As we find 2010/11 a smaller and smaller object in the rear view mirror, the real estate world appears to be returning to some sort of normalcy. The number of foreclosed properties is down as is the number of short sales. As you can see below, the number of REO Properties (Bank Owned), while still available in numbers above the levels before the adjustment, are still down considerably from darkest days of 2010 and 11.

As we find 2010/11 a smaller and smaller object in the rear view mirror, the real estate world appears to be returning to some sort of normalcy. The number of foreclosed properties is down as is the number of short sales. As you can see below, the number of REO Properties (Bank Owned), while still available in numbers above the levels before the adjustment, are still down considerably from darkest days of 2010 and 11.

The impact of this is twofold.

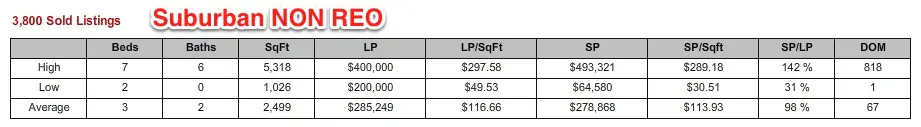

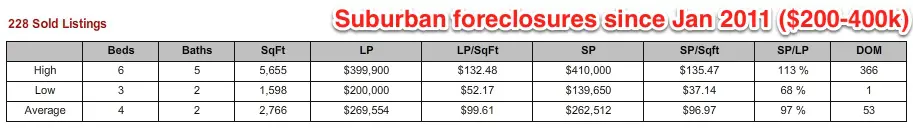

First, the opportunity to find cheap homes is far lower now than even 2 years ago. Foreclosed properties (a list can be found here) have always provided the ‘flipping’ community with ample numbers of homes to purchase, at discounts, to be fixed up and resold. While several lending rules were put in place to discourage the abuse of the system (which in reality, was another poor policy that prolonged the slump), there were still those that found homes cheaply enough to purchase and renovate despite a still declining market.

The number of cheap homes (and by cheap, I mean priced artificially low for quick sale) in the market are largely gone. As we move into 2013, the collective inventory of homes for sale, both REO and non-REO, are approaching critically low levels. Many neighborhoods, especially those mature urban neighborhoods with higher values, are off by 70-80% of their traditional available supplies (see the chart below of inventory levels in 23221 zip code)

Secondly, the removal of the large swath of foreclosures from the marketplace means that we should begin to see some slight improvement to the collective market values of homes across the US. These slight increases will be stronger in some places than others (see the Back to the Future Series) as the the lack of available inventory drives prices higher. Any market whose property values are increasing is obviously a great thing for ‘Flippers’ as the assets they own are increasing in value during their hold period.

So what does this mean?

It means that prices are heading higher until we size supply correctly and that it will be harder to find homes to flip. It also means that the community of ‘Flippers’ will need to look elsewhere for opportunity. Homes with unfinished spaces that can be completed for a reasonable cost and are located within neighborhoods that support the additional value will be an avenue to find opportunity. The other will be to find homes in need of additions. The 3 bedroom 1 bath colonials or cape cod styled homes in many of the neighborhoods built during the 1920-1940’s are one area. Smaller Fan and Museum District homes are also good targets.

The days of the easy ‘Flip’ are somewhat over and in order to continue to make money as a ‘Flipper’ one must become increasingly skilled as a contractor.