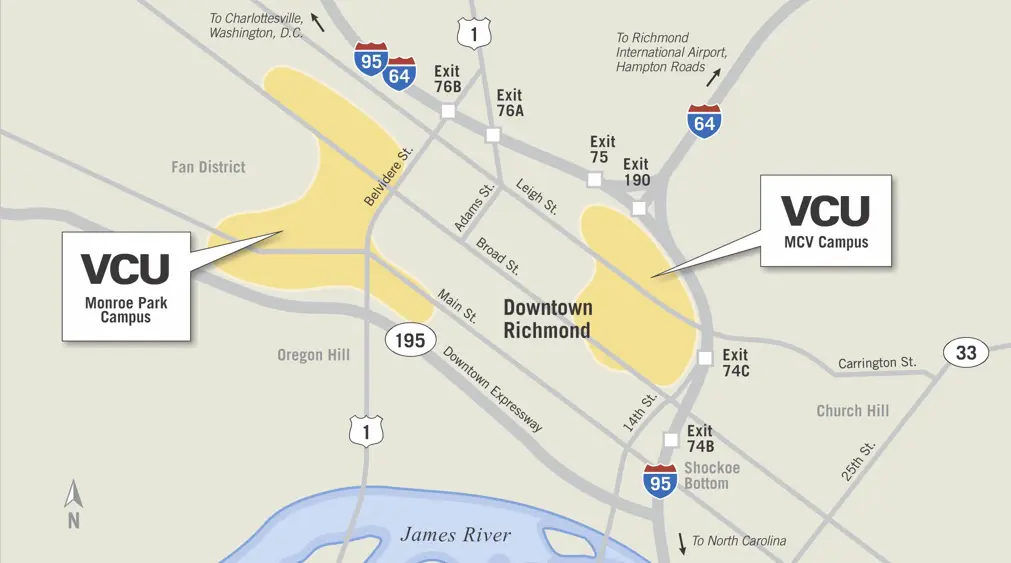

In this post, we are going to talk about what is really happening when you decide you are going to build a home (or buy a new one) in Richmond. First, we need to offer the following disclaimer – this post is full of generalizations and therefore, not applicable to all situations. We fully recognize that all scenarios will not play out as we describe below…but far more will than will not.

Enjoy…

Reality One – Builders Don’t Love Buyer’s Agents

Builders operate in one of two ways (with regard to sales people) – they either employ a brokerage to represent them OR they hire their own sales people. Regardless of whether or not they pay a salary to their employee or commission to their listing agent, they generally will pay their representative MORE if a buyer’s agent is not involved.

What does this mean? It means that the builder has incentivized their sales team to try to eliminate the buyer’s agent. What does that tell you? Not all builders do this, but most do.

Why do builders do this? Builders win when the consumer has less information and does not understand the process, values or their options.

How to defeat this practice? Get a GOOD and EXPERIENCED buyer’s agent. Every decent builder will have their site agent/representative try to register you…make sure you tell them you are working with a buyer’s agent. Once the site agent knows you have an advocate, they will pester the agent (not you) for follow up and communication will be far more respectful. It changes the tone of the conversation from ‘sales-y’ to ‘informational.’

Reality Two – The Model and the ‘Spec’ Will Tell You What You Need to Know

Builders tend to fall into two buckets – those who build cheap vanilla boxes and those who build all-inclusive (more) expensive homes. The vanilla box builder will offer a very low entry price, which is attractive, but you will quickly find that everything is an upgrade, and the inexpensive price is not as inexpensive as it seems. (The SPEC home, or speculative home, is a home a builder is building without a buyer, in the hopes one will emerge prior to completion.)

How can you tell quickly? Walk into the model home and then walk into a completed ‘SPEC’ home. If you do not see the same floors, kitchens, backsplash and master baths, you will know you have walked into a situation where everything is an upgrade.

Why does it matter? This is a builder who knows they will win the battle when they get you into their ‘Sales Center’ for your selection session. The ‘selection coordinators’ who help you pick out all of your finishes are trained to upgrade you. Upgrades of $100 here or $500 there don’t seem like a lot until you realize, by the end of the session, you have added 10% or more to the price of your home. The vanilla box at $160/SF just jumped to $180/SF.

How to defeat this practice? You can go to the sales center BEFORE you sign the contract and price the upgrades into the original contract. You do not want to be doing math and feeling pressure while surrounded by the builder’s staff. You will lose. The fewer decisions you have to make on the builder’s turf, the better off you will be.

Reality Three – The Effective Life of Materials

Building codes generally govern how your home is constructed. The improvements to municipal building codes (think – ‘increased regulation’) has helped remove shoddy work from the marketplace (not completely, but largely.) And while instances of true shoddy construction practices have been reduced substantially, the use of subpar materials has not. Almost all materials look good when they are new, but the durability is really what you need to vet, especially on the exterior. The selection of materials is the primary way a builder can cut costs without the consumer having any real idea the practice has occurred.

Why does it matter? The reasons are obvious…you want your home to last. While no home is time proof and all homes require maintenance, siding beginning to fade in 2-3 years from closing is totally unacceptable. Needing to paint trim within 2-3 years means the painter used the least expensive paint they could and wood rot is imminent.

How do you defeat the practice? Realtors have the ability to search for homes based on past owners, making it easy to identify homes built by builders which are 3, 5 or 10+ years old. A quick trip to see a few houses at various ages will tell you a TON about the builder.

Reality Four (and this one is key) – A Buyer’s Agent is an Investment

Many buyers feel that if they do not use a buyer’s agent, the builder will automatically give them a 3% discount. This belief is far from true.

In most cases, the TYPICAL compensation offered to a buyer’s agent for a newly constructed home is 2.5%. Additionally, the listing agent (in most cases) will receive part (or sometimes ALL) of the commission which would have been paid to the buyer’s agent. So, the net effect of forgoing the use of a buyer’s agent is at best 1 – 1.5%…and there is no guarantee that the builder will offer it to you!

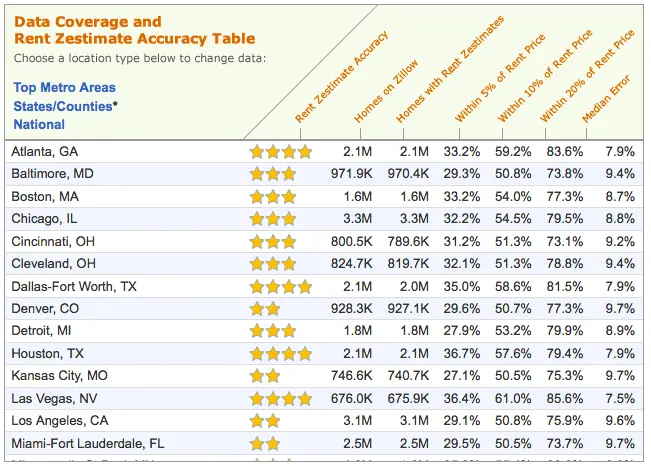

Why does this matter? Information matters and so does experience. Having access to perfect information is worth its weight in gold and no matter how much Zillow and Trulia tout their services, their core information is 60-70% reliable (and that is being kind.) Denying yourself access to information and advocacy for a POTENTIAL 1% discount seems foolish. Having an agent who can not only provide you with the most accurate information, but also a deep pool of process and product knowledge, well exceeds the 1%.

How do you find a good Buyer’s Agent?

You already have…meet the One South team

Builders spend most of their waking hours in a confrontational environment. At almost every level of the building process, from lot prices to wood floor pricing to rezoning to salaries to commissions, negotiating is required. Do anything all day every day, especially when your survival depends on it, and you will get better at it. A builder who has been building for any period of time is adept in knowing not only where they stand in any given market, but how to defend their turf with well-honed negotiating skills.

Builders spend most of their waking hours in a confrontational environment. At almost every level of the building process, from lot prices to wood floor pricing to rezoning to salaries to commissions, negotiating is required. Do anything all day every day, especially when your survival depends on it, and you will get better at it. A builder who has been building for any period of time is adept in knowing not only where they stand in any given market, but how to defend their turf with well-honed negotiating skills.

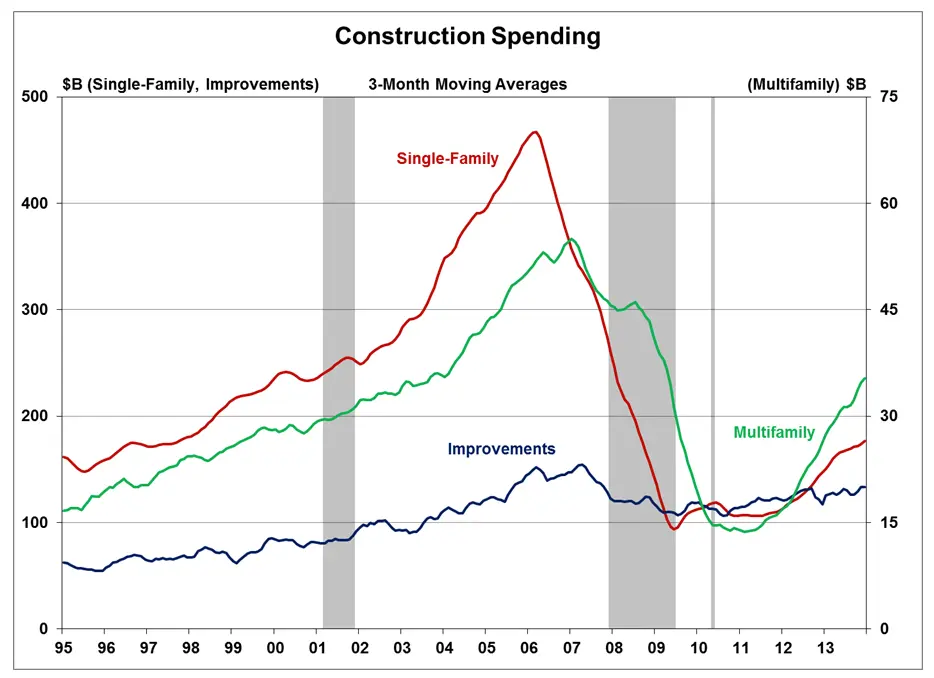

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.

Needless to say, the production which continued created an incredible overhang of quality inventory that the market was forced to absorb prior to it resetting itself. This overhang, many times brand new or recently built (and many times now owned by the local banks), provided a plethora of quality housing available for sale at steep discounts well into 2011. Additionally, special financing options were used to move excess property from the bank balance sheet into the hands of individual buyers.