A quick note –– the original date of this article is April 6, 2013.

In the years that followed the 2008 crash, no one really seemed to care about the fact that we had lived from the bottom to the top to the bottom again.

Well as we head into the 2020 market, impacted oh-so-angrily by a virus named for a beer, it is all happening again.

Being an agent when times are good isn’t really that hard –– you just call a lot of people and let the market do its work. Well now, that has all changed again.

We are at the precipice of another cycle, and we are now multiple-time cyclists.

Enjoy the original article –– the message rings true again.

From April of 2013 …

I am “cycle-ist.”

I don’t ride bikes nor motorcycles. I don’t wear yellow jerseys and I don’t wear those hats with the brims turned up –– and I don’t wear a lot of spandex (and that is a GOOD thing.)

But I am a “cycle-ist.”

Huh?

I am a “cycle-ist” because I have lived through an entire 20+ year real estate cycle and I have done it while in the real estate industry.

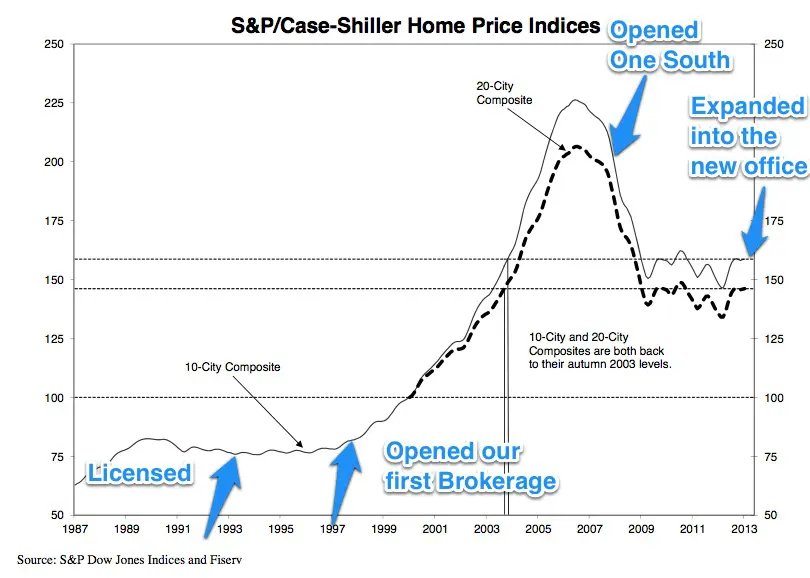

Beginning in 1993 when I was first licensed, to 2008, when we opened One South, to today, at 40+ agents strong, we have survived from the heels of the 1987 crash to the beginning of the 2013 recovery.

Why does this matter?

While predictive models will tell you what to expect based on a set of inputs, experience will tell you when the inputs to those models are incorrect. No one anticipated 30% decreases in value from 2008 to 2012, but it happened. Understanding why it did is the most important lesson to learn from it.

At the end of the day, having lived through a cycle means a far better understanding of the many levels of risk and how to mitigate them. While being in an ownership position always carries some form of risk, understanding the level of each (as well as the new forms that we discovered from 2008-11) is paramount.

When we look back at this period in American financial history, we will see more real estate fortunes made (or at least more equity gained) than at any time in our history.

- Those that have chosen to see ONLY risk will have missed an opportunity.

- Those that seek to understand the risks that they take, will thrive.

- Those that seek others who can offer pointed observations about the risks that drove us into one of the worst financial periods in our history, will thrive to a higher level.

Seek out the cyclists. They have seen a thing or two.