Periodically, you get smitten with a neighborhood, and Walnut Hill in the Rockville area of Western Hanover County tends to have that effect on people.

Walnut Hill is pretty close to what most are envisioning when they imagine a classic neighborhood in a rural setting. With extremely large lot sizes (most are between 8 and 25 acres) and the kind of gently rolling topography that brings to mind the picturesque farmland in the foothills of Western VA, the Walnut Hill neighborhood perfectly captures the imagery of what rural Americana should be.

Walnut Hill

If you have not been to Walnut Hill, you should go.

The neighborhood is a testament to the developer – they resisted the urge to take the path of least resistance and try to wedge as many lots as possible onto the site. By NOT trying to create maximum density, they ended up creating incredible spacing throughout the community that allows differing architectural styles to coexist peacefully with one another.

Walnut Hill does not ‘demand’ a specific style or size. Rather, it lets the land dictate the home. Within the neighborhood as it stands today, you see mostly traditional residential architectural forms (variations on colonial styles along with some ‘craftsman’ influences) and generally a quality material palette ensuring enduring physical structures. I think that any good design is cognizant of its surroundings and should compliment the existing homes.

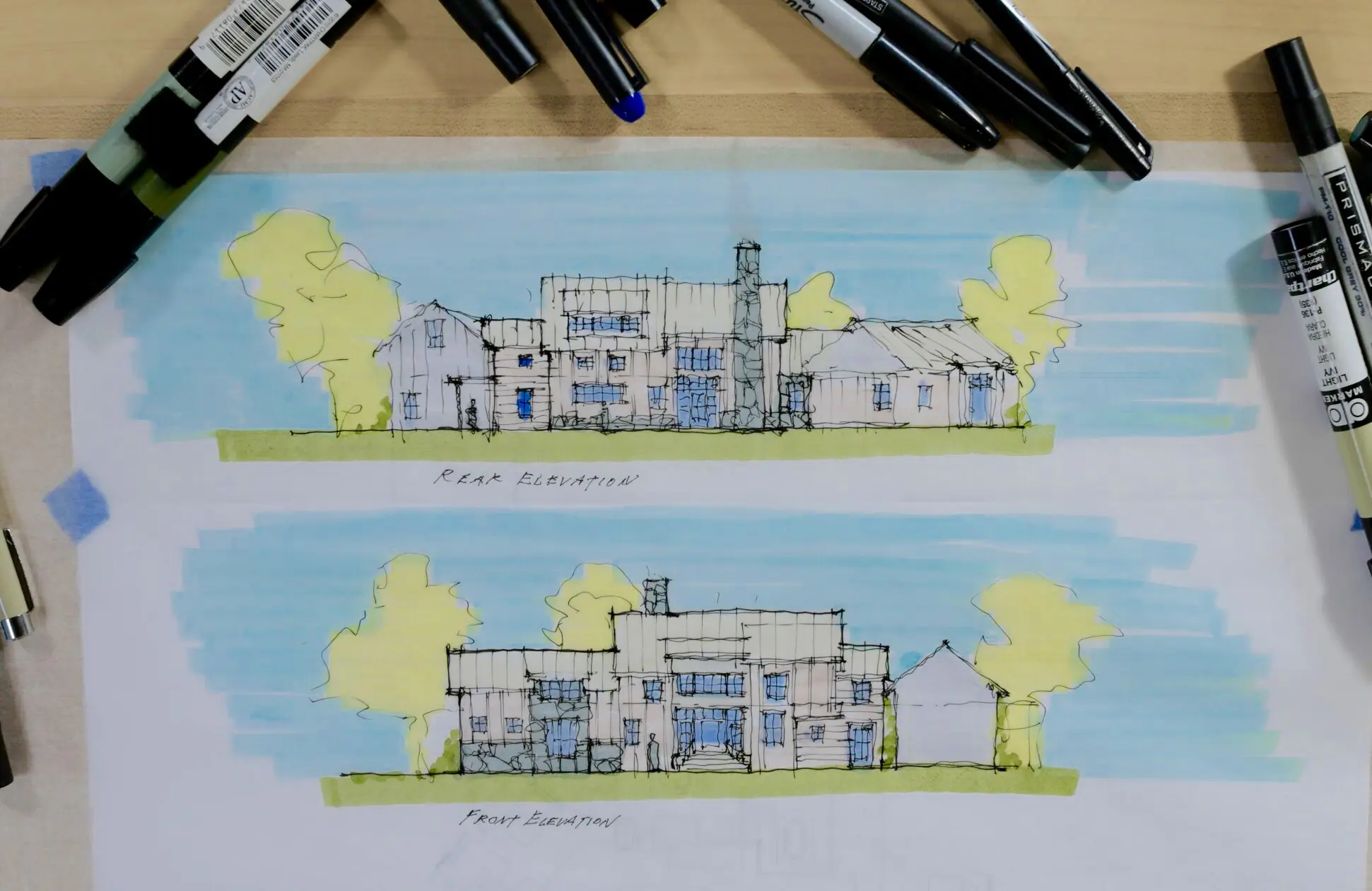

Creating the Home on Paper

Deep within every Realtor is both a frustrated architect and would-be builder.

So when we were presented with the chance to work with a builder with decades of Richmond home building expertise, WB Garrett, on conceiving a home in Walnut Hill, we jumped at the opportunity. Being involved from such an early stage is every agent’s dream, and one we wanted to make sure we took seriously.

Effectively, we were engaged with the ultimate question of ‘what should we build?’ Not just from a price and size standpoint, but in all facets — from architectural style and aesthetic to features to materials.

Several ideas were tossed about, mostly relating to style, but the concept of the ‘New American Farmhouse,’ seemed to speak to each of us. Rather quickly, we all agreed that should be the direction. We recognized that even within traditional forms were variations and departures that could work, especially in such a bucolic rural setting, and thus we chose to craft a modern version of the American Farmhouse to pay respect to the setting as well as the surrounding homes, while still introducing what the market demands.

[ Download the Walnut Hill ‘Amercian Farmhouse’ Plan ]

So the team of home builder Bill Garrett of WB Garrett, Peter Fraser of 37 Ideas and Rick Jarvis, with One South Realty sat down and discussed the features and materials for such a home and with a little hope from our friend and film colleague, Kent Eanes, we were able to document the creation of the plan in such a way that will give the marketplace a peek behind the curtain of how homes go from ideas and concepts to paper and plans.

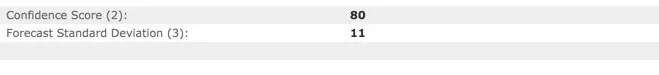

Here is a sample of AVM’s for the following home –

Here is a sample of AVM’s for the following home –

Finally, someone did their job correctly …

Finally, someone did their job correctly …