From 1995-2006, I was a 7/23 addict.

The ‘7/23’ was a loan product with a fixed rate for 7 years which became an adjustable rate product at the end of the 7th year. With the fluidity of the market, people were moving constantly and building equity quickly mattered greatly.

The Hybrids (7/23, 5/1, 7/1, 3/1…and others)

From a lender’s (and Realtor’s) perspective, the 7/23 was the best product ever dreamed up as it offered the best of both worlds – a lower rate and fixed payment. Effectively, a 7/23 offered the stability of a fixed rate product at rates roughly 2 points below the 30 year mortgage for the first 7 years, at which point it would become a 1 year ARM (adjustable rate mortgage.) The 7/23 was especially popular with those who knew their first purchase was likely to be a 10 year or less hold and/or move up buyers. If you were not going to be in the home for 30 years, why pay for the privilege of a rate for 30 years, right?

The 7/23, and with it, a host of other hybrid products which blended fixed periods of varying lengths and less frequent adjustments (than the standard 1 year adjustable products) made a lot of sense.

And then 2008 happened…

The Crash and The Fed’s Impact

When the market crashed in 2008 and the Fed began to buy down the rates, the low pricing on fixed rate products made adjustable products largely obsolete. Why take the risk of rate adjustment when you can lock a 4% rate for 30 years? It made no sense to do anything than lock for as long as possible. Adjustable rate products got placed on the shelf along with the McMansion and the Humvee and we have sort of forgotten about them.

Until now…

The New Mortgage Market

We are coming to the end of an era, folks, and it is the end of the 4% 30 year fixed mortgage. Janet Yellen (the Fed Chief) has more or less announced the Fed’s stance is about to change and with it, the last of the 30 year fixed rate mortgages will be originated in the early spring of 2015 (probably.) We will look back in 20 years with our real estate grand kids on our collective real estate knees and tell them the story of the 4% 30 year fixed mortgage products and how they used to rule the lending world. Our kids will gasp with amazement at the idea that mortgages used to be 3.875% 1+0. We will also tell them about $70/SF for housing…and pagers…and flip phones…but I digress.

As the Fed begins ease the Quantitative Easing (see what I did there??) which has kept rates so low for so long, we will begin to see rates spread back out more than the 3/4 rate point they are currently. The market does not really drive pricing (the Fed does) and when they (the Fed) decide lift their foot off of the brake and let the market go back to driving the long bond, then we will see rates rise, especially the further out the commitment (i.e. 30 years). As rates rise, adjustable and hybrid products will become more and move in vogue.

So What Do We Do?

What does all of this mean?

It means this – decision making is returning to lending. Right now only real decision a borrower needs to make it when to lock (watch this VIDEO on ‘Rate Protection’ some lenders offer, kinda cool). Soon, borrowers will need to understand all of the mortgage products available to them as the difference between the long term and short term rates will increase the complexity of the decision.

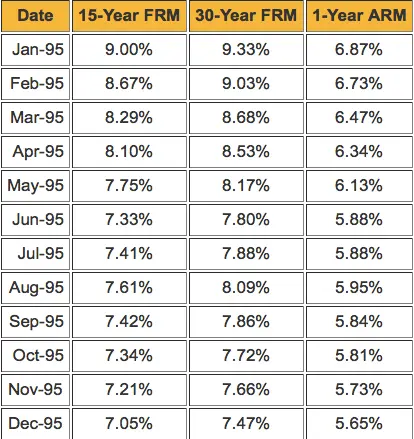

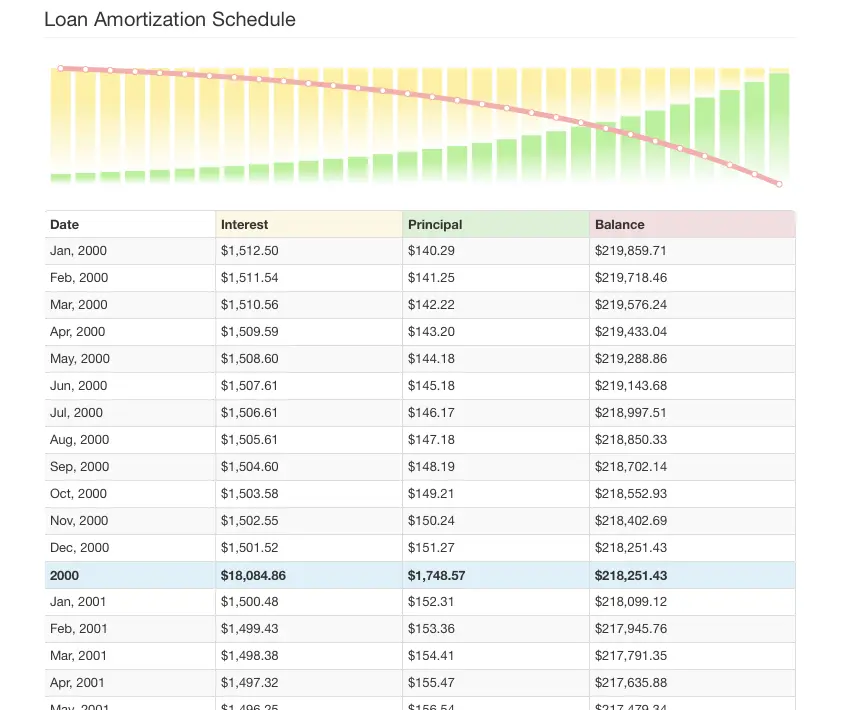

Take a look at the rate sheet from 1995 and tell me, what would you have done in January (and let me help, the difference between the 30 year and the 1 year ARM is $454/mo)?

Good question, eh?

In 10 years, you would have payed over $50,000 in additional interest if you chose FIXED over ARM. That number decreases dramatically if your payment adjusts up but what if it adjusts down? Will it go up…or down…and when?? What will happen?? HELP!!! The bottom line is you need a true pro to help you decide.

Lenders and Guidance

I think the key in all of this is to be presented with facts, options and guidance. With the prevalence of online sources quoting rates without any knowledge of the market, the customer is the loser. Quoting a rate is not providing information, despite what the online lending portals want you to believe. I cannot tell you the number of times a client has had a miserable experience when they tried to use a ‘lender’ with an 800 number and a 5 digit extension whose hours are obviously not east coast. It NEVER (repeat, N-E-V-E-R) works out.

What are the characteristics of a good lender?

- A robust and talented crew (often called the ‘Secondary Market Group’) paying attention to Wall Street, The Fed, Congress, Oil, Employment, Housing, weather and about every other input to the market which can drive rates. They keep the originator up to date when the market swings (and I cannot overstate the importance of their information and the benefit our clients)

- A direct line to their underwriting department so that they can promise a date by which your application is reviewed and approved

- A direct line to their processing department so you can see where the loans are and when you can expect paperwork delivered

- A talented, ethical and diligent group of loan officers who make sure their company can deliver as promised and to meet the timeline you need

Oh, and by the way, they should have some awfully low rates, too. The best ones always do.

The lenders we work with have all of these talents and skills for sure. It is why we recommend our clients work with them.

Does yours?

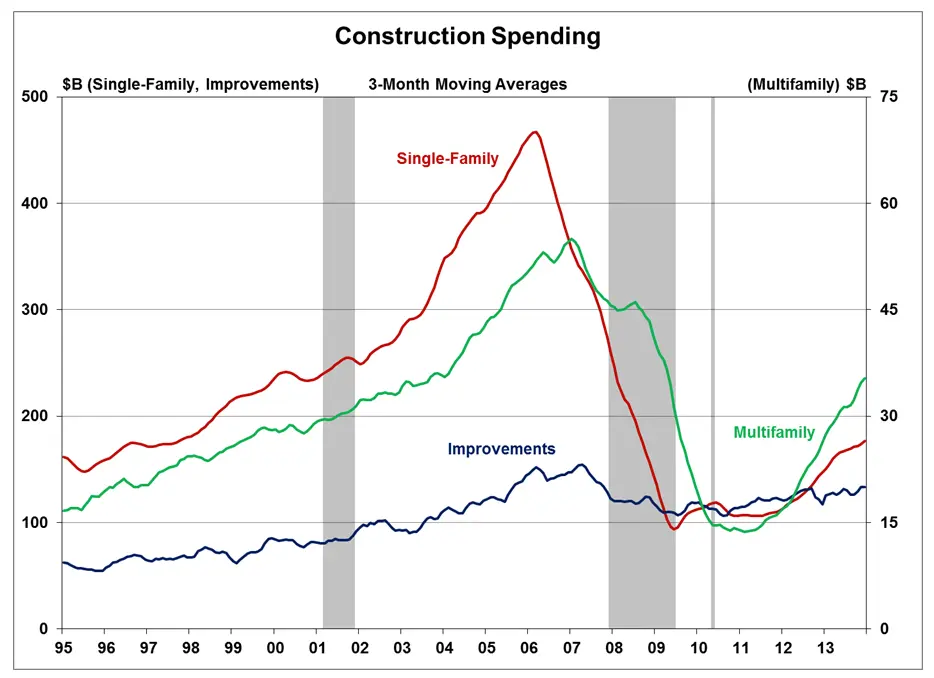

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.