Just so you know — its coming — and it is not going to be pretty.

‘And what, exactly, are you referring to?’ you may ask.

I am referring to the spring market — and if you are planning to buy a home this spring, you need to get prepared to be a part of what is going to be a likely unpleasant experience.

Wait, what?!? Buying a house is supposed to be wonderful and satisfying and amazing and fulfilling! It is where are going to raise our family and put down roots. We are going to have a green yard and a white picket fence and the birds will chirp, the flowers will bloom, music will play, and we will skip through the front door to our dream house and make our entire family dinner on holidays and have friends over for barbecues! And we will get a 3% mortgage and build equity and experience the American Dream! What are you talking about?!?

Sorry to burst your bubble, but that is not the case.

Buying a home should be all of the things mentioned above, and more. And it still can be — if you know what you are doing. But if your expectation that you, as the buyer, are in charge, then you will be sorely mistaken.

Warning that this is a bit of a long post, but an important one. Just know that buying a home in the spring market — for the best price and best terms — is not a 3 paragraph article.

The Concept of Market Balance

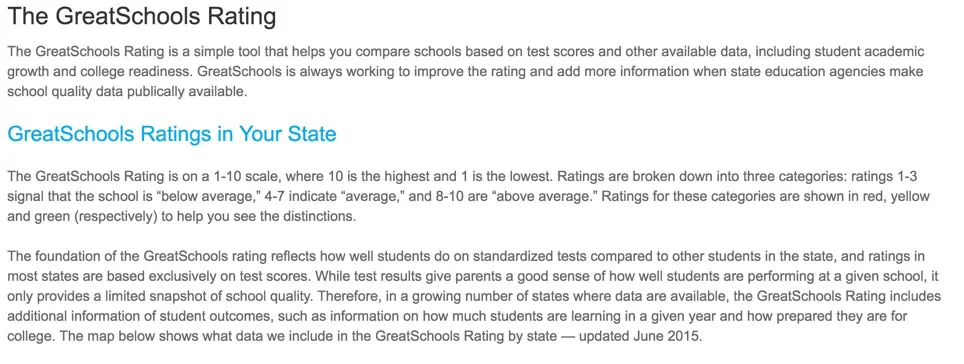

Generally speaking, markets can either be ‘Buyer’s Markets’ or ‘Seller’s Markets,’ depending on which side market conditions favor. As the names would suggest, a buyer’s market is when there are more sellers than buyers and the buyer’s get to dictate terms. And as you can imagine, the converse could also be true.

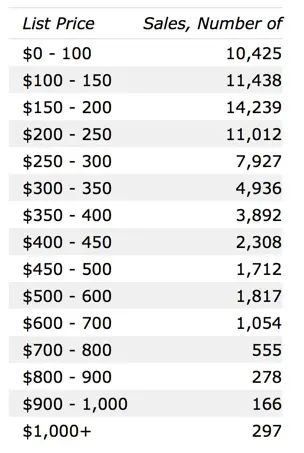

Many different metrics exist to measure market balance — but the number one measurement to determine who has the power is inventory. Real estate inventory is measured in months of supply, which tells us that if no new homes were to come to the market, how long would there be an available supply of homes to buy.

Inventory is computed using two factors — the number of available houses and the rate at which they are being absorbed.

- 1,000 homes for sale / 100 per month being absorbed = 10 month supply

- 1,000 homes for sale / 200 homes per month being absorbed = 5 month supply

- 500 homes for sale / 250 homes per month being absorbed = 2 month supply

The market is generally considered “balanced” when you have roughly 6 months of supply. Anything less is considered a sellers market and anything more is a buyers market.

Other metrics to consider include seller discounts, marketing times, and of course, pricing.

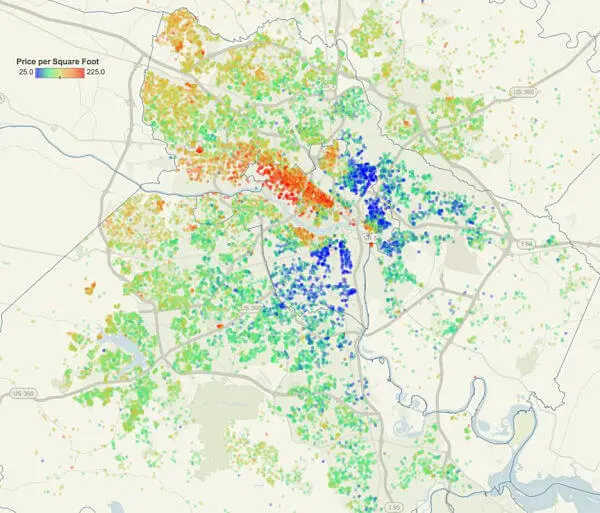

What do these charts tell you?

As you can see, inventory across the region is incredibly low. We entered a seller’s market in 2013 and it has only gotten more pronounced.

The discount sellers are willing to take to sell their home also ebbs and flows throughout the year — by sometimes as much as 3% or more.

And the difference in marketing times is striking, too. As the spring market accelerates, the times houses spend on the market decreases by a factor of 3.

You guessed it, we are in a pretty strong seller market.

Buying in a Seller’s Market

So I haven’t scared you off yet?

Great! Just remember that while difficult, buying a quality home in a seller’s market, especially when you are in an inventory constrained sub-market (the Fan and Museum Districts, Near West End, Bellevue come to mind), can be done if you know what are doing.

Lets talk about the best way to go about buying in what is an extremely strong seller’s market and come out of it with the house you want, at the best price achievable, and with your sanity still somewhat in tact.

Adjust Your Mindset

What we tell our buyers when buying in a strong seller’s market is to adjust your expectations — on all fronts. Seller’s behave differently (ok, poorly) when they have the upper hand and you need to be able to deal with it. They respond late, don’t honor dates, refuse to make repairs or reasonable concessions and often times just act kind of jerky.

The need for objectivity in your actions is key. While house hunting is emotional, fight the urge to get angry when things don’t go your way. A house is an asset, nothing more. There are literally hundreds of thousands of them in our market and anywhere between 15,000 to 20,000 transfer in any given year. Don’t take it personally.

Any house that is worth owning is going to have multiple buyers seeking it and odds are, you need to understand that the likelihood of having to navigate a multiple offer situation is high.

Know Your Market

Right alongside of having the correct mindset in terms of importance is knowing the marketplace.

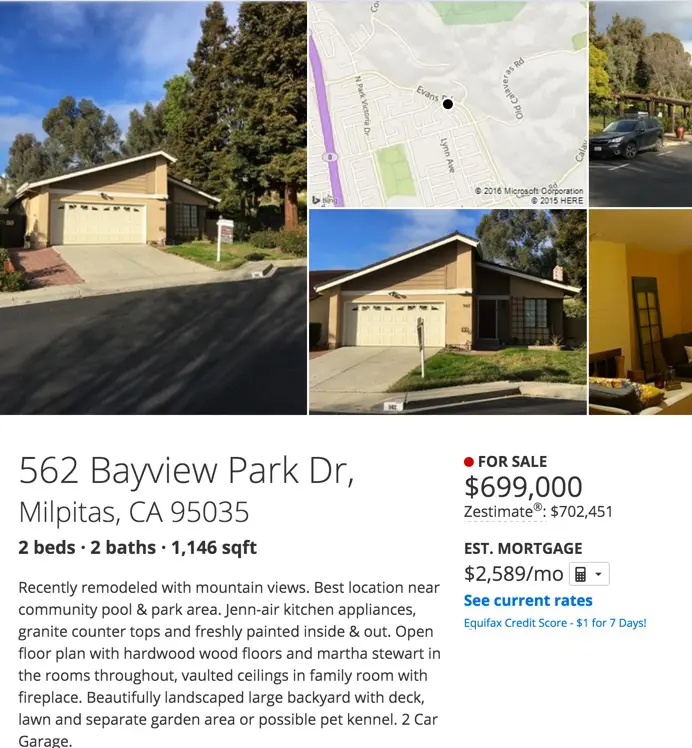

Looking online is not enough to really grasp where values are going to be this spring. You have to put your work in and get into houses. It takes time and it takes energy (both yours AND your agent’s) but without doing your homework, you will not be able to pull the trigger on the home when the opportunity presents itself.

And note that not all submarkets are created equally.

It is important to remember that the strength of individual markets may vary. Don’t assume that your friend’s experience in Midlothian will mirror yours in Jackson Ward. 23220’s inventory is far different than 23113 — so make sure to look at the fundamentals of the specific market you are buying into. Your agent should be able to use the propriety tools within MLS to help you assess your specific market’s balance.

Beware Comparable Sales

Buyer: ‘But the house down the street sold for $365,000 last fall. We want to offer $365,000.’

Agent: ‘That was last fall — this is this spring.’

I often ask people if they drive their car looking in the rearview mirror. Their answer is invariably ‘no’ — yet the real estate market asks you to do exactly that. Values for houses are largely driven by what happened in the past.

It is unfortunate.

A past sale (comparable sale) is not a constant, it is simply one measurement of what market conditions were in a prior time period. A myriad of factors — the interest rate, inventory, absorption, buyer and seller motivation — all were inputs to the sale and likely differ from current conditions.

You can’t necessarily use last season’s values as the gospel when it comes to a fair offer price when the market is accelerating. It is best to pay particular attention to the listings under contract to get a sense of the spring pricing levels (you can read more about that here.)

Be Prepared, Move Fast and Offer High

Q: What is the best way to win a bidding war?

A: Don’t get into a bidding war.

The speed at which a good home in the spring gets shown and receives offers can be unnerving.

Waiting to go see the new listing until when it is ‘convenient’ eliminates the ability to buy it before anyone else has had the chance. When a new home hits the market that matches your parameters, stop what you are doing and GO SEE IT!

I have seen far too many people wait until the weekend and find themselves in a bidding war that could have been avoided had they gone in on the day it hit the market.

Winning with Terms

Remember, a contract is made up of price AND terms (and we wrote an entire post about this very topic here).

While price matters, the remaining terms can matter a great deal, too. Understanding what the seller needs and using that to your advantage is key. As a matter of a fact, we wrote a post about using ‘currency’ to buy a home (you can read that one here) and it discusses using terms to strengthen an offer that cash cannot.

First and foremost, sellers crave certainty (at least the smart ones do) and offering a contract with as few contingencies as possible is a great way to win the deal when in competition. Waiving of appraisal clauses, capping inspection requests, and large down payments can go a long way in making your offer preferable over others.

Also know that offering flexible closing and/or possession dates can be extremely effective, especially when the seller needs to go find another home. If the seller needs you to close quickly, then be prepared to do so and if the seller needs to rent back for a week, be open to the idea. The more you make them jump through hoops for you, the less likely you are to win the deal.

Highest and Best

In most cases (not all, but most) when there are multiple offers and several are similar, the listing agent will call the agents of the 2 to 3 best offers and tell them ‘Highest and Best.’ This term generally implies that you have one chance to sweeten the offer (or stand pat) and the seller will choose the best one.

Just remember, when you are confronted with a call for ‘highest and best,’ this means you are probably close to having the winning bid — and that is a good thing. Sometimes a small price adjustment and tweaking some terms might do the trick.

But often times, the call for ‘highest and best’ means you might have to use the …

Escalator Clause

Ok, so you went to see the new listing on day one — just like you were supposed to. When you were done, you immediately walked down the street to the local coffee shop and wrote the contract. You offered full price, are willing close in 30 days, waived the appraisal clause, and agreed to absorb the first $5,000 in repairs discovered in an inspection. You also included a handwritten note to the sellers telling them how much you love the house and are going to care for it AND agreed to allow them to rent back for free for 30 days for a mere $100.

And guess what, they got 5 other offers besides yours. Really?!?

If you still want to win the home for the least amount possible, you probably need to employ an escalator clause. An escalator clause is used when a buyer’s final price is determined by the next highest offer. Generally speaking, an escalator clause will declare that a buyer is willing to pay $X for the house but if another offer is higher, then the escalator will exceed the next best offer by $Y amount with a cap of $Z, regardless of the next best offer.

When you introduce that many new variables into the equation, the possibilities increase exponentially. Just know that each situation is unique and there is not a single winning strategy. Using the escalator clause properly is a practiced art and when used correctly allows the buyer to purchase the property for the lowest price possible, given the competition.

And while we would love to go into our strategies behind the use of the clause, we don’t want to give away our secrets as we might be using them to help you win a deal this spring …

You Don’t Always Know

The most unnerving part of the entire multiple offer scenario is operating in the dark. In any competitive situation, you really are making educated guesses in an information vacuum.

Most times, you don’t know what the other offers are (unless you win and are using an escalator clause and get to see the next highest offer.) Sometimes the listing agent will tell you (in hope of driving the price higher), but most of the times you are trying to extrapolate as much information as you can and use whatever nuggets of intel you can garner to help construct an offer.

Sorry, it is just the way it is — but the key takeaway is that so is everyone else.

I have seen clients offer on a home, lose the bid, and get mad at the agent. While I understand the frustration in a loss (especially if the buyer has lost multiple times), it is rarely the agent’s fault. If another bidder wants to win, they will.

Remember, your agent does not control the other offers made and does not control the seller’s motivation for accepting the offer they choose. All you can do is make the offer you are comfortable with and let the chips fall where they may.

Use a Reputable Lender

So you up your deposit, offer more than full price, AND include an escalator clause. As a part of the offer, you include your pre-qualification letter through LoanCo.com, the Internet’s #1 Lender of Residential Mortgages. The sellers take the other offer.

I cannot stress this enough — using Lending Tree, USAA, Quicken Loans, or any other online lender will lose you the deal almost every time. Similarly, using your college roommate’s friend from Baltimore to do your loan is also a terrible idea (and no, their rates are not cheaper. Despite what they advertise, they are not — especially once you miss a closing date — but that is another post for another day.)

Any decent agent will tell you that the use of an online or out of market lender is a recipe to lose the deal. Agents all know the local lenders and they know us — when they screw up it hurts their business and damages their reputation. When we see an online or non-local lender, we know that no one in the deal, buyer, seller, or agent has any sway or influence and when the issues arise, there is no recourse.

If you want to win, shop for you mortgage locally.

Summary

Yes, this is a long post — but buying a home in the high velocity market is, in itself, a complicated process. Frankly, it is a nuanced and subtle skill that few agents truly understand.

Much in the same way that the tools don’t make the carpenter — a license does not make an agent. Choose an agent who understands the strategy of winning offers in the hyper-competitive environment. An agent with a record of helping clients not only securing the home the seek, but doing so at the best price DESPITE the competitive landscape is worth their weight in gold.

Use their experience to help you navigate the complex set of decisions that drive winning in the spring market.

If 2016 is anything like 2015, we are going to see home prices rise.

If 2016 is anything like 2015, we are going to see home prices rise.