Feels a bit odd right now doesn’t it?

- We have war going on.

- COVID is lingering / re-surging.

- Supply chains are still nowhere near functioning properly.

- Inflation is raging.

- The Fed has proclaimed inflation is ‘Public Enemy #1’ and seems hell bent on wringing it out of the system, regardless of the damage it does.

- Mortgage rates have come close to doubling in the past 90 days.

- The stock markets have shed trillions in collective value.

- Crypto is down by more than half.

- NASDAQ is down about the same.

- And the Supreme Court is now leaking documents.

Did I miss anything?

Real Estate

So I did miss one thing –– real estate.

Right now, if you read the blogs and reports coming about Q1 of 2022, you will hear nothing but things like ‘prices set new record’ and ‘inventory at all time lows.’

But if you also ‘doom scroll‘ Twitter, or listen to CNBC, you hear a far different story. Inventories are rising, traffic is down, and price reductions are becoming far more common.

So which is it? Is real estate going to continue its torrid price rise despite rising rates, rampant inflation, and all of the other upheaval brought to us compliments of Covid and Putin?

Or should we brace ourselves for 2008 Redux?

Here is what to watch.

Lending Update

On January 1, 2022, the 30 year mortgage rate was hovering around 3%.

By May 15, 2022, the 30 year rates stood at 5.5%.

Not only did the rates nearly double, the rate at which they jumped was particularly jarring –– never in the history of the capital markets have rates ever risen this quickly.

And, yes, it is having an impact.

Qualifying vs. Underwriting

But while most of the messaging is that buyers now no longer qualify, in reality, what it means is that they simply qualify for less. The uninformed conflate mortgage rates with underwriting –– and they are two different things.

Underwriting removes people from buying pool because of things like credit scores or how income is counted –– rising rates simply move a buyer down the ladder.

That is a key distinction.

Unlike 2008, when buyers were removed from the buying pool because the loans went away, today, the rising rates has made owning more expensive. The buying pool is still the same size, they just qualify for less.

The takeaway here is that the most intensely contested segment of the market –– the entry point –– won’t change that much.

Might we see weakness at higher price points where homebuilding is more common? Perhaps, but unless we see a spike in additional homes coming to the market at or near the median price points, the buyer / seller imbalance is so dramatic that I still don’t think we will see much slowdown.

Inflation

Low rates didn’t just drive housing prices higher, they pushed all asset values higher.

Additionally, the response to COVID (give everyone money to stay home) flooded the system with free excess cash.

So what happens when you give away money and drop rates to nearly zero?

Inflation.

When COVID hit and we went into lockdown, the Fed flooded the system with currency in an attempt to keep everyone flush with cash until we got the pandemic under control.

It can be argued that the stimulus had the desired effect –– at least initially.

The Monetary Hangover

But free money is a lot like free beer, it sounds like a great idea at the time but comes with a severe hangover later –– especially if you keep drinking it well past when you know you should.

Well, now is later and we drank WAY too much.

Currently, Inflation is just over 8% and the cost of goods and services are far higher than pre-pandemic, with not a lot of relief in sight.

Killing Inflation

The good news is that the Fed has already begun to change its policies in order to stave off inflation. The bad news is that it only really has two levers to pull and both have the impact of driving up ALL forms of interest rates –– mortgage rates included.

As most everyone now knows, rates shot skyward faster than at any point in history –– from roughly 3% at the beginning of the year to 5.5% by mid-May.

While the last week or so has brought some stability to the mortgage rate environment, it hasn’t meant that rates have decreased, only that they flattened for a little while to allow the market to assess the impact of the last rate jump.

Until data shows that inflation is slowing dramatically, expect rates to keep ticking up.

The 3% Mortgage’s Legacy

Which brings us to the unanticipated –– and extremely problematic –– part of the hangover.

Pretty much anyone who purchased a home prior to January of 2022 has more than likely refinanced their mortgage as rates dropped –– and is now sitting on a +/-3% mortgage. Depending on the study you read, something like 75% to 80% of all mortgage debt is now at or below 4%.

Think about it –– who in their right mind is going to give up that rate? And then turn around and buy into a market with 5.5% rates and less than 1 month of inventory?

I doubt there will be many –– and therein lies the new problem. Inventory is already at record lows, and now anyone with a 3% mortgage is probably not going to sell unless they absolutely have to –– further depressing inventory.

The economic idea that rising prices leads people to want to sell, at least in this case, is not accurate. The increased cost of capital is proving a far stronger deterrent than rising prices are an incentive.

Gotta be honest, I didn’t see that problem coming.

Inventory

So despite the idea that people with 3% mortgages are unlikely to sell, the rise in rates and the crash of the stock markets is removing liquidity (a.k.a. –– the free money) from the system.

As a result, housing inventories are starting to rise nationwide –– albeit at radically different regional rates. When the cost and availability of money changes, demand is impacted.

So how is Richmond being impacted?

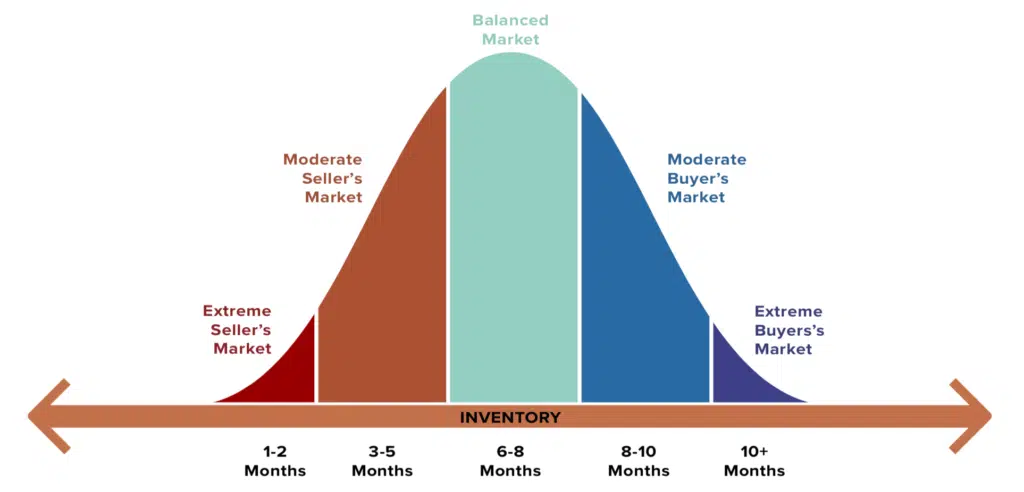

When we entered the pandemic (March of 2020,) we were already experiencing some of the lowest inventory conditions ever. Most of the US was in what would be considered a strong seller’s market with somewhere between 2 and 3 months of inventory.

After a brief lockdown-induced pause, the Great Migration buying frenzy bagan and inventories started to drop from ‘lowest of all time’ to ‘is zero inventory actually possible?’

For Richmond, we spent the large majority of the pandemic measuring our inventory in weeks, not months –– and that has not changed. As this blog is written, we are still less than a month (.80 to be exact) despite the rate jump and other economic headwinds.

So when inventories start to rise (and it is inevitable that they will,) realize that even pre-pandemic levels aren’t enough to fundamentally change the market.

I’ll start to pay attention when we have 3,000 -4,000 homes for sale, not when we move from 500 to 600.

Rents, Migration, and Millennials

‘So I will just wait for the market crash and buy a home when prices fall and rates pull back,’ has been a common refrain amongst every renter who has tried and failed to buy a home.

I am sorry, that was a poor strategy.

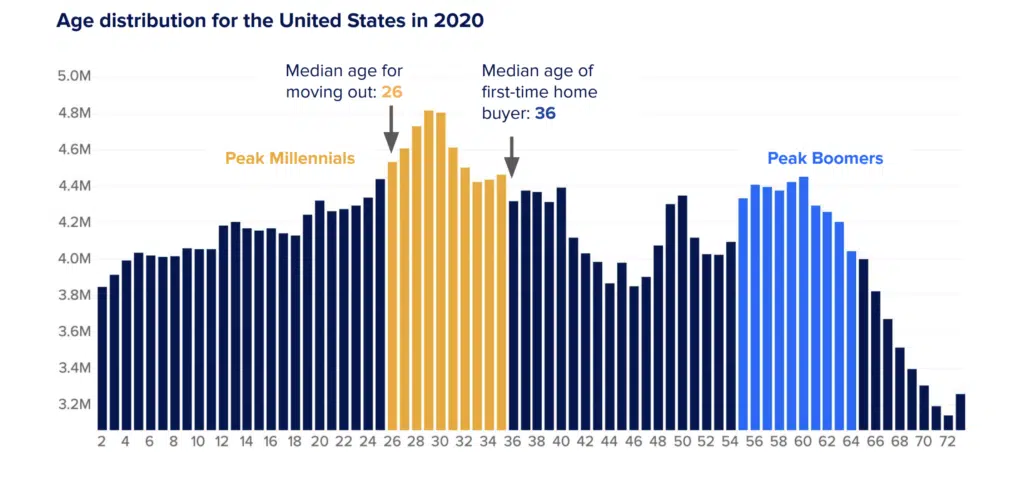

Right now, rents are up somewhere between 20 and 30% depending on your market, vacancy rates are effectively zero, and the leading edge of the Millennial Generation is just now maturing home buying age.

And did I mention that Richmond’s population is growing at some of the fastest rates in the country? In the time period following the arrival of COVID, Richmond’s growth rate has exploded –– mostly due to migration from regions of far higher costs of living.

All of the other financial stuff aside, the fundamental issue is that we don’t have enough places for people to rent OR own, and it is spiking the cost of both.

Congratulations, Richmond! All of the good stuff we have been saying about ourselves finally paid off. People from all over this great land heard our message and moved here –– now if they could only find an affordable place to live…

Summary

I get it, you can’t (almost) double the mortgage rate in 90 days and not have an impact.

I expect at some point we will see rates of price increases slow somewhat, especially if we don’t get the cost of gas and food down.

But regardless of all of the complexities of modern monetary policies and inflation, the fundamentals that underpin housing are quite simple –– how many buyers are seeking housing versus how many sellers have one to sell?

Right now, the number of purchasers so far outweighs the number of sellers that I don’t really care much about rates, or the economy, or inflation, or Ukraine, or COVID.

We don’t have enough of any kind of housing to satisfy the demand that is already here.

This problem has been steadily building since the devastation of the construction industry on the heels of 2008. We should not be surprised that we are here.