The last decade has been anything but normal – especially when it comes to housing.

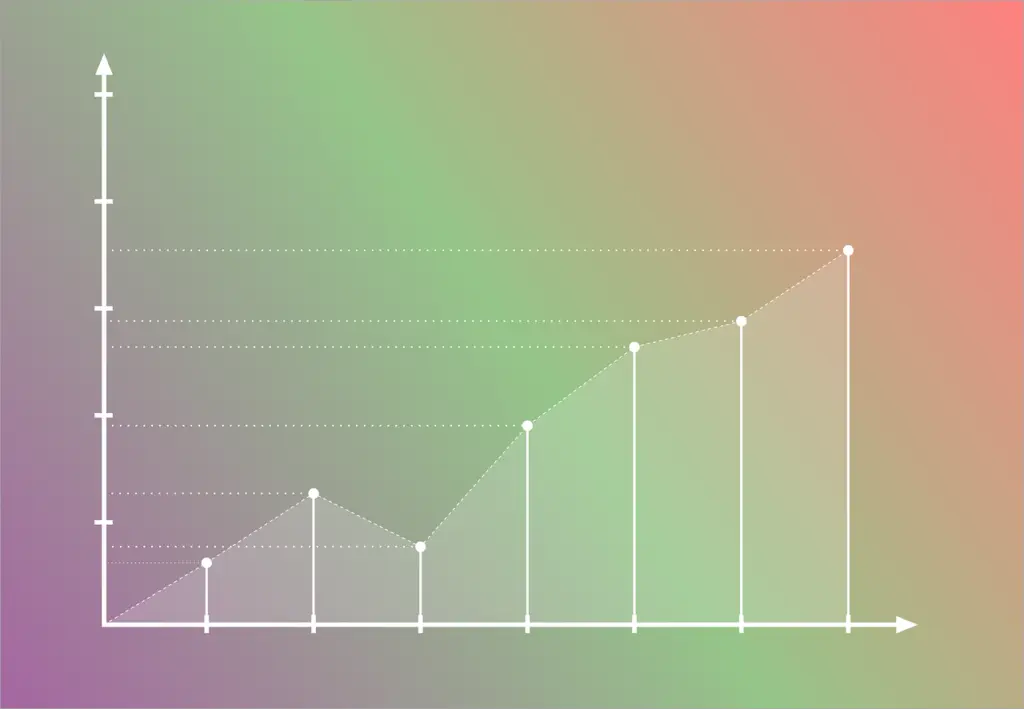

From 2007 to 2011, property values declined by 30%.

From 2011 to 2013, property values didn’t move very much.

From 2013 to 2018, property values recovered the 30% of the value that they lost, and then added some more.

It has been quite a wild ride.

The Stability of the 1990’s

For my first decade in the real estate business (1993 to 2003), the market was, all things considered, relatively normal. The crash that began in October of 1987 was largely over and the market had settled into a comfortable balance. The housing supply was greater, interest rates were closer to historic norms and mortgage underwriting practices were reasonably responsible.

When Normal Went Away

But sometime around 2003, things began to change. It was barely perceptible at first – just a sense that selling a home seemed easier. Pricing seemed to be inching up a bit more quickly, and homes seemed to sell in less time than in years prior.

But sometime around 2003, things began to change. It was barely perceptible at first – just a sense that selling a home seemed easier. Pricing seemed to be inching up a bit more quickly, and homes seemed to sell in less time than in years prior.

By 2005, the change was obvious. Prices were shooting up, mortgage underwriting seemed like an afterthought, and Realtors learned both how to start and how to win a bidding war. And despite bidding wars, appraisals never seemed to come in below the sales prices.

The rest of the story has been told many times before. Prices escalated for two more years, then nosedived, then flatlined, and then shot up again in the same way they did before the whole ordeal began in 2003. The market went from anyone can buy, to massive foreclosure, back to bidding wars — all in a period of about 5 years.

It was unprecedented.

How Old Are You?

Think about this:

If you are in your 40’s or older, ‘normal’ means 7% interest rates and an entire decade where housing values increased a < yawn > rather boring 2 to 4% per year every single year.

If you are under the age of 40, ‘normal’ means 4% mortgage rates and housing values that can move 5 to 10% per year –– in either direction!

It is quite a contrast.

So What is Normal, Anyway?

So which normal is normal? Neither, really.

The future normal will differ from both of the past normals because buyer preferences differ and because government regulations differ.

If you look at the housing stock built in the 1920’s to 1940’s in city neighborhoods, you are seeing appreciation rates literally double (or more) in the past five years. Houses that could be acquired for less than $100,000 in 2013 are now trading for $250,000 or more.

So, for homes that are considered to be ‘close-in’ and ‘affordable,’ the new normal will look more like the more recent version of normal with bidding wars, substantial price appreciation, and continued buyer frustration.

For homes located in the suburbs, especially for newly constructed homes, the picture looks far different. Demand is flattening, especially at the upper price points. Rising interest rates, out of control material costs, and increasing government mandates have all inflated the price of a new home well above the ability of the market to absorb it.

In effect, marketing times, seller discounts, and the supply/demand balance looks a lot more like the 1990’s and early 2000’s than it does the Boom-Bust-Boom sequence of 2008 to 2018.

Summary

Don’t mistake a recovering market for an overly exuberant one. In many ways, we are simply approaching the end of a correction back to trend. Had Wall Street not hijacked the mortgage market and sent us on the roller coaster ride of the last decade, we would be right about where we are today and it would have been a much smoother ride.

So what will the future bring? It isn’t a cop-out to say that ‘it depends.’ What you want to own and where you want to own can yield a radically different experience. Know your market, act accordingly, and don’t assume that all segments are behaving in a similar manner.