How much would you pay for one dollar?

Seriously, how much would you pay?

The answer is (wait for it) $1.

So What is 3% Worth?

Now, let’s take the same argument to the real estate world — how much would you pay for 3%?

When you decide you want to purchase a home and you enlist the help of a buyer’s agent, more often than not, the buyer’s agent will be paid roughly 3% of the transaction in the form of a commission. (Disclaimer: Commissions vary by property and company. This post is in no way an attempt to state that 3% is an industry standard.)

“Rarely does the 3% cost of the service equal the value provided by the agent.”

As a purchaser, you don’t really feel it, since the commission is typically paid from the seller’s proceeds. The commission line item is on the seller’s side of the ledger and feels far more onerous to the seller than it does the purchaser.

But I can safely say this: Rarely does the 3% cost of the service equal the value provided by the agent.

Cost Doesn’t Equal Value

Cost Doesn’t Equal Value

So imagine a world where every product or service was the same price. Would you drive a Hyundai or a Mercedes? Would you eat McDonalds or Ruth’s Chris? Would you shop at WalMart or Nordstrom?

The answers are pretty obvious.

“Do you think that the quality of the advice matters – especially when all advice costs the same?”

But when it comes to working with Realtor, every agent costs essentially the same. So why not use the opportunity to choose the best one?

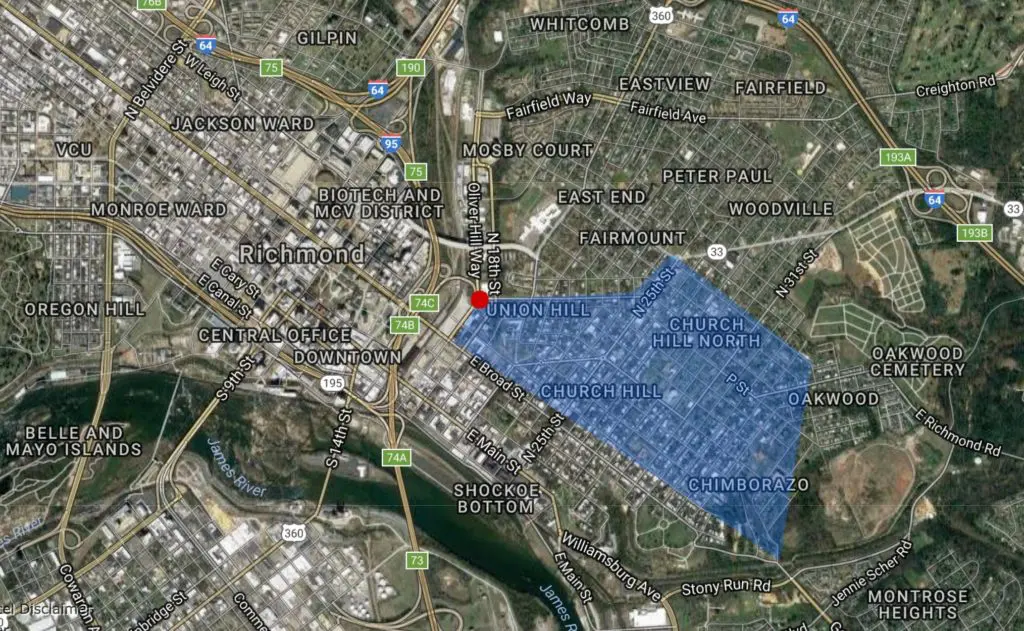

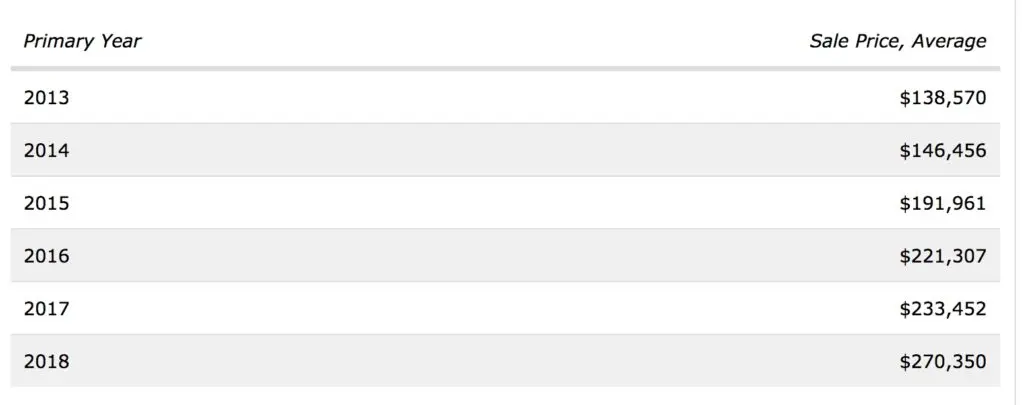

Wouldn’t you like to work with an agent who knows the value difference between a warrantable and non warrantable condo and the impact on property values? Or what about an agent who can demonstrate the 3 year appreciation rate difference between North Church Hill and Bon Air. Or could tell you at what point the marketing times spike and seller discount doubles in the Lee Davis High School district? Or James River High School?

Do you think that the quality of the advice matters – especially when all advice costs the same?

Meryl Streep or Lindsay Lohan

Warren Buffett said it best: “Price is what you pay. Value is what you get.”

Very few industries operate where price and value have as little correlation as real estate sales – and for the shrewd client, this disconnect presents opportunity. Each and every buyer has the opportunity to work with the Realtor equivalent of LeBron James for the same price as J.R. Smith (sorry Cavalier fans, too soon?)

So spend some time researching your Realtor. It is the one place in life where you really have the opportunity to drink Dom Perignon for the same price as Budweiser.

Cost Doesn’t Equal Value

Cost Doesn’t Equal Value

And in doing so, it gave us time to reflect back on what we had done in our first decade:

And in doing so, it gave us time to reflect back on what we had done in our first decade: