Micro or macro?

Micro or macro?

Factual or anecdotal?

Data point to trend?

Forest or trees?

Big picture or small picture?

There is an old adage that goes something like this – ‘Don’t bring a knife to a gun fight.’ Personally, I have always tried to avoid fights (especially ones where weapons are involved) so I find that statement particularly easy to abide by. But as it relates to real estate, I often see buyers and sellers using large statistical based arguments to guide individual decisions … or I see them using anecdotal points to try override what large sets of numbers are trying to tell them.

It is unfortunate.

Data Points or Trends?

As agents, we constantly hear – “Well the house down the street sold for $450,000 … ”

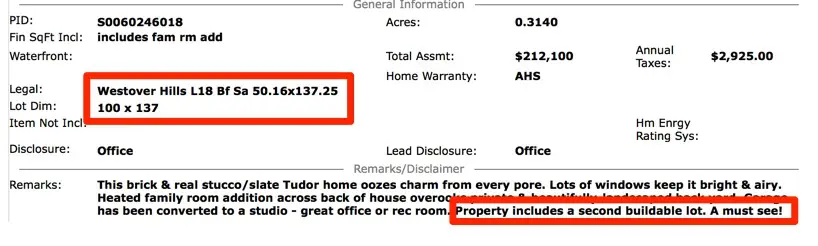

I’m sure it did … but how long did it take? Did several sell at that price or just that one? Did they drop the price multiple times or did they get multiple offers? What were the terms? Was there personal property included? Or did the seller include closing costs What was the condition? What season? How many houses were on the market when it did? Who was the builder?

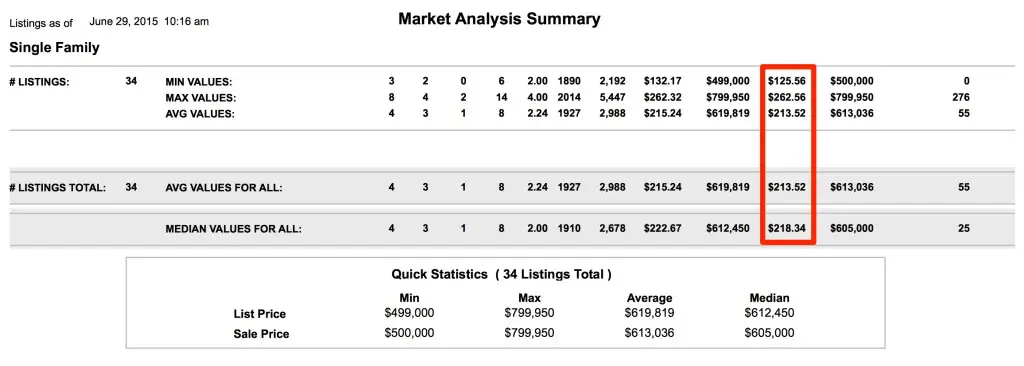

We also hear – “Well the average dollar per square foot in the neighborhood is $165 …”

I’m sure it is … but what houses were included in the analysis? Was the age range set tightly or loosely? How many had a finished 3rd floor … or basement? Or an oversized lot? Or were recently renovated? Same builder? Is the data from the fall or spring? What were the highs and lows?

As you can see, many questions need to be answered in both cases to validate either statistic. Despite the need to fully understand the statistic, many times buyers or sellers (or agents!) grab the one data point out of a sea of analysis that supports their version of the narrative and subsequently base their entire strategy upon it. It rarely works out well.

Micro and Macro Are Different

In its simplest form, MICROeconomics is the study of an individual’s (or entity’s) behavior when resources are limited. This is contrasted with MACROeconomics, where an entire economy is being studied (yes, Econ majors, I know that is a gross oversimplification of Macro and Micro theory, sorry.)

When an individual elects to buy or sell because they feel that the economy is doing well and prices are likely to rise, they are making their decision based on more of a MACRO-economic analysis. If a couple changes their behavior because 3 homes in their neighborhood just sold at record prices, then they are making more of a MICRO-economic decision.

In either case, both micro and macro based decision making is fine, when used to make micro or macro decisions, respectively. However, using macro stats for micro decisions (or vice versa) is not as sound of a practice.

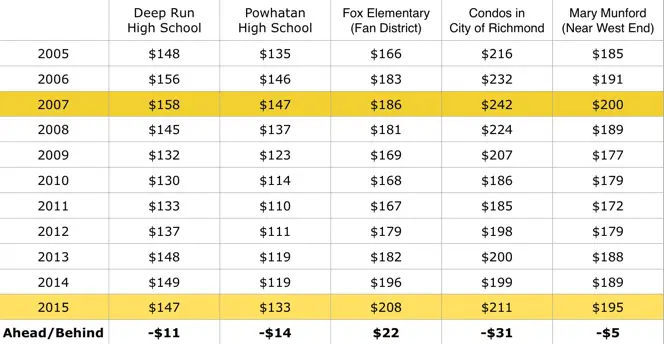

One of the most common mistakes we see is clients taking overall market statistics (MACRO) and trying to apply them to a specific neighborhood (MICRO). Take a look at the chart below – the following graph shows the inventory levels in different segments of the market:

- Overall Richmond Metro inventory levels (blue line)

- Southern Chesterfield inventory (purple line)

- Museum District/Windsor Farms (red line)

As you can tell, the inventory levels in Southern Chesterfield are far higher than both the overall Richmond market and the close-in areas surrounding Carytown. The MACRO inventory (Richmond Metro) tells a far different story about the market than the MICRO inventory counts in 23838 and 23221. A client moving from 23832 to 23221 but using a strategy based on 23832 data will not find success. Similarly, pricing or negotiation strategies based on the entire Richmond region would have drastically different results in either 23838 or 23221. Make sense?

Be wary of bringing your macro analysis to a micro analysis decision (and vice versa …)

Summary

We are all constantly searching for data points to fit our preferred narrative. Sometimes we look down the street at a single comparative sale (out of seven) or sometimes we look to MSNBC, CNNMoney or the Case-Shiller Index for aggregate demand data … both can be equally right (or wrong) depending on the type of decision you are tying to make.

In order to really make the best decisions, know your data. Apply data correctly and you will find your outcomes far better.

At the end of the day, helping clients understand where they stand in the market means impacting their financial health in the greatest of ways. How you market your listings matters … the same way understanding deeds, inspections, RESPA, Fair Housing, construction materials and zoning matters. But if you don’t understand the underlying value of what you are buying and selling, then the rest of it matters far less (and if you read any of our blog posts with any regularity, you know we spend a lot of time

At the end of the day, helping clients understand where they stand in the market means impacting their financial health in the greatest of ways. How you market your listings matters … the same way understanding deeds, inspections, RESPA, Fair Housing, construction materials and zoning matters. But if you don’t understand the underlying value of what you are buying and selling, then the rest of it matters far less (and if you read any of our blog posts with any regularity, you know we spend a lot of time

‘How much a foot?’

‘How much a foot?’