I live in a HOUSEand you live in a HOUSE, but collectively, we live in HOUSING.

Please explain…

Individually, we buy a house (or condo) that fits our needs and personality. It can be big or small or it can be blue or beige or tall or short, but it is our house. It contains our stuff and it contains our memories. It has pictures on the walls of the people, places and things that are important to us and it creaks and moans when the wind blows…and we know where the water shut off valve is (because of ‘The Incident’ back in 2007.) We also know that flushing the toilet in the master bath while the washing machine is running means an immediate increase in the shower temperature by about 20 degrees.

Once again, it is our house.

That being said, the US is comprised of millions of houses just like yours and mine. This collection of millions of homes makes up the market called ‘HOUSING’ and it is what shot to the moon in 2006 and was in free fall in 2008. The US Housing Market is a complex collection of numerous inputs (supply, demand, credit, Mortgage Insurance, schools, materials, seasonality, type, location, density, demographics, etc.) and it is these factors collectively that drive value. Despite what HGTV, Pottery Barn and Home Depot would have us believe, it is not our paint colors, furniture placement or lighting selections that truly affect value.

[ Inventory levels have plummeted since 2008 while pending inventory is trending upwards. More stats here ]

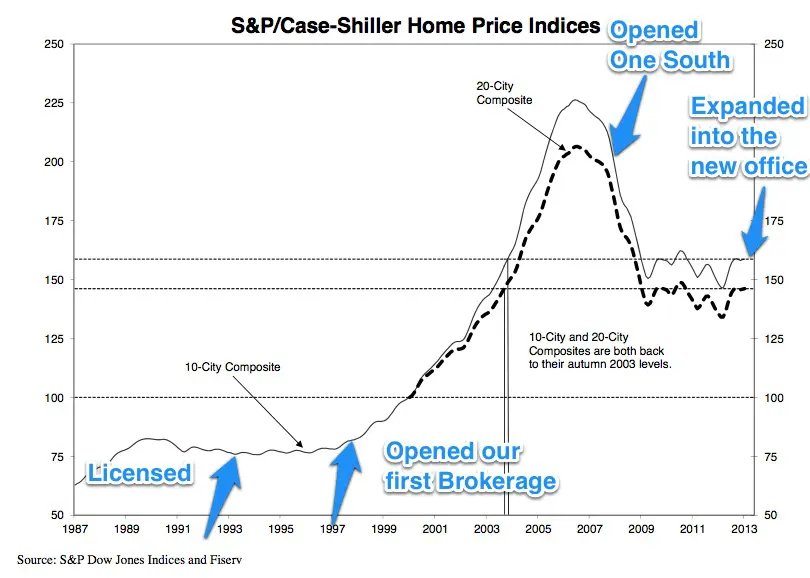

Currently (spring of 2013), we are in the throws of another massive correction…but this time to the positive. The correction that we are currently experiencing is a re-correction from the over-correction that occurred from 2008-2011. During the 5 year period prior to 2008, prices rose at an unsustainable pace due mostly due to a lending process that was flawed. The severity of the correction was due, in large part, from the UN-availability of credit once the market adjusted. The overall leverage in the marketplace in 2008 was unprecedented, especially when compared to historic trends, and when values began to fall, the debt levels exacerbated the correction on a level unseen in most of our lifetimes. The implosion of the market either caused (or was caused by, depending on who is asked) the implosion of Wall Street and the fallout in the credit market was global.

The lesson in all of this is that the HOUSING MARKET determines the value of homes and not Realtors, an appraiser, Zillow or the individual homeowner’s selections. Without a doubt, the most important inputs to the local market are controlled well outside of the region. While design trends and color palates may affect pricing to some degree, by and large, the swings in value that are significant are driven by MACRO factors. A paint job will not improve your property values by 10% but a policy shift in DC sure can. Simply put, when there are more homes than buyers, prices go down and when there are more buyers than homes, prices go up. Those who are truly shrewd investors understand this and strategize accordingly.

Remember to keep these macro factors in mind when making the decision to purchase. I see so many buyers fail to understand the overall picture and in doing so may let a home pass over an inspection item or negotiations break down over a few thousand dollars. In the grand scheme of things, owing property now, at the interest rates currently available is likely to be one of the most intelligent financial decisions you will make.

These extremely favorable market conditions will continue to be for the next 12-24 months as we correct back to trend. Keep an eye on the inventory levels and interest rates. When the graphs look like they did in 2003-5, we are back to a stable and (relatively) predictable market.

The re-correction is not over but it is in mid-process and the days to purchase an large asset at a discount are ending sometime in the foreseeable future. Serious consideration should be given to the opportunity to enter, re-enter or adjust one’s housing situation as these market conditions are fleeting.

While every purchase or sale situation and deal is different, at some point in the offer/counter-offer process one of the three following statements is uttered:

While every purchase or sale situation and deal is different, at some point in the offer/counter-offer process one of the three following statements is uttered: [

[  History also plays a role.

History also plays a role.

A buyer’s agent works for YOU when you buy a home.

A buyer’s agent works for YOU when you buy a home.