A lot of what we talk about on this blog is the condition of the market –– especially localized market conditions –– and how they are trending. We also spend a lot of time talking about pricing and valuation methods.

But today, we are going to take a break from the math and talk about a more fun topic –– the lofts and flats of Richmond VA.

(photo credits to Kent Eanes, Trevor Frost, Dennis Papa, and Bryan Chavez)

We All Love Lofts

I think that deep down, a little part of each of us wants to own a loft. Whether it is a small flat in an old industrial section of town or a fully renovated uber-loft with the perfect blend of new and old, lofts are just cool.

Think about it –– how many times have we seen a hip loft or groovy flat serve as a centerpiece for a movie or favorite TV show?

Often.

I mean, how can you forget the iconic scene in Big with Tom Hanks and Elizabeth Perkins bouncing on a trampoline in the young Hanks’ NY loft?

Or do you remember the scene in Wall Street where Daryl Hannah’s character (Darian Taylor) turns Charlie Sheen’s (Bud Fox’s) penthouse into a post-modern art museum (complete with the Talking Heads playing in the background)?

Or even Demi Moore and Patrick Swayze making pottery in their recently purchased dream loft in Soho in Ghost? (sorry, but that video was a bit too risque to show in this blog …)

Lofts are Cool

Admit it, each time we see a perfectly decorated loft, we think, ‘Wouldn’t it be cool if we …’

The answer is, ’Yes, it would be cool.’

And the good news is that we can help you.

Where are Richmond’s Lofts?

The lofts in Richmond are primarily set in two Richmond neighborhoods –– Manchester and Jackson Ward. Yes, Church Hill, Shockoe, and Scotts Addition have a few options (and even a few can be found in the Fan District), but most of the spaces that can be called ‘lofts’ are located in the formerly industrial districts of Richmond.

The good news is that there is also a wide range of styles, sizes, and price options in our market. Unlike New York or San Franciso, where the lofts tend to be large and frightfully expensive, there are numerous options for smaller and more affordable lofts if your budget isn’t unlimited.

Here are some of our favorite spaces in Richmond.

The Decatur | Manchester

Have you ever heard of The Decatur?

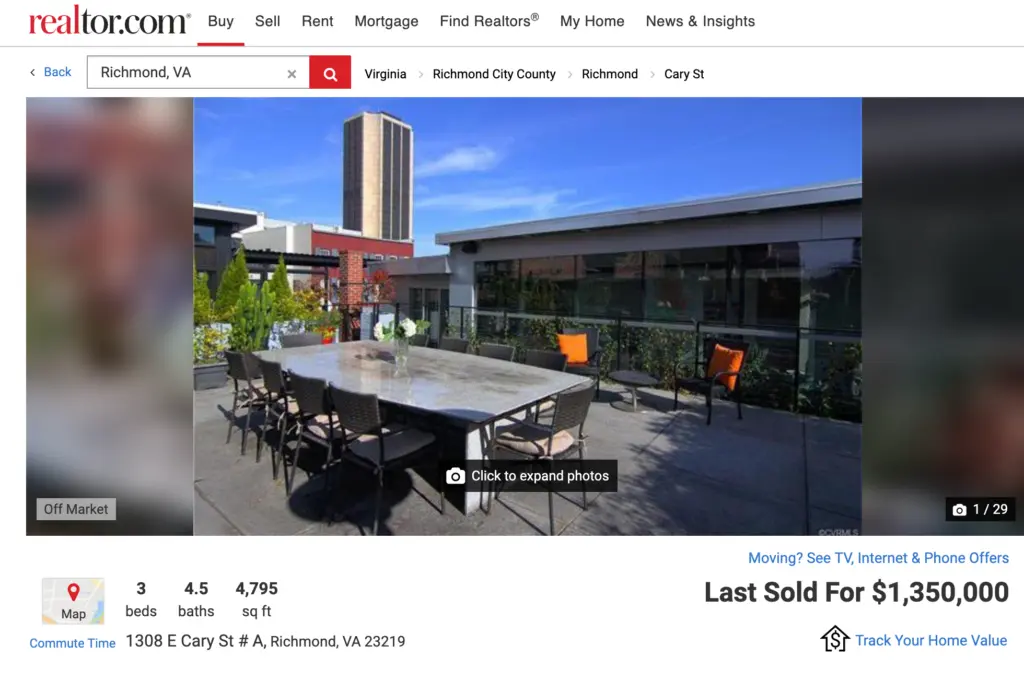

The Decatur is a niche 4 unit property in industrial Manchester abutting the Plant Zero/ArtWorks property between Hull and Decatur along 3rd Street.

Developed in the early 2000s, the Decatur is 3 residential spaces –– all designed in a different fashion –– and one commercial space.

The Decatur loft is currently for sale and can be found here

What makes The Decatur unique is that each owner bought their space in raw and then finished it according to their own wishes, and with some extremely high-end finishes (think ‘build to suit‘ loft!) Unit C, the Rodriguez-Chapman loft recently sold and Unit B, the Brickner-Connell loft (with private elevator) is currently on the market.

And yes, the roof deck must be seen to be believed, with some of the most expansive views in all of Richmond.

The Emrick Flats | Jackson Ward

In the early-mid 2000s, just as the development momentum of Downtown was heating up, a small group of developers decided that the concrete and glass former car dealership that they had just bought would make a really cool condo building.

And thus was born the unapologetically industrial and super-groovy Emrick Flats.

As condos go, Emrick occupied a very specific and edge place in the Richmond market. Emrick wasn’t for everyone –– it either spoke to you or it didn’t –– and you knew it immediately. It made the condos quite easy to sell, honestly, as you could tell within a few minutes how a buyer felt (I was lucky enough to represent the sales in the building.)

The beauty of truly industrial space is that almost any non-traditional aesthetic works. Minimalist works. So does contemporary. So does modern. So does eclectic. The ways each owner took what the condo offered and made it their own was really fun to see.

Emrick’s unit size tends to be a bit smaller (and so does the pricing) with the exception of a few of the top floor spaces. A few owners either combined multiple units or have multi-level spaces with private decks.

Availability will vary within the building so you have to keep an eye on the market to make sure you don’t let the perfect flat slip by.

The Scudder Loft | Shockoe

When Steven Spielberg came to Richmond to film Lincoln, he needed something worthy of, well, Steven Spielberg.

Unit 1501 at the Vistas met the standard and served as his home for nearly a year as he filmed the epic bio throughout Richmond and Petersburg.

The Scudder residence at the Vistas differs from most of the loft spaces in Richmond in that it is located in a more polished part of town and within a newly constructed tower, as opposed to within an older building in one of Richmond’s revitalized industrial districts.

Despite the fact that the Vistas building was new at the time, the renovation was special.

Local architect, Dave Johannas’ team handled the re-design, as well as many of the selections, and helped execute the owner’s vision. For anyone who has had the opportunity to spend any time in the condo, it is spectacular, and (at least in my opinion) the views are the best in Richmond

Gotham | Downtown

In 2000, no one from Richmond was thinking about Downtown living.

The native Richmonder viewed Downtown as a place to work, and maybe eat (or drink) and then leave –– until Gotham.

The non-local developers of Gotham (Chicago and New York) purchased one of the ‘iron fronts’ at 12th and Main Streets and created 8 contemporary flats in a former office building that (I believe) was formerly owned by a printing company.

Of the 8 spaces, the two penthouses that front on Main are the most special.

(For a complete listing of condo projects and availability, check out our Ultimate Guide to the Richmond Condo Market).

The private elevator entrances, the multi-level living, the contemporary aesthetic, the first of Richmond’s roof decks, even the name ‘Gotham’ –– all of these features were effectively unseen before and when combined into purchasable spaces, changed Richmond’s view of itself.

Gotham deserves a lot of credit for showing Richmond that Downtown was, in fact, a really great place to live.

Other Lofts

The lofts (and projects) we listed above are a sample of what is available to the loft enthusiast, but there are others.

Properties such as the Old Manchester Lofts (Manchester), The Mule Barn (the Fan District), the warehouse side of The Reserve (Tobacco Row) and the Cedar Works building at Rockett’s Landing help satisfy the loft need in Richmond with smaller space options.

Other one-off renovations, such as the spectacular flat that local developers Tom and Angel Papa created in Shockoe Slip, or several other combined units at the Vistas, Riverside, and Rocketts Landing serve the need for larger spaces and come to market occasionally.

At the end of the day, Richmond’s loft market is a healthy one with more depth than many realize. And when combined with a diverse supply of new infill townhouses in many of the same neighborhoods, the Richmond housing market has never healthier.

And in doing so, it gave us time to reflect back on what we had done in our first decade:

And in doing so, it gave us time to reflect back on what we had done in our first decade: