We recently had a past client ask us about buying a beach house. The question was basically this – ‘Is it a good time to invest in a vacation rental/second home property?’

The answer is ‘yes’ — but with a lot of caveats AND provided you understand the basics.

In full disclosure, we own properties that would fall into the second home/vacation rental category, and know many who do as well, so our recommendations and observations come from our own experiences and those around us.

The Good

Pricing

Pricing is down still substantially in many second home markets (not all, but many). While there has been some resurgence in pricing off of the 2011/12 bottom, it has not come back as strongly as primary home pricing has — making vacation properties, at least for the near future, acquirable at a discount from their heights of 2006/7.

Rates

Rates are still low, too … like looooooowwww. It makes the monthly carry more affordable than it ever has been.

Rents

Generally speaking, despite a blip during the depths of the crash, vacation rents have maintained a stable upwards trend in most markets. As income drives values in investment property (at least in theory), positive rent trends should have positive impacts on long term values.

Air B and B

The Air B and B topic deserves a lot more discussion that it will receive here, but suffice it to say, the ability to receive some income without paying the expensive management fees commanded by many vacation rental companies is potentially a game-changer for many. Much of the AB&B story is yet to be written (legal, tax, liability) but stories are emerging about people doing well employing the AB&B model.

The ‘Meh’

Loan Products

Despite low rates, the mortgage products that allow us to purchase 2nd homes/vacation homes require a larger down payment than primary residences. When you require more cash in up front, it does tend to shrink the buyer pool a bit. A smaller buyer pool means less demand … you see where I am going.

Additionally, some of the funky loan products that existed before the crash that made it a bit easier to acquire vacation/second homes have gone away, too. But all in all, a little stricter underwriting and some lower loan amounts might not be a bad thing in the long run, no?

Inconsistent Cash Flows

Unlike typical real estate investments, vacation rentals get the majority of the income for the property in in the high season. When you receive 80% of your yearly income in a 4 – 6 month window, it can make budgeting a BIG challenge.

Furthermore, the best time to do repairs (the off season) is when the bank account is the lowest. Budget discipline is a must.

Tax Treatment

A ‘Second Home’ and an ‘Investment Property’ are different animals in the eye of the IRS. The core issue is how much personal use you are allowed before the property becomes treated a second home versus an investment property. Consult your tax advisor as everyone’s tax profile is different (and if you need an excellent real estate tax advisor, we have one!)

The Bad

Maintenance

No one tells you about the maintenance when you buy a vacation property. Do yourself a favor, whatever the maintenance estimate is on the pro-forma, triple it … especially if in a salt water market. We buy a gas grill a year for our place in the Outer Banks. We also buy spoons (no idea why), wine glasses (Ok, I get that) and beach chairs at an alarming rate. Oh, and have to paint at a rate 3 or 4x of what a non-salt home requires. Just keep that in mind.

Management

An property manager in Richmond will take anywhere from a low of 5% to a high of maybe 10% of rents to manage an apartment complex. But in many vacation market, the fee is closer to 20%, especially in a weekly rental market. It makes an extremely big difference to the bottom line.

Other Factors to Consider

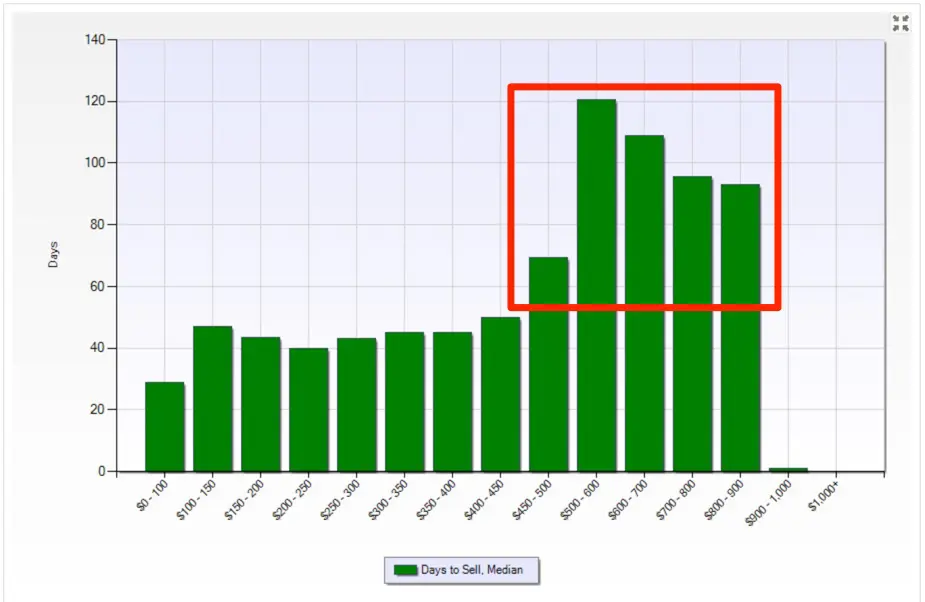

Value Swings

If you think that 2007 to 10 was a bad time for residential property values, you should have seen the fall in vacation markets. When disposable income drops (as it did during the crash), a second home quickly becomes a luxury you can do without. Value swings only really matter if you need to sell, but just be wary that it usually the time when you need to sell that prices tend to be at their lowest.

Distance

Each of has a difference in tolerance for travel. The ability to make a 3 or 4 hour trip each weekend is easier for some than others. Make sure that the property you own is within a distance that is tolerable both now and in the future as the novelty wears off quickly. If you are an easy traveler, then most of the Atlantic beaches are within reach. If you are more of an ‘hour-at-most’ type of traveler, look to the mountains, one of the closer lakes or one of the rivers of Eastern VA as your best options. Richmond is blessed with many great getaways 60 – 90 minutes from most parts of the Metro.

Your Life

So much of life is yet to be revealed (deep, eh?). When we bought our property in the OBX, we had two young kids and the ability to get away with far more regularity. We now have 3 kids and between travel sports, college, business and other commitments, our personal use of the home is pretty infrequent. So the takeaway is just to project out (as best you can) the ability to use the property personally and make sure that if life changes, it is still a smart investment in your portfolio.

Summary

In reality, the vacation/2nd home discussion requires far more in depth than is allowed for in a simple post. It can be one of the most emotional purchases you can ever make, but it really needs to be one that is extremely well thought out.

So if you want to discuss more about this market, we would be more than happy to share some our experiences. And we also have several great Realtor contacts in many of the surrounding markets so we can help point you in the right direction for representation.

All industries have jargon … real estate is no different.

All industries have jargon … real estate is no different.