I think that deep down inside, each Realtor is part frustrated architect and part frustrated photographer (ok, this Realtor is) and thus my obsession with extremely well done photography. Nothing quite lends itself to powerful photography quite like people, nature and architecture.

Being lucky enough to work in a city with architecture dating back centuries, unique shots are everywhere. And being lucky enough to work with some really talented artists (yes they are artists) only makes our job easier.

Here are some of our favorites.

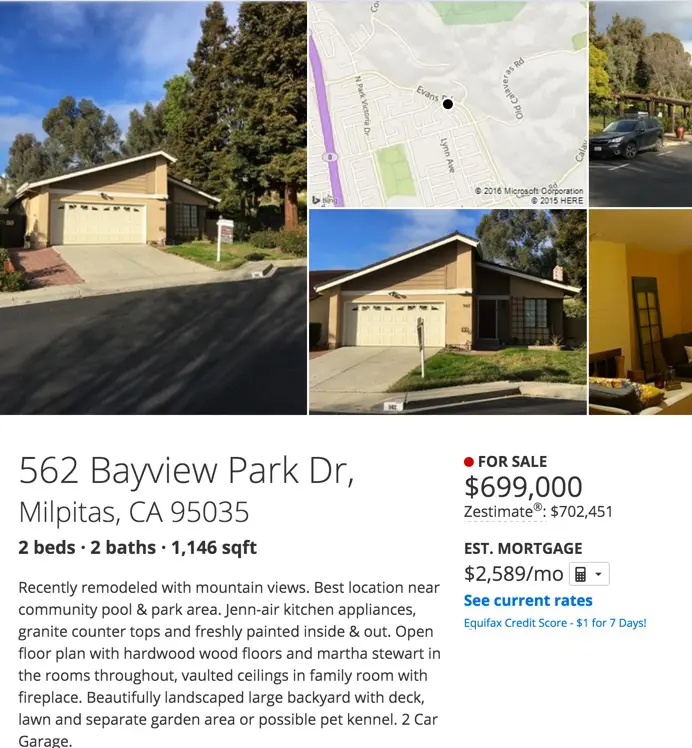

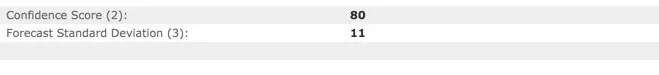

Here is a sample of AVM’s for the following home –

Here is a sample of AVM’s for the following home –

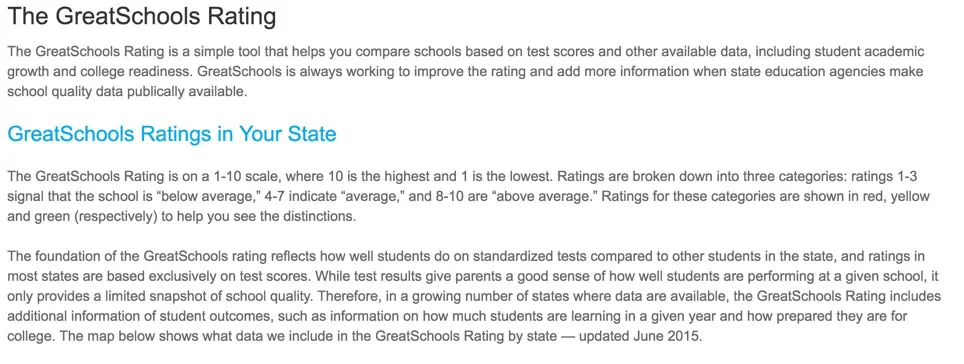

Finally, someone did their job correctly …

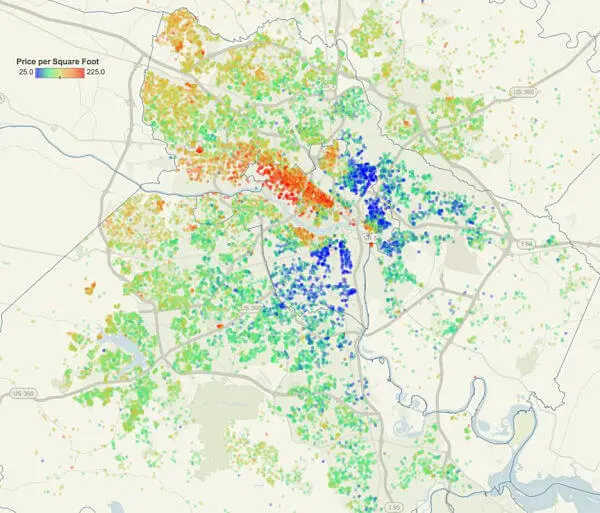

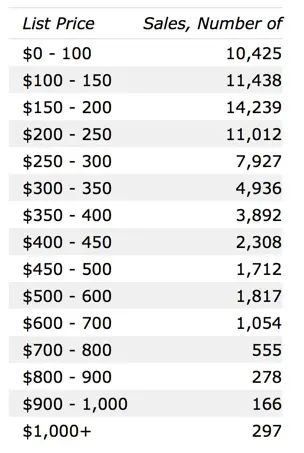

Finally, someone did their job correctly … If 2016 is anything like 2015, we are going to see home prices rise.

If 2016 is anything like 2015, we are going to see home prices rise.