I once heard someone say (and I thought it brilliant) that when you decide to buy a house, you are not only buying a home, but you are also buying the money to buy the home. What they were implying is that the price you pay for the money you borrow (the interest rate) will have a significant impact on much your financial life.

How Much Interest Did I Pay? WHAT?!?!

Ok, a $300,000 loan at 5.5% over 30 years requires a payment of $1700/mo (before taxes and insurance) and over the course of the 30 years, you will have paid $317,000 in interest. In effect, a 5.5% mortgage makes the amount of interest you pay for the money you borrow as expensive as the asset itself. While interest rates dipped below 5% and stayed there for a considerable period of time, the sub 5% interest rate is historically more rare than Haley’s comet. The impact of interest will become increasingly more impactful soon as a rate of 8.25% (where they were in 2000) will mean the interest you pay is actually 2x the amount you actually borrow …

American Finance

The majority of American finance is driven by the monthly payment.

Almost all of our bills arrive 12 times a year, from credit cards to utilities to cars to Netflix and thus, we think in terms of impact to our monthly finances. We are a month to month society whose entire debt structure is driven by how much we can afford per month. Ask your local lender for any type of loan and the first question will be about your monthly income…same for the local Chevy dealer. With almost every loan driven by the monthly implication of the payment on monthly income, it is no wonder we think in terms of monthly payment.

So, lets take a look at what is REALLY going on inside of a mortgage and not just what the monthly payment is.

The 30 Year Mortgage

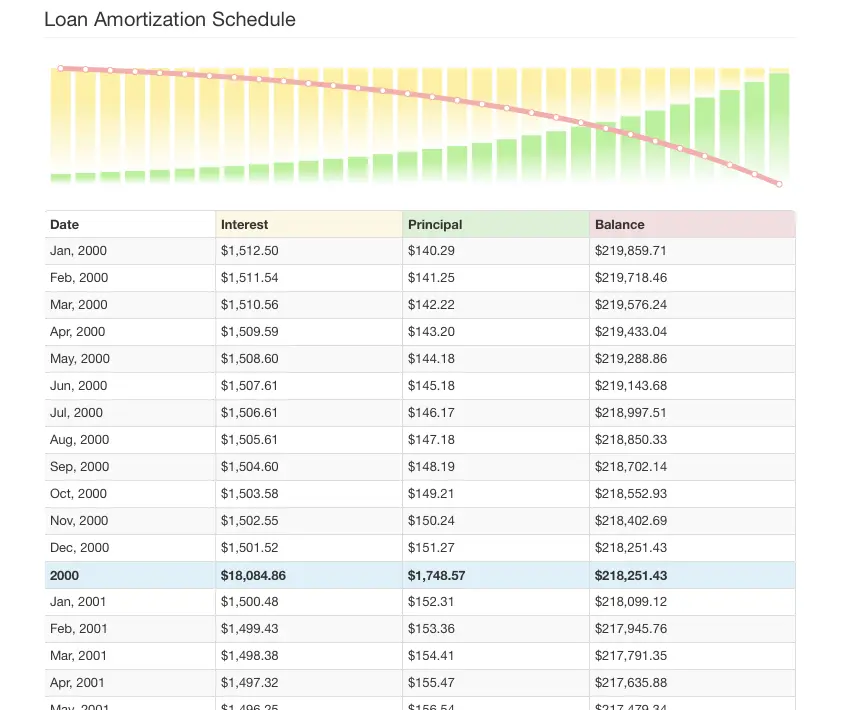

First, the 30 year fixed mortgage in the amount of $300,000 originated in January of 2000

- $1,703/mo payment

- $613,000 in total payments over the life of the loan

- $313,000 in total interest paid over the life of the loan

- Last payment due in December of 2029

- After 5 years, the balance is still over $277,000

- After 10 years, the balance is just over $240,000

- After 15 years, the balance is just under $200,000

In 15 years, you have paid off just under 1/3 of your mortgage.

The 15 Year Mortgage

Now, lets explore what happened if you chose a 15 year mortgage in lieu of a 30 year mortgage.

The 15 year mortgage was computed at 4.75%…15 year mortgages tend to trade at .75% less than 30 year mortgages:

- $2,333 monthly payment

- $420,000 in total payments over the life of the loan

- $120,000 in total interest paid over the life of the loan

- Last payment due in December of 2015

- After 5 years, the balance is $204,000

- After 10 years, the balance is $100,000

- After 15 years, the balance is $0

How Do They Compare?

Consider these points:

- The difference in payments over 15 years ($2,333-1,703 x 180 payments) is $113,000.

- The savings in interest is $193,000 over the life of both loans ($313,000 – $120,000)

- The debt is paid down by $200,000 in 15 years fewer ($200,000 vs $0)

- The $113,000 you invested in your mortgage swings $393,000 in your favor in 15 years.

Stated differently, the ‘extra’ $603 per month you make in payments is really the same as being invested in an investment product whose PRE-Tax rate of return approaches 15%. Additionally, the favorable tax treatment that real estate receives will increase the return by several points (depending on your tax rate). A 15%+ rate of return on cash with little to no risk would make Warren Buffet sit up and take notice.

Let me repeat…the difference between $2300/mo and 1700/mo is close to $400,000 in 15 years!

So when you look at the impact of mortgage on your purchase, you see that the structure of your debt can make a HUGE impact on your net worth.

Personally, I get frustrated when I hear people talk about the monthly payment with little, if any, discussion about the impact on the actual debt. Much of our collective indebtedness can easily be attributed to a lack of fundamental understanding of mortgage principles, by both the public and the lenders who provide the advice.

Choose Wisely

Am I saying that everyone should use 15 year mortgage products? No. I am saying to secure the maximum amount of debt with little to no understanding of its impact is foolish. Many legitimate reasons exist to stretch your debt to the maximum…but many reasons not to also exist. Question your strategy.

Conventional underwriting looks at your income relative to you payment and not to the actual debt amount. Mortgage companies underwrite you more on how much debt you can reasonably service and not really at how much you can reasonably repay. It is a huge difference.

The takeaway advice is this … spend as much time understanding the loan you seek as the house you buy. Numerous mortgage calculators exist to help you better understand the impact of rate and term on mortgage interest – (List of Mortgage Calculators here)

Looking at homes online (or in person) is a lot more fun than poring over numbers, but securing a poorly structured mortgage is far more costly in the long run than even a poorly constructed home.