For those of you who know me, I don’t think the following will come as a surprise to anyone:

- I follow a lot of bloggers

- I read a lot of articles

- I listen to a lot of podcasts

The bottom line is that I spend considerable time nearly every day consuming information on all things real estate.

And in my time researching the market, I have come to one irrefutable conclusion.

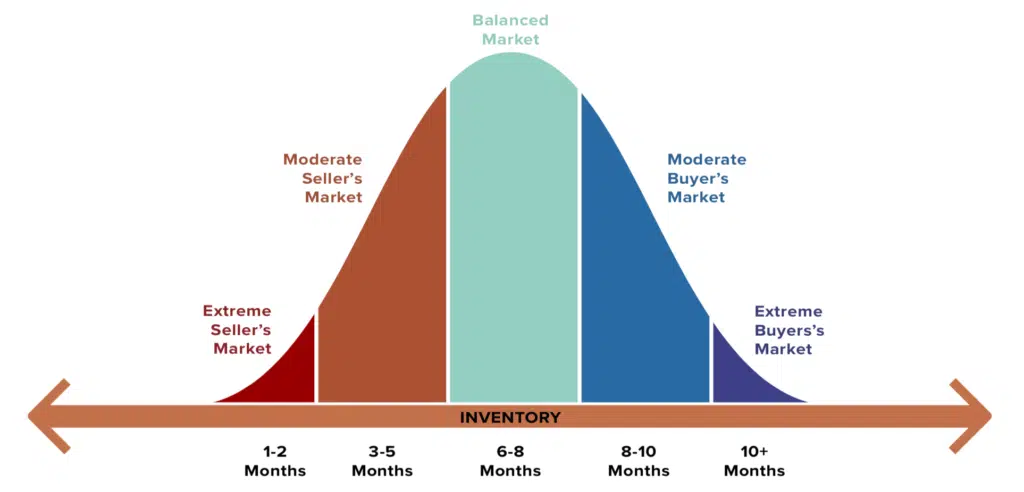

If you only want to follow one metric to understand how your market is doing, follow ‘inventory.’

Inventory is a Calculation

Now, when I say ‘inventory,’ I am using the term in a very specific way.

Inventory, when used in real estate, refers to a specifically calculated metric that effectively measures the ratio of buyers to sellers.

Why is it so important? Two reasons:

- Inventory measures the market currently, unlike closed sales which measure the market 45-90 days in arrears

- Inventory is strongly correlated with price movements and can be used to forecast price appreciation –– but more on that in a moment

Definition

Inventory is defined as follows: it is the ratio of ACTIVE homes for sale relative to the number of homes that have been ABSORBED (gone under contract) in the last 30 days. The measurement is stated in terms of ‘months’ or ‘months of supply’ and answers the following question –– How long would it take us to run out of homes to buy if nothing new hit the market?

Inventory = Availability (Sellers) / Absorption (Buyers)

Example: 1,000 homes for sale / 500 homes pending in the last 30 days = 2 months of inventory.

Make sense?

Inventory Comprises All

Inventory is the ultimate measure of any market.

Why? Because it combines all market inputs into one simple ratio.

Every input either impacts the number of buyers or the number of sellers:

- Building costs? That is a seller side input

- Credit scores? Buyer side

- Interest rates? Mostly Buyer side … but interest rates can impact how many homes a builder can build, too.

- Jobs? Buyer side.

- Lot supply? Seller side.

- Building codes. Seller side.

- Rents? Buyer side.

- School ratings? Buyer side.

- Commutes? Buyer side.

I could go on and on, but you get the point.

Any and all factors that impact the market manifest themselves in the inventory calculation by either creating more or fewer buyers or sellers.

Inventory and Appreciation

Nobel Laureate Economist Robert Shiller (and author Irrational Exuberance), has dedicated much of his work to the study of real estate.

Most real estate pros are familiar with the Case-Shiller Index, which looks at median home prices –– both nationally in the aggregate, and in 20 different metros, individually. The Case-Shiller Index, introduced in the early 90s, is considered the gold standard of home price appreciation measurements.

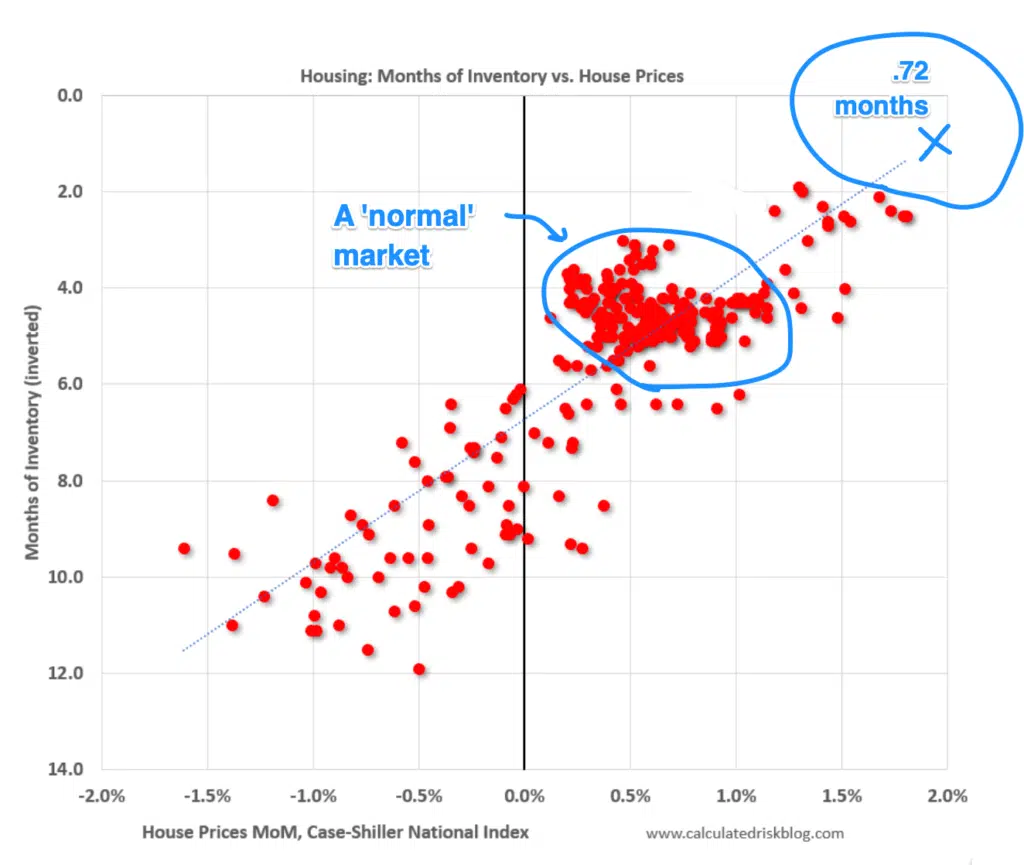

But in addition to the national measurement of home prices, he also created a matrix that plots inventory levels against price appreciation / depreciation.

As you can see, the correlation between the two is rather obvious –– when inventory drops, prices not only rise, but by a somewhat predictable amount. And when inventory rises, price growth slows –– or even falls –– depending on how far inventory rises.

Show me the inventory count in any market segment and I can tell you an awful lot about how that market is behaving.

Observations

A few observations jump out at me –– which I feel are critical to note as the market is changing:

- Housing inventory tends to hover between 3 to 5 months historically (in other words, 3 to 5 months of inventory is what most consider to be a ‘normal’ market)

- Prices flip from rising to falling anywhere between 6 and 10 months

- At no time in history have prices fallen with inventory less than 6 months, and even have risen with as many as 8 months of inventory

- There are far more instances of rising prices than falling prices

Why are these observations so important to note? Because we are so far from the critical inflection points, despite what the news and other media outlets might have you believe.

So Let’s Look at Our Market

Calculating inventory is not difficult –– if you know what you are doing, it takes about 30 seconds.

Pick a segment (say Zone 22 / Western Henrico between $400K and 600K) and count the active inventory (see screenshot below):

And then count the number of homes that have gone under contract in the past 30 days (see screenshot below):

As you can see, there are currently 26 active listings and 36 homes have gone under contract in the past 30 days (I pulled the info on 7/16/22.)

26 active / 36 pending = .72 months

If you then go to the Shiller matrix, you can see that at .72 months, the expectation of appreciation is still approaching 2% per month (roughly 18 to 24% per annum.)

In other words, still quite robust.

Yeah, But…

I know the counter argument is that as rates rise, the buyer pool will shrink. Yeah, I don’t disagree, but I think the buy side of this ratio is by far and away the less important of the two.

Right now, we have the following conditions governing our market:

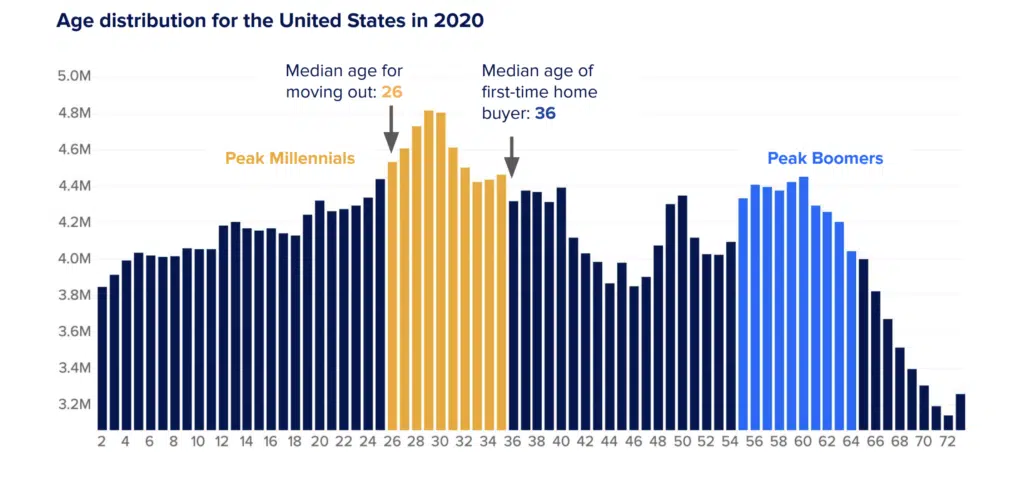

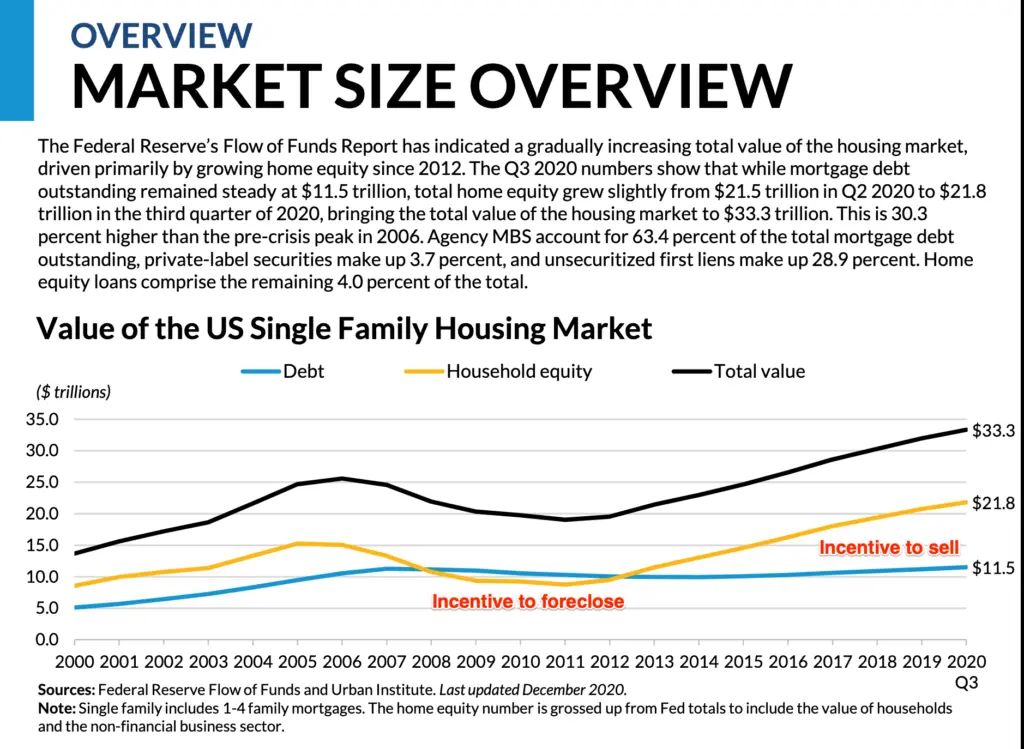

- Home building is still lagging behind demand for reasons relating to labor availability, material availability, and lot availability. The collective deficit of housing has been growing since 2011 and we are still not building enough houses to keep up with demand, much less chew into the deficit

- Building costs have increased so quickly that realistically, it is darn near impossible to build a single family home for less than $500K –– and generally it is closer to $600K

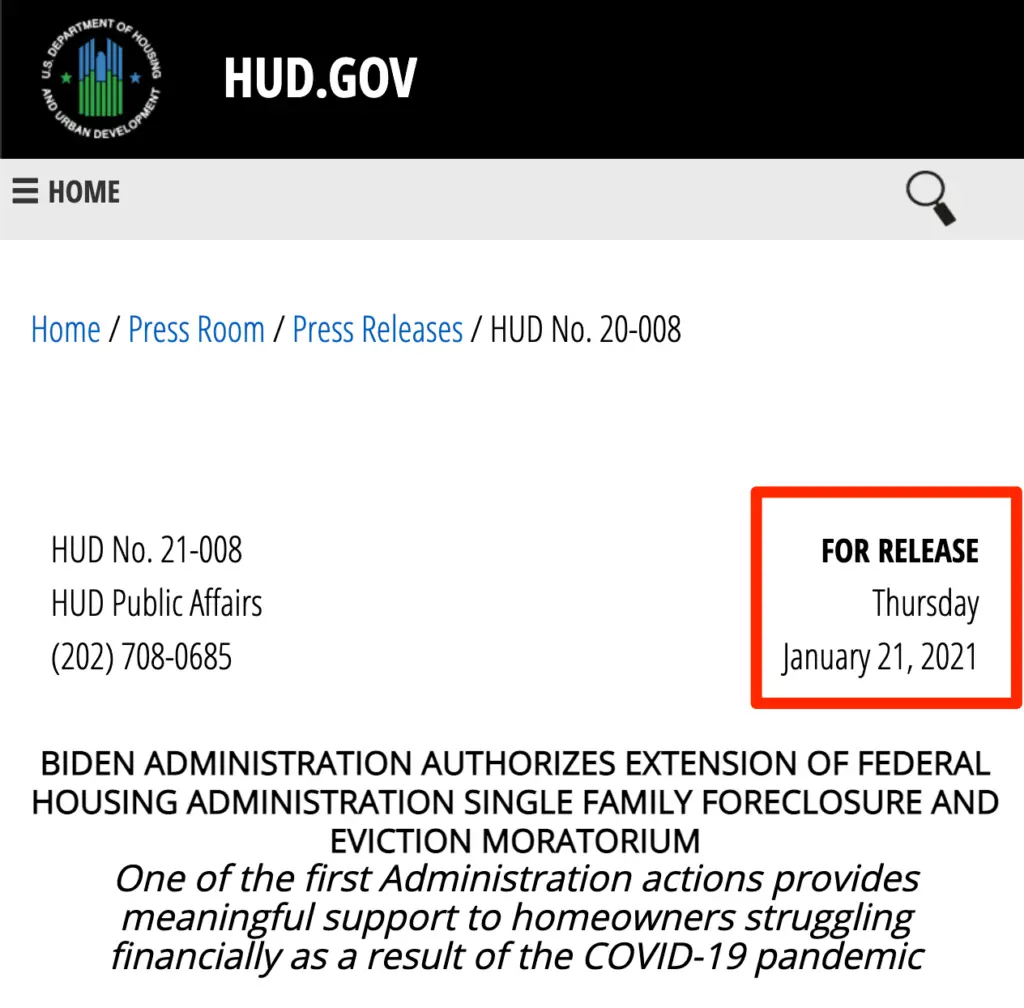

- All of the people who bought and refinanced their home at 2.5 to 3% are now far less likely to move and re-enter the market with a mortgage rate in the upper 5s to 6% –– meaning the excess inventory needed to push down prices will not likely come from the resale side

- Investors have accumulated a tremendous number of median priced / affordable homes and are similarly unlikely to bring them to market with rents rising at the pace they are

- The least risky form of construction is to build apartments or other multi-family rentals, and many large homebuilders have already begun to shift their focus to building ‘for rent,’ further depressing single family detached construction

And thus, the likelihood of an inventory spike (think 2008) is extremely low and will remain low for the foreseeable future. Building isn’t going to provide the solution and now resales will also become far more scarce for the reasons discussed above.

As a matter of fact, I think the inventory issue is more likely to get worse than better once the market settles in and the Fed stops trying to squeeze out inflation –– but I seem to be in the minority in that opinion. I guess time will tell.

Don’t Mistake What I am Saying

Does .72 hold true for all markets? No, of course not.

Every market and every segment has its own set of dynamics.

Furthermore, just because inventory is low does not mean prices will rise at the maximum rate. If you notice on Shiller’s index, a market with 4 months of inventory can appreciate anywhere from 3% per year to closer to 12% a year, so it varies quite a bit.

Here is a sample of inventories across the RVA region:

- Western Hanover (Zone 36) at $600K is currently 4.3 months due to several new neighborhoods where construction is prevalent

- Downtown neighborhoods (Zone 10) at $800K is 1 month

- Forest Hill Corridor (Zone 60) is pretty much 1 to 2 months at all price points

- Goochland (Zone 24) at $600 / 700K is closer to 9 months, mostly due a lot of construction.

So don’t mistake this blog for saying that the market isn’t subject to adjustments, only that far more segments than not are still in extremely low inventory conditions and the ability to add new housing at scale and at affordable prices is next to impossible.

Summary

Look, it is easy to believe in the idea of that which goes up, must come down.

But this idea of gravity and prices ignores the underlying inputs –– Millennials paying record rents are trying to become owners despite the fact that there aren’t enough houses to go around.

Sorry, I don’t care that mortgage rates have doubled. Mortgage rates have not fixed the fundamental problem –– in some ways, the increase in mortgage rates have made the problem worse by shifting the buyer pool down the price gradient where even less housing is available, but I digress.

No, the real problem, which we are not currently seeking to solve, is that we can’t build houses fast enough or cheaply enough to satisfy the demand. The layers of regulation at all levels (federal, state, local, neighborhood) have made homebuilding an incredibly compliance-based endeavor –– and I don’t see any of the regulatory oversight of homebuilding becoming less problematic … ever.

Besides, this problem is not new. We tend to forget that housing prices were rising quickly well before COVID –– as a matter of fact, the affordability issue was easy to see coming.

How easy? We wrote this article in 2016.

So keep your eyes on not just inventory in the aggregate, but in your area and price band specifically. Odds are, unless you live in an area where new construction is prevalent, your inventory count is still 2 months or less –– meaning that your prices are in no danger whatsoever.

And to the buyers, if you are waiting for a market correction, I think you may be waiting for a while. Yes, competition has thinned to some extent, but as long as housing supply stays below demand, prices will continue to climb.