Getting sick of wafer thin walls, small closets, constant rent increases, low water pressure, and unassigned parking? Perhaps it’s time to buy your own home and invest your hard earned money instead of enriching your property manager and apartment owner.

What began as One South’s ‘Tenant to Home Owner’ Manifesto quickly became a post called ‘The Ultimate Guide to First Time Home Buying.’ We thought the ‘Ultimate Guide’ was a fair title as it covers pretty much any and everything you will need to know as you begin to transition from paying someone else to live to paying yourself.

Table of Contents

- Understanding Your Lease

- Searching Online – Zillow, Trulia and MLS

- The Timeline

- Selecting Your Team

- Realtors – Buyer’s agents and commissions

- Mortgages

- What, Why, When, How, Who, How much

- Types of Mortgages

- Closing Costs and Down Payments

- Inspections

- Valuations – Appraisals, Assessments, Zestimates, and CMA’s

- What to Buy?

- Condo, Townhouse or Single Family

- Building (and Negotiating with Your Builder)

- Foreclosures

- Fixer Upper

- The Common Mistakes

Understanding Your Lease

(Disclaimer – no two situations are the same so the advice offered regarding any legal document is intended to be general in nature. Please consult your legal advisor before taking any action.)

Before you are a buyer, odds are you are a tenant. And did you realize that being a renter actually gives you a huge advantage as a buyer, if you leverage it correctly.

Why, you ask? Because you have nothing to sell AND you can often be quite flexible with your closing date. As a seller, having a buyer with flexibility is of great advantage.

If you cannot find a copy of the lease, ask the property manager for it. By law, they are required to keep a copy.

Now that you have the copy, take the time to read it. The most important clauses for you to understand are the ones regarding RENEWAL and DEFAULT.

Renewal – Most landlords include language that automatically renews the lease for another year at either 30, 60, or 90 days from the lease anniversary.

If you do not tell your landlord you’re going to terminate by a specific date, then most leases automatically renew, often times at a higher rate. And generally, notice to terminate is the burden of the tenant so remaining quiet will lead to auto-renewal.

I have seen so many tenants miss their notification and have their lease automatically renew for another 12 months, which can obviously wreak havoc on the home buying process. We strongly suggest a month-to-month option, even if slightly more expensive, to give you flexibility to find the correct home and to allow for some flexibility in the event of delay. Being under time pressure does not make for good decision making and often times having 30 extra days in your pocket pays you back in spades when the inevitable last minute issue comes up with the lender, title, or inspection.

Default – While the word ‘default’ sounds onerous, it’s nothing more than a legal term. Typically, a landlord will have language in the lease outlining the penalty if you wish to break a lease. While breaking a lease is never the preferred option, if a good enough deal presents itself then it may be the best strategy. Make sure you understand your particular property manager’s stance on breaking the lease before taking this approach.

Typically, a landlord will have a 1 to 2 month penalty for a tenant who wishes to break a lease. Please consult your lease to confirm your lease contains this clause.

Know that landlords who own more than a few units are governed by the Landlord Tenant Act (LTA) in Virginia and are very aware of their limitations. A landlord cannot treat different tenants differently (for a myriad of reasons mostly related to Fair Housing) so generally they have a standard policy for lease breaking. In most cases, they are willing, for a penalty, to release you from your lease without impacting your credit.

PLEASE NOTE – Accepting a penalty to break your lease is different than deciding not to pay your lease (Not Paying is NOT a good idea). It is simply buying your way out of the lease.

Searching Online

The biggest misconception in the online search world is that Zillow and Trulia are the same as the Realtor Multiple Listing Service (MLS). While there are parallels, the MLS contains the most homes for sale and at the correct price and availability. It is the database the realtors use and it updates in real time.

Zillow and Trulia develop their property lists from a myriad of sources, not all of which are reliable. Additionally, there is a delay (sometimes multiple days) between when a property is listed in MLS to when it becomes visible on Zillow or Trulia. In the current inventory environment, immediate notification is highly preferable.

The accuracy of information in MLS is protected by 40 pages of rules and regulations that includes fines and suspension for non-compliance. Zillow and Trulia have no such rules or guidelines and obviously, the reliability of their information is suspect.

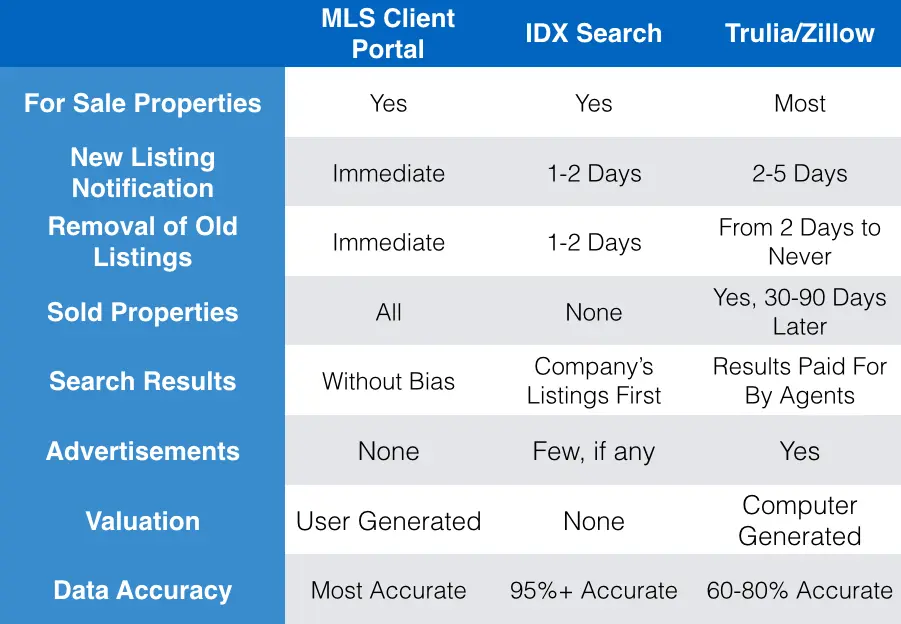

The chart below outlines some key differences –

Zillow and Trulia are good at many things (like GENERAL searches and GENERAL valuations), but are often used by serious buyers as a substitute for MLS. In doing so, buyers tend to miss many of the best properties by learning about them late or not at all.

The Client Portal/MLS Direct Link – By far and away, the most effective tool to use in your search is the direct link to MLS called the Client Portal. A Client Portal to MLS can only be set up by a Realtor and will give you a direct link into the Realtor’s MLS Database AND IN REAL TIME! AS you can see from the chart above, MLS provides:

- The MOST Homes For Sale

- The MOST Information on Individual Homes

- The MOST Accurate Availability Status (For Sale, Under Contract, Sold, Price Reduced)

- REAL TIME Updates

At the end of the day, just get the Client Gateway from MLS. It is the best resource.

And if you want to know even more, we have written extensively in our blogs about the use of online portals for search.

- Searching Online – Know Your Source

- Dangers of Trulia and Zillow

- Assessments, Appraisals and Zestimates

The Timeline

Before the real estate bubble burst in 2007/2008, not only was it easy to find a home, but it was easy to buy one. I literally saw people decide over a bottle of wine that they wanted to buy a home on a Friday night and be under contract by Monday. It’s not so simple anymore, and that is a good thing.

The general timeline looks like this:

- Talk to a Lender – Start now. And by now I mean like right now. (We have a great relationship with Chris Owens with Southern Trust Mortgage. He is experienced and his company has a wide range of mortgage products that work well for the first time homebuyers.) We have written extensively about how to choose a lender, but suffice it to say, getting the mortgage side straight is critical for a successful outcome. Getting started early means you will have an opportunity to clear any credit dings, let any deposits season in your account, make necessary arrangements for any gifts, etc. This ensures that you are not impacting your ability to secure a mortgage DURING the contract period. It will also allow you to properly understand the best type of mortgage product to use in securing the home you wish to buy. More on this under ‘Pre-Qualifying for a Mortgage’. (NOTE – We discuss the dangers of the Online Lenders later in this post. PLEASE PLEASE PLEASE PLEASE read that section.)

- Search – Give yourself a good 45-90 days (if not more) to look and be diligent. Learn the market. Learn the areas. Look on both sides of the river. Look at old and new housing. Look at it all. Even if you’ve bought a house before, you need to acclimate (or re-acclimate) to the current market. We like to tell our clients to ‘look strategically,’ meaning look at price points above and below your target zone, as well as housing in multiple areas.

- The Offer and Counter-Offer Period – Once you make a bid on a home, there is paperwork that must be prepared. Most agents work digitally and signing documents can be done online. Generally speaking, if an offer is not contingent on the sale of your own home and it’s at or near full price, a day or two should be enough to get all of the details worked out and signed off on. If there are multiple offers, it is bank owned or otherwise a distressed property, or an estate with multiple heirs, then allow for several days to a week. If it is a short sale, well, some short negotiations have literally taken months. (NOTE – all real estate offers must be written in order to be binding. While verbal agreements can be honored, they are not enforceable so telling your agent to ‘see if the seller will take $200k for it’ pretty much never works…)

- Offer Accepted and Under Contract! – Once you have agreed to price and terms, with all signatures and initials, you are officially under contract. Figure you will be in contract with the seller for a period of anywhere from about 30-60 days before closing (unless you are building a new home, that is closer to a 8-12 month process.) If you are buying with cash, a closing can be done sooner, but if you are using a mortgage then anything under 30 days is pushing it, especially if it’s during the robust spring market. You will have to get all of your inspections done and any defects must be negotiated prior to closing. During this time period, the bank will be doing their underwriting and verifications (see below) as well as the appraisal. More on the appraisal in a moment.

- Inspections – Typically, you will have anywhere from a week to two weeks to complete the inspections (more on this in the Inspections Section). Inspections can take on many forms including ‘Whole House Inspections’ (which are not really as advertised), roof inspections, pest inspections, well and septic inspections (in rural properties), foundation inspections, and the ever-popular-in-Richmond ‘Radon Inspection.’ Without going into too much gory detail, the inspections are done at your expense (except septic, well, and pest) and the contract you use includes language about your rights when a defect in the property is found. Effectively, the buyer has the right to ask the seller to make repairs and/or credit the cost of the repairs to the purchaser at closing. If the seller refuses to make repairs of requested defects, the buyer can elect to pull out of the contract and have their deposit returned. (This is a big of an oversimplification and can depend on specific contract language, so ask your agent to go through this in more depth.)

-

Want to see what an appraisal looks like? Appraisal – So after you are under contract officially, your lender will employ an appraiser to come to the property and offer an unbiased third party opinion of value. We talk more about the appraisal process later in this post. Ultimately, the bank is looking to make sure that the price you pay for the home is in line with market values and that the loan they are going to give you is consistent with the value established between buyer and seller.

- The Attorney’s Role – Additionally, during the contract period, your closing attorney will be preparing all of the paperwork required to transfer the property, checking the title of the home (to make sure the sellers have the right to sell it to you and have paid off everyone who would have a claim against the property) and preparing the HUD statement (this is also called the CLOSING STATEMENT.) The HUD is the document which will show where each penny of the transaction went for both the buyer and the seller.

- Pre-closing – Okay, time to sprint around, freak out, and otherwise stress at the last minute. It’s the nature of the beast. For a number of reasons, tons of stuff comes together at the last minute and even though you have done everything you were supposed to do when you were supposed to do it, it’s still chaotic. In a perfect world, everything goes almost as planned, but closings are rarely a perfect world. This is due largely to the changes imposed by the Dodd-Frank Legislation of 2010 which added numerous layers of ‘protections’ for the consumer. In reality, these ‘protections’ have served to make the last minute adjustments impossible to implement reasonably. But I digress…

- Closing – And now, the big day! At the appointed hour, you show up at your attorney’s office (or Title Company, more on this later) to sign what seems like an incredible amount of paperwork and many large legal documents. Know that sometime before closing, your attorney will have told you how much to bring in certified check to closing (they do not take personal checks) so build in time to get to your bank. Oh, and bring your driver’s license or other form of picture ID…they need to notarize the documents. The paperwork you are signing is a combination of loan documents and legal documents that simultaneously finalize your loan, officially take possession of the property and the pledge it back to the bank in case you decide not to pay the mortgage. It will take anywhere from an hour to two (depending on the questions you ask and the style of your attorney.) Once you are done, they hand you the keys and it is yours…

Selecting Your Team

Purchasing a home requires a team. Along with the agent, a number of additional service providers will be a part of the process. Often times, a team works far better if the team members are familiar with one another…especially amongst the agent, lender and attorney. This fact is especially true when attempting to close a transaction quickly. That said, a buyer is free to choose any and all team members.

Generally speaking, the following team members will be a part of the process:

- Your Realtor, the Buyer’s Agent – The Realtor who represents you is called the Buyer’s Agent. There is a contractual services agreement between you and the agent that defines compensation and duration of the contract for the service. All agents in the transaction are required to abide by a code of ethics (found here) and numerous state and federal statutes surrounding discrimination and fair housing. But also know that the primary difference between the buyer’s agent and the seller’s agent (below) is whose pocketbook they are looking after.

- Their Realtor, the Seller’s Agent – This is the name on the sign. While they are bound by the same code of ethics and fair housing laws, it is their job to get the seller as much money for the property as possible. They will try to make a log cabin look like it’s the Taj Mahal (at least on paper) and to make sure you pay as much as possible. When you call the name on the sign, you are calling the seller’s advocate, not your own. It is akin to asking your spouse’s divorce attorney for advice… do you really think you will get an objective response?

- Your Inspector – Most people elect to have a licensed home inspector do a ‘whole home inspection’ within the time frame specified in the contract. (The American Society of Home Inspectors or ASHI is the professional group that most reputable inspectors belong to.) Usually, this entails the inspector checking out the house, from top to bottom and handing you a report of the home’s condition, including needed repairs and their estimated costs. Know that the inspector can only inspect what they can see (meaning the inside of the walls go largely un-inspected) or what they can reasonably reach. Often times an inspector will tell the buyer that they should ‘have a licensed HVAC tech service clean the unit’ or ‘have a roof inspector check for leaks in the SW corner’ if there is something a little beyond their capabilities. The inspection report is what will drive the second round of negotiations over what items will be repaired or credited to the buyer.

- The Closing Attorney (Your Attorney) – The closing attorney is the person who actually closes the transaction. They prepare the HUD Statement (also called the Closing Statement), which has columns for both the buyer and the seller. The HUD will have accounted for every penny of the transaction so that each side totals up perfectly. Effectively, the closing attorney takes all of the documents between buyer and seller, bank and buyer, and title insurance and buyer, puts them all together, gets you to sign everything, collects and distributes all of the money, and then records everything at the courthouse to make it official. Some elect to save money by allowing the title company to close the transaction, but we typically recommend an attorney.

- NOTE – Attorney vs. Title Company – To expand on the point above, a real estate transaction can be legally closed by either an attorney or by a Title Company. A Title Company typically costs slightly less and can basically provide the same service with one major exception – legal advice. If a closing begins to go poorly (inspection dispute, lender delays, personal property issue) the Title Company cannot offer legal advice. In the large majority of closings, the attorney who is closing the transaction will offer free advice related to the transaction and can either keep a deal together or minimize the likelihood that a small dispute escalates into something far more expensive. Generally speaking, the difference in cost is anywhere from $100 to $300, and having legal advice built in as part of the closing fee is worth the incremental cost.

- Your Lender – If you are using a mortgage company, you will have been in quite a bit of contact with your mortgage professional. We will talk more about the lender in the ‘pre-qualification’ section of this post.

- Your Appraiser – Okay, not your appraiser…it’s the bank’s appraiser but you still pay for it. The appraiser is a neutral third party who gives their opinion on the value of the home. They are required to submit their estimate of value on a standardized appraisal form. They select the three most comparable recent sales and compare them back to the home you are buying. Hopefully it will support the price you are paying. While the flaws in this process are numerous, it is the way the game is played. You can look more on appraisals in the section on valuations.

Realtors and Commissions

Ahhh…the section about commissions.

It would take me about 5 days to cover all of the subtleties and complexities of who gets paid and when, so I’m going to stick to the basic scenarios which play out in most transactions. When you see the word ‘typically,’ I mean about 95% or more of the time.

Resale homes typically offer a buyer’s agent commission that is paid to the buyer’s representative by the seller. Yes, the commission paid in the transaction to the buyer’s rep is paid by the seller, meaning that the home you buy does not cost you commission.

Typically, the commission paid to the buyer’ agent is stated as a percentage of the sale price ranging anywhere from 2.5% to 5%, depending on the type and price of the property. For most resale homes, a buyer’s agent’s expectation is + 3%. Sometimes you will see commissions go down on expensive properties (say $1M or so) and up on inexpensive ones like foreclosures (below $100K).

So, to repeat, when you buy a home you typically do not pay your representative. The seller does.

Another scenario (and this happens ALL of the time): You are out in the car and you see a home. You don’t want to bother your buyer’s agent so you call the listing agent directly. This can get you in trouble because, if you have singed a contract with your buyer’s rep and the listing agent shows you the home, they may be entitled to the entire commission and you might be responsible for compensating your buyer’s agent. If you are going to call on a sign, then make sure to tell the listing agent you are working with a buyer’s agent and ask how the property can be seen. If they are having an open house, then you are fine. If they need to make a special trip to show you, make sure they know you are working with your own buyer’s agent. Many a small claims court has heard commission disputes over this exact scenario so don’t make that mistake.

Pre-Qualifying for a Mortgage

There are three basic levels of mortgage approval and each one is of increasing levels of value:

- Pre-qualified

- Pre-approved

- Pre-underwritten

Pre-approved – Being Pre Approved is better. It means all of the above PLUS verification of income, debts, and assets. Becoming pre-approved means the lender has been able to verify that what you said in the conversation is true and that you are reasonably certain, provided nothing in the financial picture really changes, that you are qualified to purchase the house you choose within the budget allowed.

Pre-underwritten – Being pre-underwritten is the highest level. It takes it even one step further by not only verifying the information supplied, but actually running all of the income, debt, and asset verifications through the underwriters in the home office. Going through the pre-underwriting is especially important when job changes have occurred recently, commissions (or bonus) is a large percentage of the income, or there are other issues which might give an underwriter pause about giving you credit for your full job history or all of your income.

Remember, the amount of income you think you make, the amount of income the IRS thinks you make, and the amount of income FHA/Fannie/Freddie think you make can all be vastly different.

Types of Mortgages

We could spend a lot of time here, as mortgage finance is a complex topic. But for brevity’s sake, we will attempt to stick to the major points.

To set the stage: Did you realize that a 30-year mortgage with an interest rate of 5.50% means that the total of the payments you make will be twice as much as you borrowed? Few people think in these terms and spend far less time on understanding mortgages than they should, which can be financially detrimental in the long run.

The three basics types of mortgages are:

- Fixed Rate Mortgages

- Adjustable Rate Mortgages

- Hybrid Mortgages

As the names would suggest, the primary difference is if (and when… and how often… and by how much) the rate on your mortgage adjusts.

Interest Rate Chart

The chart below compares many type of mortgage products. Please note that the chart comes from a national online source and may not accurately reflect the rate environment in our specific region. Please consult your local lending source for actual quotes on rates and terms.

Fixed Rate Mortgage – In a Fixed Rate Mortgage, the interest rate does not change over the life of the mortgage. If you secured a fixed rate mortgage for 6%, the rate in one month is the same as month 360. When rates are low, more buyers select this option to lock in the rate over the life of the loan.

Adjustable Rate Mortgage (ARM) – In an ARM, the rate is subject to change at specified intervals. Typically, the language in the mortgage document will also contain caps, meaning that the mortgage rate can only adjust by a specified amount in any given adjustment period. Typically ARMs are either 1 year (meaning the rate adjusts yearly), 3, or 5 years.

It should also be noted that ARM products, in addition to specifying the intervals at which the loan adjusts, also tie the rate to an index. Treasury rates, the LIBOR (London Interbank Offer Rate, which is similar to the US Federal Funds rate) or the Prime Rate are all indexes, which are used to determine rate adjustments.

The Hybrids – In addition, you will see hybrid products, which combine elements of both the fixed and ARM mortgages. Hybrids often offer a fixed rate for a period of time (say 5-7 years) and then turn into a 1-year ARM. Market conditions and mortgage company speculation will often drive creation of hybrid loan products, which come into the market and leave with regularity.

To get quotes on rates and loan products, we love Chris Lester with Southern Trust — clester@southerntrust.com/804 307 7033

Closing Costs

Lender Fees – Getting your loan is not cheap. Points and origination fees, along with a host of other fees (all detailed on the HUD or Closing Statement prepared by your attorney,) are paid to the lender to help secure the loan. Know that all of the fees you see on the closing statement should have been disclosed in detail by your lender at the time you made official loan application, if not before.

Title Insurance – Title Insurance is an insurance policy you buy to protect your basic ‘property rights.’ Title Insurance is also a fair large contributor to the closing cost total. Title Insurance legally insures that when you take title to the property, no one else can lay either an ownership or monetary claim against the property.

NOTE – Title Insurance will become increasingly important when many homes bought at foreclosure auctions during the period of 2009-2012 trade hands again in the coming years. Many were foreclosed on using less than scrupulous methods by banks and it can be assured that many foreclosures will be challenged in the courts. It is wise to purchase the ‘Enhanced Title Policy’ as the insurance grows with the value of the property.

Other Closing Costs – Other closing costs/fees include:

- The Survey

- Homeowner’s (or Hazard) Insurance

- Recording Fees

- Tax Service Fee

- Floodplain Certification

- Courier Fees

- Prorations

- Escrows for Taxes and Insurance

Down Payments

For the most part (and this is a big generalization), mortgage companies like to see 20% of the purchase price come from the seller in the form of actual cash, but don’t stop reading here if you don’t have 20%. It gets better! The bank’s thinking is this: If you have $50,000 of your own cash in on a $250,000 home, then you will do what you need to do to make that payment every month. Likewise, if you do not and they have to foreclose, they should be able to sell the $250,000 home for enough to cover their $200,000 debt.

That said, it does not take 20% to buy a home. You can do it for as low as 3.5% (or 0% if you are a Veteran). Many loan programs exist that allow buyers to purchase housing when they do not have 20% of the price for a down payment. The biggest difference is the effective interest rate you will get… the lower the down payment, the higher the effective rate.

The loan products that exist with down payments less than 20% either use Mortgage Insurance (MI) or some type of 2nd mortgage at a higher rate to raise the effective rate you pay to adjust for the additional risk. In effect, the rate on the mortgage increases with the additional leverage. While that is not technically the way it works, it’s basically true that the less cash you put into the deal, the higher the rate you will pay.

How Do You Qualify?

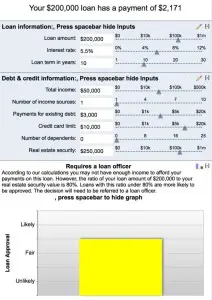

In its simplest form, a lender will let you spend 28% of your gross monthly income on housing, provided your overall monthly obligations do not exceed 36% of your gross monthly income. The 28% figure is called the ‘Front End Ratio’ and the 36% is called the ‘Back End Ratio.’

So, in effect, if you earn $4,000/month, your maximum payment allowable is 28% of $4,000, or $1,120. This maximum payment includes not only the principal and interest payments, but it also includes the projected real estate taxes and the homeowner’s insurance. The total is often called PITI (Principal + Interest + Taxes + Insurance).

This 28% figure can go down if the other debts (car, student loans, alimony, credit cards) exceed 36%. Now, understand that different loan products may have slightly different ratios and other mitigating factors may exist. Recent graduates from medical school come out with high levels of debt and little cash, but with huge earning potential… there are loans for Doctors where everything discussed above is thrown out the window. Likewise, debts near expiration may not count against the back end ratio.

The bottom line is that a good lender is a valuable team member (notice a theme developing around lending? It is critical to select a good lender.) They understand the thousands of pages of underwriting guidelines and will know how to paint your financial picture correctly so that you receive the best rate.

Inspections

One of the first time homebuyers biggest fears is buying a home that will end up being filled with problems. While there is risk associated with buying, helpfully, through proper inspections, the risk can be be minimized.

In almost every case, a buyer has the home they are buying inspected by a professional inspector. The inspector’s job is to go through the home, on top of the home and under the home, checking for problems, and furnishes the purchaser with a report of all of the defects found. This report should not only include a list of any defects, but pictures of the defects AND an estimated cost to remedy the defects. The cost to remedy is a key part of the inspection.

From the National Association of Certified Home Inspectors – A material defect is a specific issue with a system or component of a residential property that may have a significant, adverse impact on the value of the property or that poses an unreasonable risk to people. The fact that the system or component is near, at or beyond the end of its normal useful life is not, in itself, a material defect…

The buyer (and agent) can then go back to the seller with a list of defects they wish to have remedied or receive a credit to repair. If the seller refuses, the buyer can request to released from the contract, get their deposit back and begin the search anew.

That was the simple version…

The reality is that every inspection is different and outcomes differ greatly depending on the defects found, the type of loan, the personalities of the buyer and seller (ok, and agent) and the number and seriousness of the defects.

First, the inspector’s job is to find DEFECTS. Unfortunately, the definition of DEFECT is gray (at best) and is always interpreted differently depending on which side you are on. Is a roof that does not leak but only has a few years left a defect? Is the 20 year HVAC system that seems to be working ok technically a defective system? Are the stairs to the basement without a railing a defect? You can see how this goes…

Here are common items that cause ‘interpretation’ issues:

- Rotten Wood – Where does ‘rot’ officially begin and when does it end? This is especially true on wood siding

- Older Big Ticket Items (HVAC, Water Heater, Roof) – If it on its last leg but working, is that defective? Hard to say…

- Building Code – Building codes change and over time, what was once allowable is no longer. Older neighborhoods have this in spades…

- Poor Workmanship – ‘My brother’s cousin finished the 3rd floor…’

Additionally, the cost to remedy the repairs always causes some conflict. The inspectors always estimate high (or put it in a range) and thus the sellers always complain that the cost to remedy the broken doorbell is 4 times as high as it should be. The inspector is really giving a cost to cure that is published in some type of matrix by some type of inspectors guidebook and it is designed to cover the inspector’s rear end. But I digress…

A few things to note/remember about inspections:

- You have a finite time period to get the inspection done so get it done early. If defects are found, you need to figure out if you are going to proceed or not because the other tasks that need to be done before closing (appraisal, survey or title insurance) cost money and take time. If you are not going to by the home, you don’t want to spend money on house specific costs.

- Many inspectors now suggest that specialists come in to look at specific items like HVAC or old roofs. Make sure to allow time to get these inspections done, too, if they are needed.

- The seller can either remedy the items that are defective or CREDIT YOU THE COST FOR YOU TO REMEDY THE ITEMS. Know which items you want the seller to fix and which ones you want to take a monetary credit for. This is a big deal.

- Lenders do not like to see language about repairs to be done after closing so if you are going to receive a credit, make sure to take the credit in the form of closing cost or other item NOT labelled as ‘repair credit.’

- Know you inspector. Suburban inspectors are less versed in older city properties. Similarly, an inspector who works older properties may not be as versed in the country building codes.

At the end of the day, the inspection process is a small renegotiation between buyer and seller and in 90% or more of the cases, inspection items get addressed and the deal stays together. But each year, every agent has several deals that end up blowing up due to the inspection. It is part of our industry.

Valuations

So what is a home worth? Well, simply put, it’s worth what someone is willing to pay for it.

Houses are valued differently by different people. Someone who has bad knees would obviously be less interested in a 3-story townhome, just as someone who likes to work on motorcycles in their 4 bay garage would be less interested in a condo downtown. In that regard, homes (and their values) are established by those who want to buy them, not by those who do not.

That said, there are many different types of valuations, each one measuring something slightly different. We wrote an article that goes into great depth about Valuations.

Fair market value (FMV) – A willing buyer and a willing seller, neither of which is under undue pressure to buy or sell, establish fair market value. Unfortunately, FMV is not always accurately reflected in the other forms of valuations.

Appraisals – If you get a mortgage, you are going to get an appraisal. The bank charges you about $500 to send out an appraiser to examine the house and compare it to other similar recently sold homes. If sales A, B, and C indicate that you are paying a fair price, the appraiser will note that the property you are buying meets or exceeds the price you are paying. Suffice it to say, probably 95% or more of the homes under contract meet or exceed appraisals. In reality the appraisal process is a moderate annoyance.

When appraisers get it wrong: This can be an issue because there is no real way to combat the appraisal. Typically, unique properties or new properties which push prices will run for most risk of this happening.

The appraisal is used by the bank to set the maximum loan amount, so if an appraisal comes in low, it just means the buyer may have to make up the difference in cash. If cash is a constraint, then a missed appraisal can be a big deal. But, again, if you are buying an existing home in an established neighborhood, the appraisal is not usually an issue.

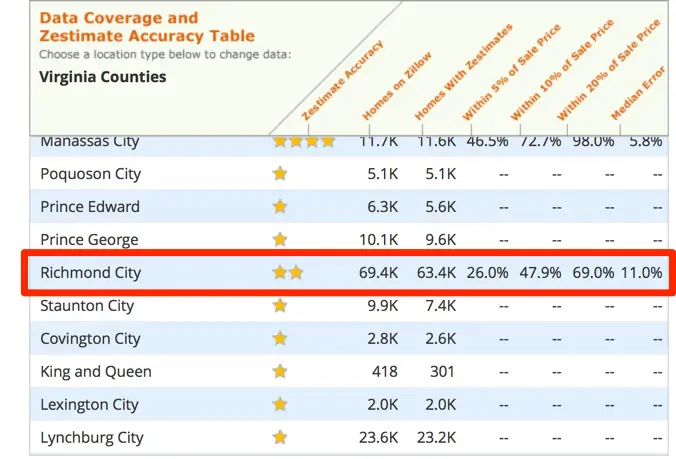

Zestimates (or other computer models, often called AVM’s or Automated Valuation Models)- Take these estimates with a grain of salt; they are pretty much worthless. If you want to know roughly how much it costs to buy a 4 bedroom home in Salisbury or Wyndham, then yeah, look at Zillow. You can look in MLS, too, to get better information, but I digress…

Without giving too much detail, just know that the algorithm used to create the estimates is based on data which is 60-70% accurate, at best. The data that feeds into Zillow and Trulia (and others) comes from a myriad of sources that range from ‘somewhat’ to ‘not really’ reliable. So do your homework and use these valuations at your own risk. Zillow does not offer a money back guarantee, and I have seen more than one buyer or seller make foolish decisions because a computer in Seattle told them to.

Assessments – The assessment (or TAX assessment) is the level at which the local municipality (town, city, or county) will tax your property to pay for schools, fire and rescue, and other county services. Your assessment is the county’s (or town’s) estimate of the value of the property.

In reality, the assessment is about collecting maximum tax revenue. The county or town attempts to value property high enough that the owner thinks, “hmm… yeah that sounds about right,” but also not so high that they complain. If the county can perfect this number, then they will maximize their revenues and minimize challenges.

Two things to note about assessments: One is that if the home has sold recently, then the county will usually set the assessment equal to the sales price. So recent sales will usually make the assessment more reflective of market value. Secondly, not everyone tells the county about improvements they make to a home, so often these are not reflected in the assessed value.

The assessment is not a particularly useful number other than for “back of the napkin” types of valuations.

Condo, Townhouse, or Single Family

(If you want to know about condos in more depth, check out our Ultimate Guide to Richmond VA Condos)

Which is right for you? It depends. But generally speaking, housing for the first time buyer tends to fall into the following three categories:

- Condos

- Townhomes

- Single Family Homes

I left out the discussion of both land and investment properties (duplex, triplex or other commercial mixed-use properties). If you are interested in those, pick up the phone and give us a call. Trying to discuss the different options when it comes to either raw land or income producing properties requires a different post dedicated purely to those subjects.

Condos – Condos, at least in Richmond, tend to be smaller than single family and located primarily in the city. As a result, they are less expensive and thus a good option for an entry owner.

Things to note about condos:

- Condos are different than single family in that the land and much of the structure in a condo is owned collectively and the space you live in is what you actually own. In a single family home or townhome, you actually own the dirt upon which the property sits.

- The condo will come with ‘dues’ which are your contribution to the expenses and upkeep of the building. They contain a small portion that goes into the bank for future repairs (the reserve account) so that in the future when the roof needs replacing or exterior painting, there is money in the budget to do it.

- The condo association is effectively a small government that runs the condo. Residents vote on decisions and elect officers who run the condo (usually in conduction with an outside management group).

- Bad news… the associations can get kind of prickly, especially over increases in dues or large repairs.

- Good news! Maintenance is typically nil and there are usually some additional amenities that make it a cool place to live (pool, exercise facility, security, elevators, parking, etc).

- An important thing to note: the difference in mortgage finance. Read more about condo finance here.

Townhomes (or townhouses) – Townhouses are located all throughout Richmond in pretty much every area of suburban and urban development. Generally speaking, the town home is used as either a part of a larger planned community or on infill piece long since passed by development. The townhouse is generally an attached property of 2-3 bedrooms and is designed to provide ownership affordability.

The primary difference between condos and townhouses is that the owner of a townhouse owns the ground beneath them and the sky above. This makes them easier to finance than condos.

Things to note about Townhomes:

- In a townhouse, you own the land upon which you sit. This makes mortgages far easier to obtain and also means that you have no one living above or below you.

- They are are usually connected on one side (or both). Noise (if not soundproofed properly) and maintenance issues can affect your experience.

- Townhomes are usually part of an overall community and often come with a community clubhouse, pool, tennis court or other common amenities. Townhouses also have dues, but they are typically less than in a condo because the burden of maintenance is the owner’s. In some cases, townhomes will have exterior maintenance included.

- Townhomes can be a good investment if the cost of land is expensive and the demand in the area is high. Most people prefer a single family home, so townhomes prove to be good investments in areas where the single family home is far more expensive. If the average home is similarly priced, buying the townhouse might not be the best idea.

Things to note about Single Family:

- You own the land and the structure, unlike condos, and there is space between you and your neighbor, unlike a townhouse.

- Single family homes comprise the largest part of the market and can be found in all ages, shapes, styles, and sizes all over the Metro. Additionally, single family homes tend to break down along the suburban (1/4 to 1 acre lot size) and the rural (5 acres or more) line.

- They are are the easiest to finance.

- You are responsible for all of the maintenance (unless in some type of low maintenance neighborhood usually targeted at empty nesters).

- Sometimes a community association will be mandatory, impacting some of the exterior freedoms. Fence types, siding colors, and other restrictions may be a part of a community governed by an owners association. Luckily, the planned community HOA is usually far less onerous than the condo association.

The New Home

The lure of a new home is powerful and comforting on many levels. I think deep down, we all want to live in a brand new home at some point in our lives. But is it a good idea?

It can be if you really know what you are doing and why you are doing it.

Know this about new homes: You rarely steal them. Typically, each new home that sells will be priced at or above the most expensive last new home to sell. As neighborhoods build out, prices tend to rise (with the obvious exception of 2008-2011). So, if you are going to be seeking a new home, it is important that you are committed to being there for a while.

New homes tend to be broken down into two categories:

- Speculative (Spec) Homes

- Custom/Contract/Ground Up

Speculative Houses – The SPEC home is a home that was started before the buyer emerged. Typically, a builder will like to have a few SPECs standing so that a buyer who needs to be in a home in the next 90 days can still make some décor selections and take possession at a reasonable time.

Ground Up or Contract Houses – Other times, a client will want to choose a specific lot and have a great deal of input as to what gets built. These buyers will literally watch their home get built from the ground up and wait anywhere from 6 months to a year for it to be completed.

Like the spec vs. contract job, there are also basic types of builders:

- Custom builders

- ‘Semi-custom’ builders

- Production Builders

Custom builders – As one would imagine, the custom build fewer homes per year and build very few alike. They also tend to operate in the upper price points. A good custom builder can take your plan or theirs (or even a series of ripped pages from a magazine) and build something to the buyer’s tastes.

Semi-Custom Builders – The semi-custom builders tend to build 10-20 houses in a year and will have a cadre of plans to draw from. They will build at the upper middle price ranges and try to position themselves as higher quality than the production builder, but less expensive than the true custom builder. A semi-custom builder will also include more standard features than the production builder and tends not to play the game of upgrade-a-palooza that the production builders do.

Production Builder – The Production Builders can be found in the middle price points (or lower) where absorption is greatest and will build upwards of 50 houses in any given year. These builders will often have their own showrooms, complete with design staff whose goal it is to get you to upgrade from the sheetrock box standard to the house that looks like the model you fell in love with. Production builders make their money in volume and efficiencies (and upgrades) so customization is not their strong suit… and they will KILL you with change orders.

Negotiating With Builders

Negotiating with each differs, as well.

Negotiating with a production builder is like negotiating with Target; you don’t so much negotiate as watch for sales. By keeping an eye peeled for incentives (usually to coincide with quarterly or yearly production goals) you can get some money off a production builder. They will also tend to offer packages at a discount (hardwood floors throughout if you contract by x/x/xxxx) or free appliances or upgrades.

If you want a deal from a semi custom builder, find a spec home. Usually, as semi custom builder builds on a credit line and if they have more than a few specs being built but not sold, the bank will not loan them any more money so they are better off selling to you at a slight discount and building another one.

The true custom builder generally won’t negotiate too much, especially if they are building an entirely new plan. If you can build something close to what they have built before, they can usually sharpen the pencil a bit and find some room to work with you on price.

We wrote a series of posts on this exact topic:

But remember this: When you negotiate with a builder, you are negotiating with an expert. The entire builder life is one big negotiation and any builder worth their salt is still standing because they are good at it. Builders negotiate with banks, with suppliers for materials, with contractors for labor, with the county for permits and inspection, with developers for land, and of course, with clients, over and over again.

So if you are going to build a new home, do your homework, have a plan, and know that the house you build should be the home that you live in for some time.

Oh, and it is kind of fun…

We Want to Buy a Foreclosure

Okay.

This can be a great idea or a terrible one.

First, understand that a foreclosure is not a ‘thing’ as much as it is a condition. Foreclosures are properties that, due to the default of the borrower (meaning they quit paying), are now owned by the lender who owned the loan when the owner quit paying (this is a gross oversimplification, I know). Since the property is now owned by the lender, they need to sell it and will typically take some percentage less than full value for it.

You can more or less buy a foreclosure at two points:

At The Courthouse – Some people will literally go to the courthouse steps and bid to purchase the property as-is, right alongside the bank that ordered the foreclosure. When you do this, you are buying with little to no guarantee about condition and will only have had a brief period to do a visual inspection. Most times, the bank will elect to buy the property back to themselves (sounds weird, I know) and then decide whether or not to fix it up, wholesale it, or just get it habitable.

Through MLS – If the bank buys it back at the courthouse, then as soon as they know what they have and develop a reasonable plan of action, they will list is with a Realtor, place a sign in the front yard, put it in MLS and sell it. So most foreclosures can be bought in the ‘regular’ way someone would buy a house.

But What Are You REALLY Buying?

The issue with foreclosures is that most assume a foreclosure is a good deal… this is not necessarily the case. While the foreclosed home may be discounted for the pricing a non-foreclosure would command, if the repair costs exceed the discount, then what purpose did the purchase serve? Why buy a home for $150,000, spend another $50,000 to fix it up and have a home worth $200,000? People do it all of the time…

Remember – Foreclosures come with additional layers of risk, both from a title standpoint (especially now that we have millions of contested foreclosures proceeding from the crash) and from a renovation and repair standpoint. While the repairs may look cosmetic, you really never know. Once a homeowner loses the incentive to maintain the home in the face of foreclosure, things can get ugly quickly. There are a lot of horror stories about what owners in the throws of divorce, job loss, and subsequent foreclosure have done to the homes they were losing (ductwork can get abused in the worst ways…)

Do You Want a Foreclosure or Do You Just Want a Deal?

So when I hear someone say that they want to buy a foreclosure, what I’m hearing is that they want a deal and are looking to add value via renovation or repair. Finding homes which are in need of repair can be found through multiple channels, not just foreclosure, and a smart Realtor/Buyer team can use advanced search techniques designed to identify properties where value can be created through subdivision, substantial renovation and/or addition or tear down.

- Motivated Sellers – Often times, Realtor remarks will include ‘Motivated Sellers.’

- As-is Property – When you see ‘as-is’ it usually includes some work is needed.

- Short Sales – If you are willing to stick it out, here is the list…

- Foreclosures – As discussed above…just because it is a foreclosure does not make it a good deal… but here is the list.

A final note: The type of foreclosure also matters. Fannie Mae, Freddie Mac, FHA and VA all handle the sale of foreclosures differently, but with a defined set of protocol and will often resale the property with financial incentive on the mortgage side that can have real value. Buying a Fannie Mae foreclosure with a low down payment and low interest rate can be more impactful than negotiating several thousands off the price. Think big picture and you can find value in all aspects of a transaction.

The Fixer Upper

So you want to buy a fixer upper? Cool, we have bought a ton of them. It can be fun, but it can also be a total pain. Beware.

The term ‘fixer upper’ can mean many things and generally, the term means something different to each and everyone. If you are a contractor, then your version of ‘Fixer Upper’ is different than a professional decorator’s version.

I tend to think of Fixer Uppers in the following categories:

- ‘Painter Uppers’

- ‘Wall Openers’

- ‘Rehabs’

The Painter Upper – As you would expect, a Painter Upper is really a cosmetic renovation. Paint, flooring (carpet, vinyl, wood), some drywall repair, and maybe an appliance or two all fall into the category of Painter Upper. In reality, you are only replacing items that are non-structural. You don’t really need a handyman or contractor to oversee, you just need installers and/or a Lowe’s Credit Card.

The Wall Opener – When you have to open up the walls to fix plumbing, electrical, or structural issues, the risk increases dramatically. If you need to open up the walls to renovate a home, you better be sure of what you are doing. Once the walls are open, all of the trades (framing, plumbing, electrical) will probably be needed and the cost (and time) just jumped. I have seen (and had to deal with) what seemed a benign repair jump in expense substantially when the true cause of the issue was found.

As a side note: The HGTV shows make it seem like you can move walls and fix foundations for hundreds of dollars. It is wholeheartedly irresponsible and borderline criminal. Do not think that the costs they illustrate are in any way accurate. You will be sorely mistaken.

The Rehab – The last type, the full Rehab, is a big project. If step one is interior demolition, you are in a big project. While you may hope to save some of the structure (and save some money), you really know that all new plumbing, electrical, drywall, flooring, fixtures, and kitchens/baths are part of the rehab. I might also classify putting an addition on a home as a Rehab because the process is pretty similar.

In Rehab (or addition), you will probably need to have a licensed contractor oversee the work and you will need to get permits. An un-permitted job or one where no licensed contractor is used is a huge risk to you.

The bottom line is that Rehab is not the right idea if you are new to ownership. The risk far outweighs any upside.

At the end of the day, all resale homes will require some level of fixing up. The key is knowing what repairs/renovations are investments and what are expenses. A good Realtor will be able to tell you what improvements are likely to bring value in excess of their expense.

Common Mistakes

While we have inserted numerous boxes with tips and things to know when buying a home, but here are few more pitfalls to avoid:

- Not Doing Your Homework – Falling in love with a home is easy and unless you understand what you are buying, it is easy to take the love for a home and try to make it yours. Spend some time looking to gain understanding about market values. If you look at a good number of houses in a structured way, you will begin to build a model in your mind. Don’t rush into a decision.

- Doing What Your Buddy Did – ‘Well, my friend bought in Midlothian and loves it, so we have decided to buy there too.’ Don’t do this. Each person’s motivations are unique. Just because friends live somewhere, doesn’t mean you should too.

- Under Buying or Overbuying – Remember, transacting a home is expensive. When you go to sell your home, it is safe to say you will lose 10% of the value of the home in commissions, repairs, closing costs, and other expenses. So if you buy a home today that will get you through the next three years before you will outgrow it or have to move again, you should consider skipping a step. Is this risky? Perhaps… but it is also risky to buy a home today and then in three years buy another one and lose much of your equity in the transaction. Think forward as much as possible and buy for the long term. I am not suggesting you stretch yourself beyond reasonable comfort, but just know that each time you sell and buy, you lose thousands of dollars in the transaction.

- Using an Online Lender – Don’t do this. Please, please, please, do not do this. If you want to use Quicken Loans or USAA, then you had better make sure you won’t experience a penalty for a missed closing date. Penalties for missed closing dates come in many shapes and forms; from moving companies, to rate expiration, to seller lawsuit to Realtor commissions, and can all can be your responsibility. Is this an attempt to scare you? Yes. Is it legitimate? You bet. Quicken and USAA are great for refinance, just not for purchase. You have been warned…

- Incorrect Use of Zillow and Trulia – Trulia and Zillow are not MLS. They are chocked full of inaccuracies and over-reliance upon these sites will cause you to receive information late or not at all. They have some neat tools and they rank well, but once again, they are not MLS.Here are some things to know:

- Search results are not organic

- Search results are not policed for accuracy

- The Agents in the sidebar pay to appear there

- Agent reviews are controlled by the agents

- Zestimates are within 10% of the value only 66% of the time (in the good markets)

Use these sites at your own risk.

- Calling the Name on the Sign in the Yard – The name on the sign represents the seller and it is their job to get you to pay as much as possible. Likewise, when you call the name on the sign, you can get yourself in a pickle with commissions owed (this topic is too complex to be discussed here as ‘Procuring Cause’ legal precedent is extremely nuanced and hard to summarize), but just remember that you should call YOUR agent for info, not theirs. If you are out and about and you do call a sign, let the listing agent know you are working with a buyer’s agent.

- Not Disclosing Fully to Your Agent – I have been in several situations where clients didn’t really come clean and it came back to bite them. If you are struggling with your loan, don’t be afraid to say so. Even if it’s embarrassing or disappointing, hiding and hoping can really put you in a bad situation and potentially get you sued. As agents, we all know the leverage points to get you out of a contract, but these points disappear the closer you get to the targeted closing date. Always disclose fully to your agent and you will receive the best representation.

Summary

Buying a home, when done correctly, can be one of the most financially beneficial undertakings imaginable, but the flip side can be just as negative. A good representative is equal parts advocate, counselor, advisor, psychiatrist, and tour guide, and will not only help you navigate the increasingly complex process, but will help you make sense of the endless supply of information.