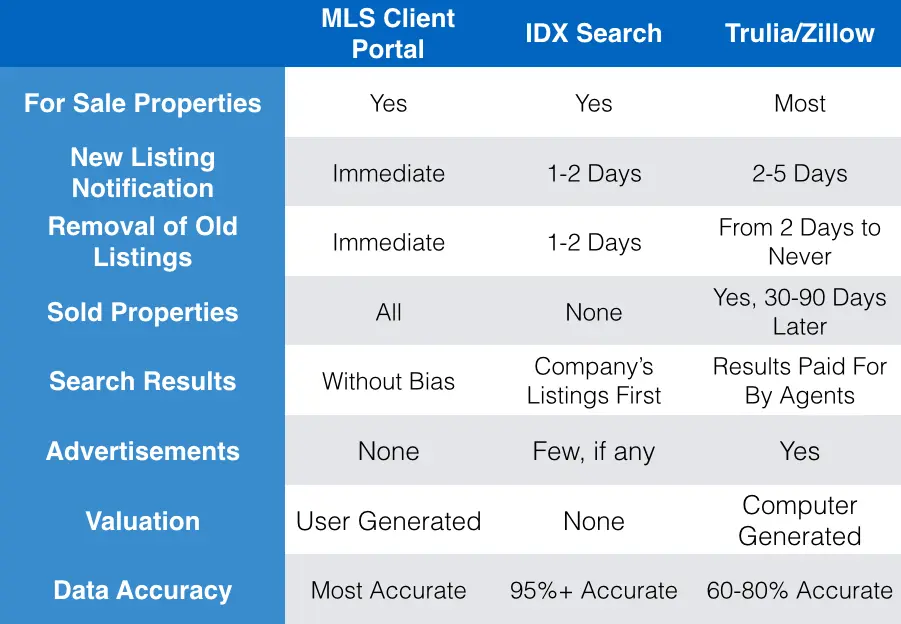

Want to know the best way to search for homes online? See the chart below.

The explosion of online search sites has changed the landscape for both the public and Realtors as it relates to searching for a home…both good and bad.

The good is that the information the public seeks is far more available than it ever was. The bad news is that not all search sites are created equally.

At the end of the day, the ‘closer’ the site is to the local MLS, the more accurate it is. Without going into boring technical details, the MLS (Multiple Listing Service) is the most accurate database of both available homes and sold ones. Not only do Realtors use MLS, Appraisers use it as well due to its accuracy.

The public may only have access to the MLS database via a ‘Client Portal.’ This can only be set up by a licensed Realtor who is a member of MLS and the information therein cannot be displayed publicly.

IDX Search sites (the one you are on right now) is a very close approximation of the FOR SALE (not SOLD) properties available and pulls its data directly from MLS. Since an IDX feed is published by the MLS, it is subject to a very specific set of rules as to how it can be used and its accuracy is directly related to many of these rules. Generally speaking, an IDX search site will be accurate to within a day or two of real time meaning any change in a property status will be reflected usually in no more than 48 hours from the change. IDX does not show sold data.

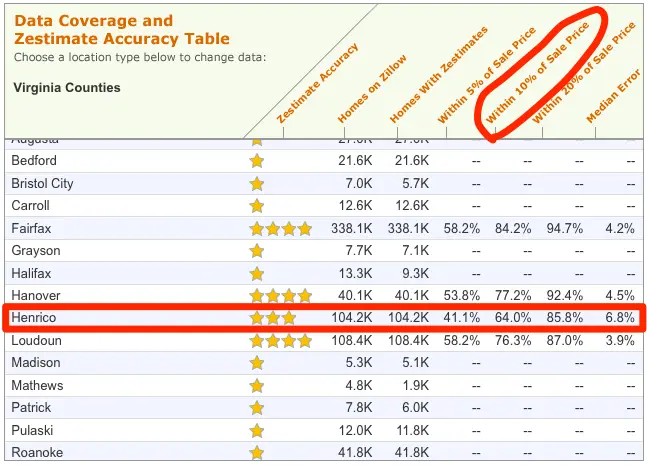

Trulia and Zillow do not receive data directly from MLS and thus are far less accurate in both property availability and status (ACTIVE, SOLD, UNDER CONTRACT). While they have numerous tools available to help predict values and market conditions, by their own admission, are only able to predict values within 10% of the actual value roughly 60% of the time. It should also be noted that the search results are skewed by who pays to be at the top of the list. In effect, T and Z act more as a message board and far less like the true database they claim to be.

Make sure to understand the strengths and limitations of the site you choose to use.

If you’d like us to set up a ‘client portal’ for you that gets you direct access to MLS, just click here.