2014 $118.00 $155.00 +31.4% 2015 $122.00 $159.00 +30.3% 2016 $127.00 $177.00 +39.4% 2017 $134.00 $171.00 +27.6% 2018 $139.00 $170.00 +22.3% 2019 $147.00 $179.00 +21.8% Summary