I think all salespeople, as we age, tend to do more of our selling by telling stories and using analogies than we did when we got started. Call it experience or call it wisdom (or just call it being old,) but the ability to take a current situation and compare it to a universally recognized feeling somehow makes it more real to our clients. When you can take an odd situation and make it feel familiar, it helps the client feel at ease with their decision. Familiarity begets comfort.

So recently I ran into an old friend at lunch who I do not see often. He owns a small business selling supplies to local restaurants and has been doing so for many years. Of course, he asked how the market was (all friends ask their Realtor buddies this question.) I told him it was good (which is true) but I sure would love it if people felt a little more like they did in 2006 again. If it was 2006, we would be almost TOO busy (if there was such a thing) as our company had matured greatly since we opened and I wanted to see what we were capable of in the best of times.

I said I wanted the market to feel like they were all driving convertibles again. He looked at me and grinned as he knew exactly what I meant.

We All Drove Convertibles

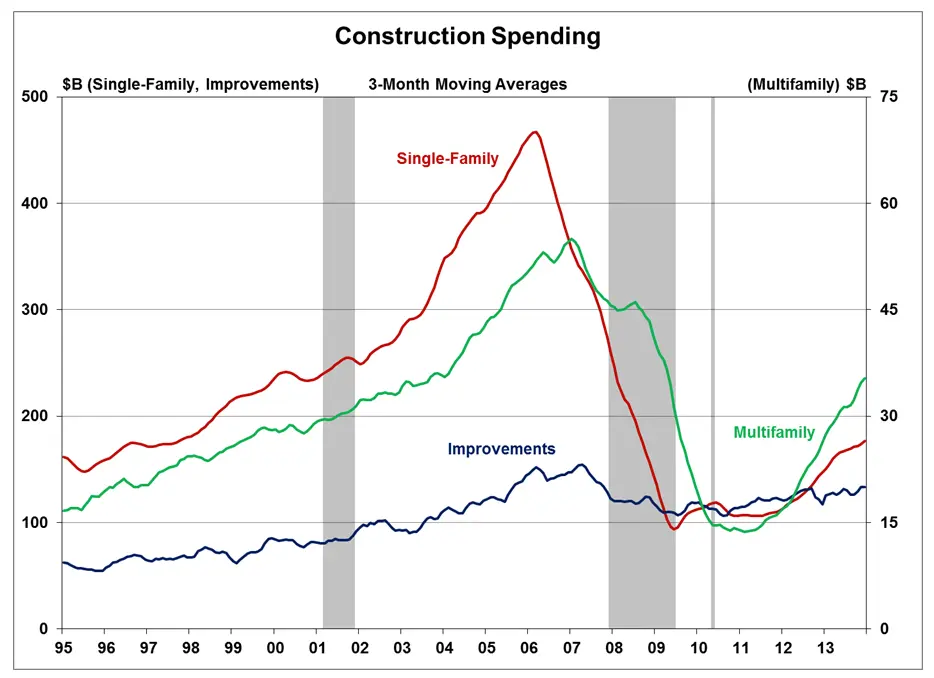

From 2004-2008, the development market was booming.

The long neglected neighborhoods in Richmond were in the midst of a rebirth with condos, creative office spaces and apartments all being redeveloped at an astonishing pace. The banks were willing participants with (relatively) easy terms and a shared belief that the market was bulletproof. Lending was based as much on momentum as anything else. The development community was ripe with opportunity and the developers had both the skill and capacity to really execute projects. The Richmond we knew in 1995 looked nothing like the one in 2005. It was one of the most amazing transformations I had ever seen in a 10 year period.

The best analogy was it felt like we were driving a convertible on a sunny day with no clouds and a slight breeze with the radio (or CD, or XM, or iPod) playing our favorite tunes over and over. It was a good time.

Driving in a Downpour

And then a few raindrops began to appear.

While there were hints of the coming changes as far back as the summer of 2007, the definitive marker for the bursting of the bubble came in September 2008 with the announcement Lehman Brothers had collapsed. By early 2009, all of the feelings of being bulletproof and carefree disappeared into thin air.

Beginning in late 2007, and continuing well into 2011, banks decided the best way to stay in business was by NOT loaning money. New home buyers disappeared completely and subsequently, droves of sellers decided to hand their keys back to the mortgage companies which had given them loans only a few years earlier. No one wanted to make a decision, especially not one with any risk attached to it, and the market froze. With no loans, there were no transactions and with no transactions, values plummeted.

Sticking with the driving analogy, we had gone from (in 2006) driving a convertible along the beach without a care in the world to (in 2009) driving an old minivan in a downpour, in the dark, on an unfamiliar curvy road somehow knowing that the bridge ahead was probably already washed out.

I don’t think anyone wants to live through that economy again.

Driving Home From Work in April

As we enter 2015 the world has changed yet again. It is better, for sure, but we are not back to where we were…and maybe that is a good thing…at least for a while.

For the last two consecutive spring markets, we have seen rapid absorption, price appreciation and a gradual relaxation of some lending standards. The last two fall markets have been shakier. Spring momentum of 2013 and 2014 stalled by the late summer and some of the gain of the first half were gone by the end of the year. While other current economic standards (oil, stocks and bonds, employment, inflation) all seem to be in pretty good places, no one will mistake 2015 for 2006. Alas, it is no 2011 either, and that is okay by me.

The bottom line is we are now in a place where buyers and sellers can make plans based on expectations rooted in realistic probabilities. And while we have not returned to a market where the inputs (new housing, interest rates, development) are back to pre-recession levels, they are on the way back to normalizing themselves. With normal inputs comes stability and with stability comes predictability. At the end of the day, words like ‘predictable’ and ‘stable’ are good words for real estate.

To use the driving home analogy a final time, imagine driving home from a good day of work on that first warm day of spring. It may be a bit chilly to roll the windows down, but you so anyway. And while you darted out a few minutes early from work, you still didn’t miss all of the traffic (and even hit a pothole or two) but it somehow seems okay after living through the ride on the curvy road in the rain. And despite the fact the days are not perfect (yet), you know summer is coming and with it grilling outside with friends, family and familiar faces all in good moods ready to enjoy life for awhile.

The drive in 2015 is less about the car and more about the attitude. Lets all sit back and enjoy the ride, whether in a VW Beetle, Dodge Stratus, Mustang GT or Maserati Quattroporte…

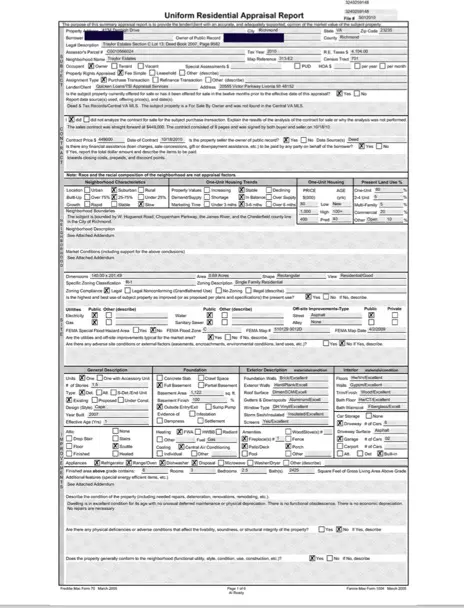

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.