The question was posed to me the other day and (in so many words) it went a little something like this –– ‘When do you think that prices will start to come back down for housing? I mean, they can’t go up forever. Especially not at this rate, can they??’

For any of you who follow the blog, you know that I can’t answer questions with simple ‘yes’ or ‘no’ type answers –– especially when taking on such a big question.

Sorry, I am just not wired that way.

Besides, a question that important deserves more than a one-word answer –– and so the first blog of 2021 will tackle the pricing question, if for no other reason than it is really important to understand where the market stands and what it means to each of us.

Why Even Ask the Question?

Do you realize that up until 2008, we never asked about housing prices going down?

Why? BECAUSE THEY HADN’T GONE DOWN IN 80 YEARS.

The last time that house prices fell nationwide was during the Great Depression of the 1930’s. That’s right, it took a global depression for house prices to fall.

Disclaimer –– ok, it can be argued that in 1990 / 1991, we had a very small fall in the median home price in the period following the 1987 stock market crash, but it was like maybe 2-3% at most, it was over in 18 months, and the price adjustments were more regional than national. When I say that prices have not gone down in nearly a century, I am referring to a dramatic and tangible adjustment in prices like what happened in 2008.

So just to recap –– for the better part of 80 years, home prices in the United States have marched relentlessly forward regardless of market conditions, economic malaise and / or other upheavals:

- In 1963, John F Kennedy was assassinated in Dallas –– and home prices kept moving up

- In 1973, when interest rates AND unemployment rose simultaneously (remember ‘Stagflation’?) AND WE HAD A PRESIDENT RESIGN –– prices kept advancing

- In 1980, when mortgage rates were 17% and oil was $123 / barrel AND MOUNT ST HELENS ERUPTED –– home prices still rose

- In 1986, the Chernobyl nuclear facility blew up and sent a radioactive cloud over Europe and the world –– and house prices didn’t notice

- In October of 1987, when the stock market fell more in one day than on any other day in history while the Savings and Loan industry was in the process of imploding –– home prices were flat for a year or two and then began to rise again soon thereafter

- In 1991, when Saddam Hussein invaded Kuwait and dared the rest of the world to do anything about it (and the world took him up on that request) –– house prices rose

- In 2000, when the internet bubble burst and the NASDAQ lost 76% of its value in less than 6 months –– not even home prices in Silicon Valley were impacted

- And in 2001, when terrorists hijacked planes and knocked down the two most important buildings in the most important financial district in the most important city –– home prices continued to rise

Notice a pattern?

Mortgage Fraud and the Financial Crisis

It wasn’t until the Financial Crisis of 2008 that we learned that housing prices are capable of going down. But it took a unique combination of factors –– the most significant of which was absolute and complete mortgage fraud orchestrated by Wall Street to exploit the people of Main Street –– in order to accomplish what no other economic events could.

And it is the fallout from that fraud and the subsequent news and headlines in the period following the Financial Crisis that drives so much of the suspicion about the housing market we are currently experiencing.

Let’s examine the reasons.

Supply and Demand

Albert Einstein is credited with saying that, ‘everything should be made as simple as possible, but not simpler.’

I happen to agree.

The simplest way to look at any market is through the lens of supply and demand. Not to rehash Econ 101, but when demand exceeds supply, prices tend to rise –– and when supply exceeds, demand, prices tend to fall.

We know this.

And so in honor of Albert Einstein’s mandate for simplicity, we can agree that in order for home prices to come down, we would need to have either:

- Demand for housing dry up, or

- Supply of housing skyrocket

Let’s look at the possibility of each.

Demand Destruction

So what could cause people’s demand for buying home to dry up? Well, many things could (in theory) cause the number of buyers to drop but let’s first look at the extreme events that didn’t cause buyer demand to drop to such a rate that prices fell:

- Marginal tax rates as high as 90% in the 1950s didn’t (and no, not a misprint)

- The 17% mortgage rates in 1980 didn’t

- Recessions in 1973, 1980, 1991, and 2003 didn’t

- The Cuban Missle Crisis, the Cold War, Korea, Vietnam, Iraq 1 and 2, and Afghanistan didn’t

- Even a COVID-driven worldwide shutdown didn’t

So what did finally cause buyers to go away?

Fraud.

When Wall Street hijacked mortgage lending and started giving out loans to anyone who asked regardless of their ability to repay, and then sold those loans with false stamps of AAA ratings to any investor stupid enough to buy them, the fallout was a 5 year reset where prices fell by as much as half, depending on your market and housing type.

And even then it was not necessarily the lack of buyers –– but the lack of credit –– that did the market in. In what seemed like a day, credit markets swung from ‘anyone can get a loan’ to ‘no one can get a loan.’

No credit (loans) > no buyers > no demand > prices crash > foreclosure > prices crash more. Repeat…

The sub-prime lending debacle that led up to the banking / financial crisis of 2008 was the largest sustained period of fraud in the history of the US.

Simply put, only an industrial level of fraud at the highest level of the financial markets, combined with regulatory agencies that were either complicit or asleep at the wheel (or both), was able to meaningfully derail the housing market.

So nearly a century of modern history has shown that if you don’t monkey with mortgage underwriting, the housing market tends to remain remarkably stable year over year –– despite all other political or economic conditions.

What Drives Demand for Housing?

This is a far more subjective question than an objective one, but two basic reasons exist why people want to own housing –– and have wanted to own it since the dawn of time:

- Houisng provides stability

- Housing is a ‘safe’ investment

The Need for Stability

While I think we all enjoy traveling from time to time and seeing new places or visiting family and friends, the feeling of arriving back home to YOUR sofa and YOUR controller and YOUR coffee maker just feels right.

With a few exceptions, we are not an innately nomadic species, and thus we like to have a place we call home.

Don’t believe me, ask Abraham Maslow.

Maslow’s famed Hierarchy of Needs (above) asserts that there is no way to reach the pinnacle of the pyramid (Self-Actualization) without our most basic needs being met. And if you read the words describing each level –– shelter, property, connection, status –– it smacks of housing.

The need we all feel to have a home base, a center, a domicile, a way to express ourselves, and a place that no one can take from us is powerful –– and all financial arguments aside, these are fundamental human instincts and at the core of why we crave a place to call home.

A Smart Investment

So, not only does owning a home make us feel good, it is financially prudent.

As it is often said, the only guarantees in life are death and taxes. I think they need to add one more –– rent (or mortgage.)

The bottom line is that living with a roof over your head requires an investment by whoever resides there.

So, if you have to pay someone to live somewhere, wouldn’t you rather pay yourself? Well that is what ownership does.

This becomes especially true when you realize how little the difference between a typical rent payment and a typical mortgage payment actually are:

- Average rent payments in 2020 were nearly $1,500 per month

- The median mortgage payment in 2020 was $1,500 per month

That fact alone should make you want to own, but there are more:

- Beneficial tax treatment on many levels

- Additional legal protections

- The ability to use leverage to acquire it

- Subsidized borrowing (government-backed mortgage rates and extended terms)

Besides, you have to live somewhere, right? I mean, have you ever tried to live in your 401k? Ever had your buddies over to watch the game in the basement of your IRA? Ever taken a nap on your mutual fund? You get the picture.

Housing is the only appreciating asset that I know of that provides basic human needs.

And not to wrap myself in the flag here, but I also think that we tend to forget that homeownership (ok, the right to own property) is one of the fundamental rights provided by our Constitution –– and many people on this planet are denied the privilege of ever owning property.

Yes, we can always satisfy our housing needs by renting a place, and yes, sometimes renting even makes sense. But on the whole, homeownership is not a concept Hallmark invented to sell more cards –– owning a home helps fulfill the human desire for refuge and stability.

Show me a stable country, and I’ll show you one where property rights are fundamental rights.

So, when you see pricing of the typical home inch up every year DESPITE every conceivable economic headwind possible, it should tell you something about the need we all feel to secure our future and provide for ourselves and our loved ones.

Supply

So if housing feeds our inner caveman and we can’t destroy demand despite recessions, stagflation, oil prices, wars, and/or COVID, maybe the supply of homes will spike and the excess number of homes for sale will push prices down??

Its possible –– but just not likely.

In order for someone to purchase a home one of two things need to happen –– someone needs to offer an existing house for sale OR a builder needs to construct a new one.

Let’s look at each.

Resale Homes

In what is a bit surprising, the percentage of the population that moves in any given year has been on the decline –– and this is a long term trend (and honestly, I did not know this.)

Beginning in the 1950s, the percentage of people that move (migrate) has fallen sharply –– from roughly 20% of the population in any given year to now less than 10%. Technology and other factors seem to be the most likely culprit (in an information economy we don’t need to live where the jobs are in the same way we did in the manufacturing economy of prior eras) and thus the market for resale homes was under systemic pressure well before the inventory woes of today.

Inventory Woes

So needless to say, the supply of resale homes has been on the decline for a considerable amount of time and feels unlikely to undergo such a change that could cause it to dramatically shift in the other direction.

Why do I say that? Because where are you going to go? The market in which you sell is the market in which you purchase and when inventory is as low as it is now, it is only human nature to stay put since finding the next home is no guarantee.

Ask any agent who has been an agent for any length of time and they will tell you that inventory levels have been under pressure and in decline ever since we began the recovery in the latter part of 2012.

At first, the fast-approaching lack of inventory was not apparent as we had an overhang of overbuilt homes that needed to be absorbed and a buying public that was still reluctant to hop back in the game.

But sometime around 2015, the number of sales began to recover to pre-bubble norms and houses started to get absorbed, and absorbed quickly. Marketing times began to drop sharply and the discounts sellers had to take to get a home sold also began to tighten.

It was at this point that we began to build new homes in earnest in order to … pick … up … the … uhhh … slack … wait, nevermind.

New Homes

Perhaps the most impacted segment of any market in the wake of the Financial Crisis was homebuilding.

From March of 2006 to March of 2009, the US went from building more homes than it ever had (2.2M per year) to building fewer (478K per year) than at any point in the last 60 years.

That is 78% less, if you are scoring at home.

And for the most part, homebuilding has never recovered.

Not Enough New Homes

Most economists agree that the US needs something on the order of 1.5M new homes a year to keep pace with population growth.

The US finally surpassed the 1.5M new home start level in December of 2019 for the first time since late 2006 (14 years!) and then COVID hit. The new home momentum we were finally beginning to see withered quickly in the face of the COVID uncertainty.

Due to the 14-year long rate of undersupply of new homes, several studies peg the current new housing deficit in the US at somewhere between 3M and 4M homes.

So to summarize, home building is at least 3M homes (if not closer to 4M) below where it needs to be. Even in its good years, the building community was only able to create 500K to 600K more homes than were required to keep pace with natural demand.

Stated differently, if we can max out the homebuilding industry to 2.2M homes again (which is about 700K over the 1.5M yearly demand), it would take us 5 years to erase the 3M to 4M deficit.

Given the fact that we can’t overproduce housing easily AND the long term trend is to NOT relocate, the bottom line is that a supply-side crash is extremely unlikely.

So What Could Sink the Market?

It is a great question, and I honestly don’t know –– because massive fraud is the only event in the last 90 years that did.

Think about it –– in less than one year, we experienced COVID, massive civil unrest in the wake of the killing of George Floyd, and the most contentious election on record –– and real estate values WENT UP!

Wait, what?!? Up?!?

So in a weird way, that seems comforting.

Other Risks

But if pressed, below is a list of the other risk factors that could (ok, should) have an impact on the housing market:

- COVID Behavioral Shifts –– The behavioral shifts brought on by COVID have caused a disproportionate number of people to exit large markets and land in 2nd and 3rd tier cities and/or suburbs. Why live in a 300 SF apartment in NYC for $3K/mo when you can live in the ‘burbs and use Zoom? This is causing some regional price adjustments in both directions.

- Forbearance –– The pending foreclosure spike due to the end of the forbearance protection period will rear its ugly head soon. That said, there has never been more equity in housing (meaning sellers will sell their home versus allowing foreclosure) and any foreclosed properties will likely be absorbed quickly by a starving buyer pool.

- Reform Fannie + Freddie –– The potential for DC to enact legislation that impacts the way we underwrite loans and / or restructuring of Fannie Mae and Freddie Mac is always an issue. For years, DC has threatened to remove the implied guarantees from Fannie and Freddie which could shorten the duration of mortgages (say from 30 years to 10 or 15) and probably cause mortgage rates to jump. In this tender of a market, I just can’t see DC doing anything that could injure housing –– but logic has never stopped DC from making a dumb decision at a poor time, has it?

- The Deficit –– The dramatic increase in the Federal deficit and the pending tax burden we will all have to bear will have an impact on our pocketbooks for sure. COVID has been hugely expensive, but don’t forget that over the last 30 years, we have fought three hugely expensive wars and are committed to massive unfunded entitlements that date back to FDR. The Federal Government was carrying a huge debt load before COVID, and the final bill is not as of yet known. Higher taxes never help an economy, but they are on the way.

- Mandates / Regulation / Compliance –– Policy mandates that have dramatically increased the cost of building new homes. Yes, the Chesapeake Bay is important, and so are other green initiatives, but you can’t force the entire burden onto builders and developers and then complain about the price of a new home. Studies show that up to 25% of the cost of a new home is in regulation and compliance –– and that is before the impact fees extracted at the local level by the counties and cities. The bottom line is that cost gets passed on to the consumer.

- Materials –– The cost of construction materials has gone through the roof. Some cost increases are due to the interruption in the supply chain due to COVID, but long term costs are trending higher. When you combine material increases with the compliance expense (above), you can’t build a decent house for less than $400K (or more.) Affordability has become a ‘forever’ issue in my opinion.

- Demographics / Demography–– Demographics in the US are working in our favor for sure. The Millennials are entering the market in force and will help support all forms of consumption –– especially housing. And despite what seems like insurmountable problems and systemic differences, the US is still the best place on the planet to live and thus we will always have an immigration waiting list. Positive population growth is important and an ample workforce even more so. That is an insurance policy few other countries have at their disposal.

- Affordability –– Affordability issues are about to rear their ugly head, too. Home prices are rising quickly, but incomes are not rising at anywhere close to the same pace. You can’t continue to have price increases beyond the ability for someone to afford it. This is especially true at the entry point of the market. Stay tuned…

- Mortgage Rates –– Yes, the mortgage rates are in the 2s and 3s. And yes, in 1980 they were 17% –– so higher rates are not necessarily the killer most assume them to be. But only a very small slice of the home buying world remembers even the 7% rates of the early 2000s and thus when rates start to climb (and they will at some point) it will be interesting to see what happens.

Each of those factors can potentially have an impact, but other than the likelihood that DC will fundamentally shift how mortgages are issued, I don’t see a single threat on the horizon that could cause a fallout on the scale of what happened in 2008.

DC, The Federal Reserve and Falling Home Prices

And I think this is key –– while not only does the average consumer remember the housing crash of 2008, so does almost every senator, congressman, and financial regulator –– and trust me when I say this –– THEY DON’T WANT TO SEE IT HAPPEN AGAIN.

When prices fall, it sets off a series of events that spiral downward quickly. Just because the price of your home drops, the debt does not, and when debt levels are higher than the price of the home, foreclosure starts to become common. Large numbers of foreclosures tend to lead to prices falling even more, which leads to more foreclosures, which leads to even lower prices … you get the picture.

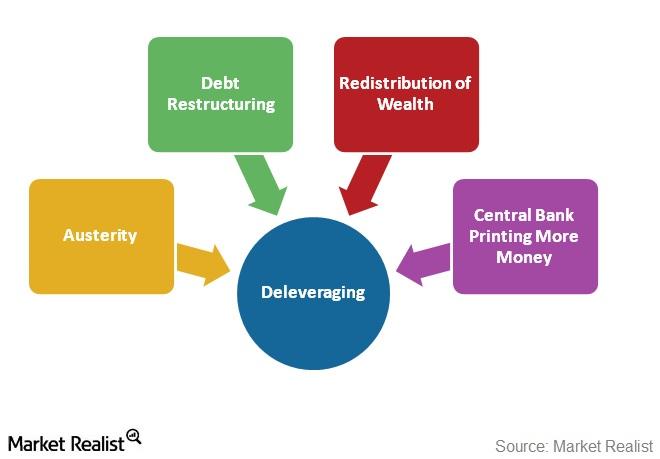

The official economic term for a declining cycle of pricing is ‘deleveraging‘ and it is vicious, indiscriminate, ugly, and thoroughly painful.

No one –– I repeat, NO ONE –– wants to see that happen again.

Summary

Yes, I am sure that regional pullbacks are entirely possible, especially in the areas where economic losses are greater (Las Vegas or Orlando for example) or where a shift in employee behavior is permanent (Zoom and its impact NYC / SF) –– but those losses are likely to abate once the vaccine becomes available and the virus is in the rearview mirror.

And could there be another financial crisis on the scale of 2008 that we don’t know about? Of course. The nature of markets –– and of life –– is that you never reeeeeeeally know what everyone is up to. Market adjustments tend to occur when we least expect them to.

But, as long as the following conditions continue:

- The US population continues to grow

- The supply of housing remains constrained

- Mortgage underwriting remains constant

Then the US housing market should remain healthy and a 30% drop in prices is highly unlikely.

As a matter of fact, the likelihood of prices rising more is far greater than the chance of them pulling back, and thus the idea that waiting to purchase at a lower price several years hence is also unlikely to work in your favor.

Don’t allow the events of 2008 to cloud your vision in 2021. The conditions could not be more different.