If you ask 10 Realtors what their job is, you will get at least 11 different answers.

You would get answers like:

- ‘We make dreams come true’

- ‘We take the mystery out of buying or selling a home’

- ‘We facilitate transactions’

- ‘We market properties’

While all of those answers are true to some degree, we think they miss the most important and fundamental service Realtors can provide to our clients – accurately valuing property.

Why do we feel this way?

Because if we can help you understand the reasons why properties are valued the way they are, then you will make a decision that benefits you both now AND in the future. In this new market of volatile market swings and conflicting information, helping our clients make sense of a hugely important financial decision is a responsibility we take extremely seriously.

The Rise of the Data

In case you missed it, the internet is having an impact. How we communicate, how we date, how we shop, how we research our decisions (ok, research each other), how we promote ourselves and how we get our news have all been impacted. And as the web continues to evolve, search engines, aggregators and analytics companies are becoming increasingly sophisticated in their ability to not only make sense of the mind-boggling amount of data available, but to present it to the user in better and better ways.

Algorithms are Everywhere

How are these companies making sense of the data? Algorithms, that’s how.

Algorithms for categorization, algorithms for valuations and algorithms for recommendation are becoming not only more prevalent, but more accurate. Google is said to take into account over 200 different factors in how it ranks pages. Zillow says it recalculates its Zestimates on over 1M homes per day. The city (and counties) collect taxes based on valuing properties they have never been in and have to be able to defend if challenged. And IBM advertisements claim that they can predict who is going to drop out of college based on how far they live from campus (or something like that.)

But are they getting it right? If they get the underlying data right, then yes …

Agent Algorithms

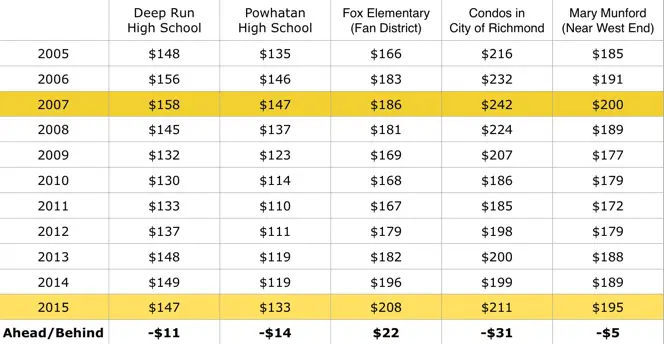

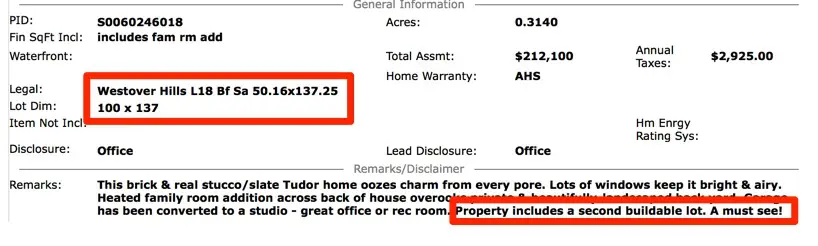

Analyzing ‘housing’ (as an overall market) is one thing, but analyzing an individual house, and the surrounding neighborhood, and the floor plan, decor, color palate and neighbor’s car on blocks in the front yard, is quite another. And this is where the agent adds value.

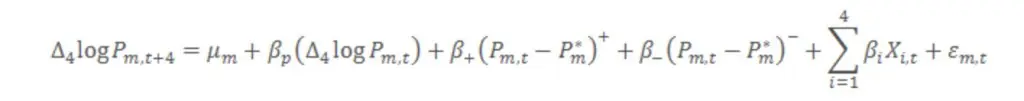

Good agents have algorithms, too, and they are very accurate. Good agents have the ability to look at the data that matters and use it to help their clients make great decisions. And while they may not have the same number of µ’s and Σ’s in them that Zillow’s model does, our models contain one thing that the national predictive models never will – the correct and applicable underlying data set.

- Do you think Zillow knows the difference in value between Grace Streets north and south sides? Good agents do.

- Does Realtor.com know that Woodland Heights recently received its historic designation … and what the impact will be? Your agent should.

- Can Google accurately reflect the subtle but important differences between the Ryan Homes and Eagle Construction warranty departments? Good agents can.

- Can any computer model tell you where the shrink/swell soils are in Richmond? An experienced agent can.

- Can Trulia tell you how another agent negotiates? Once again, a good agent can.

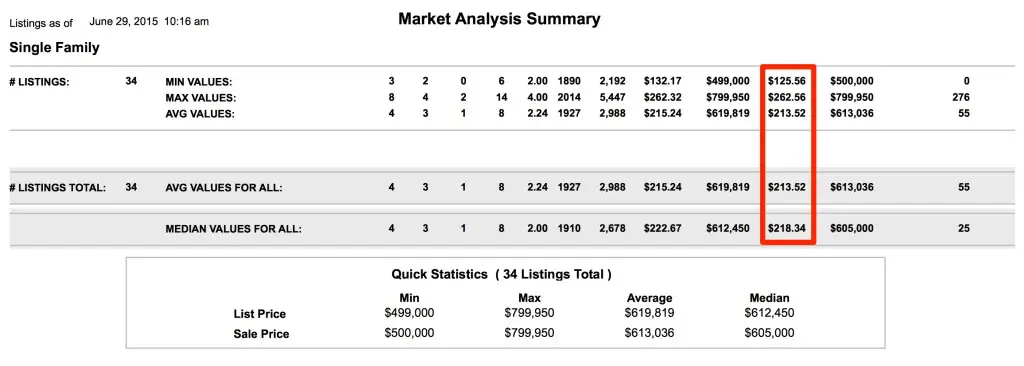

Our Algorithm

You want to know about our algorithm? And what makes it better than Zillow’s?

Here’s ours:

- YOUR Best Decision = YOUR NEEDS + As Much Math as Required + Current Market Conditions + YOUR NEEDS + Schools + What is Available + YOUR NEEDS + Time of Year + Decor + Architect + Parking + Other Agent + Richmond + YOUR NEEDS + Timing + Development + Inspections + Lender + YOUR NEEDS + Builder + Trends + Whatever Else Needs to Go Into the Analysis + YOUR NEEDS

And do you know why our algorithm is better for your situation? Because we wrote it for you.

And do you know what else? If your needs change, we will change the algorithm accordingly …

Our algorithm was written for one person – you. YOUR best decision is about what YOU need and not what we think or what Zillow, Google, your buddy, your boss, your mother, a colleague, or a friend of a friend at a barbecue thinks.

Summary

At the end of the day, good agents are far better at impacting their clients decision about individual houses than any über-computer run by any team of Stanford grads will ever be. Our algorithms incorporate things that the computer models cannot even fathom and we change them each and every day based on the need of the clients we are working with.

All accomplished agents have advanced algorithms. We can’t always explain them, but they work extremely well.

‘How much a foot?’

‘How much a foot?’