Definition: Fair Market Value (FMV):

- A selling price for an item to which a buyer and seller can agree.

- The price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.

- The price that property would sell for on the open market.

I once had a professor tell me that Fair Market Value was the price at which both sides felt like they got screwed (I loved that one!) but I will let the more formal definitions rule the day.

Fair Market Value is basically the price at which two willing parties can agree upon to exchange an asset.

Ok Then, What is an Appraisal?

In real estate, an appraisal is a 3rd party analysis of a property’s value based on recent sales of comparable (similar) properties –– but that does not necessarily mean it represents fair market value.

The appraisal is nothing more than a (supposedly) qualified and (hopefully) impartial individual offering their opinion of the value of the home. The appraiser is hired by the lender (well, you actually pay for it even though the bank requires it) and is used to set the value upon which the loan amount will be based –– provided it is equal to or less than the purchase price.

So if you are getting a loan for, say, 80% of the value of the home, the bank will loan you 80% of what is either the price on the contract or the appraised value –– whichever one is lower.

And to answer the question –– Yes, an appraisal is mandatory if you are getting any type of conventional loan to finance your property.

How Does an Appraiser Arrive at the Valuation?

Typically for residential purchases, appraisers employ the ‘Comparable Sales’ method. The Comparable Sales method uses 3 recent closed sales of similar properties –– makes adjustments for any differences –– and then computes a value.

While there are other appraisal methods for income-producing property (the ‘Income Approach’) and unique properties where similar sales are few and far between (the ‘Replacement/Cost Approach’), the comparable sales approach is used in a large majority of cases when residential property is purchased.

Rapidly Changing Conditions

For a moment, imagine the value of something OTHER than real estate.

What do you think the last Super Bowl ticket is worth? The $200 it says on the ticket or the $3,500 you can get for it on StubHub? And what do you think that ticket is worth on the day AFTER the Super Bowl? Not much …

And what do you think a bottle of water is worth in the middle of the Sahara? The $1.59 you paid at 7-11 or closer to $1,590 the person with the empty canteen just offered you?

You get the picture.

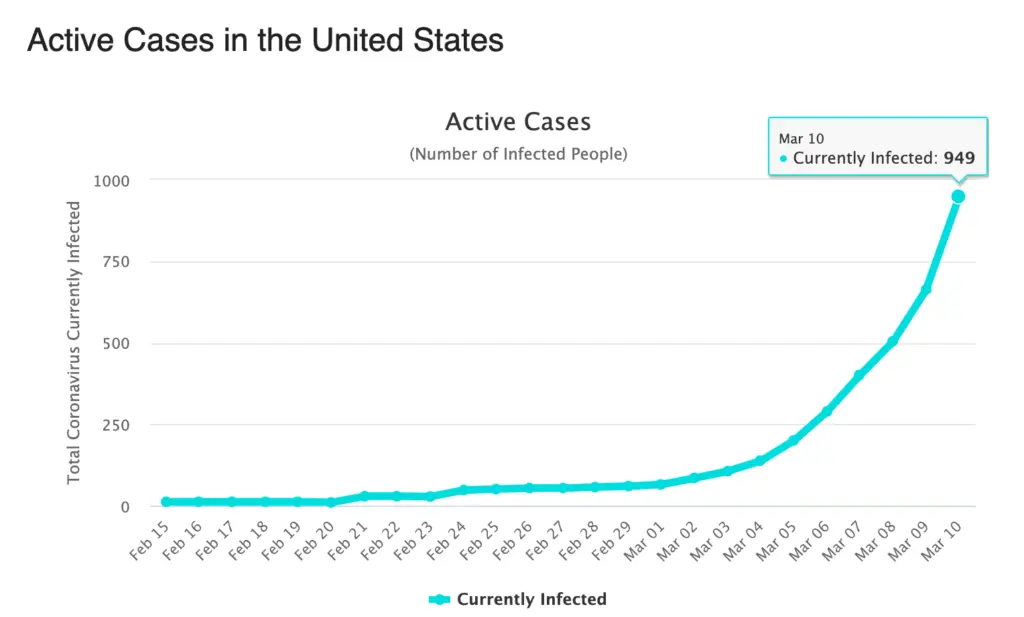

The point is that market values are fluid and constantly in flux depending on any number of reasons. And thus, as market conditions change, so does market value.

And trust me when I say this, this market is one of the most fluid markets in the history of real estate.

The Issue Now With Appraisals

As we like to say at One South, using past sales to predict future values is a bit like driving your car while looking out the rear view mirror. It will tell you where you’ve been, but not necessarily where you are going.

This is especially true in the current environment.

In a market where 10-15 offers is not uncommon and inventory levels are the lowest in history, past sales are always going to yield a value lower than where the market is trading.

Simple economics states that when demand exceeds supply, prices rise (and the converse) –– and when the number of buyers exceeds the number of sellers by as much as it currently does, it only makes the difference between the appraised value and the sales price that much larger.

It’s frustrating that one of the most integral parts of the home buying process is so disconnected from actual values.

The Mistake Buyers Make

The ‘Missed Appraisal’ (one where the appraised value is lower than the contract price) is extremely common right now –– especially when multiple offers are involved.

So for many buyers, the jubilation (and relief) of winning a competitive offer situation quickly turns to doubt when the appraised value is less than the price they paid. In effect, buyers allow a third party valuation opinion based on events in the past to cast doubt upon a decision made on current market inputs.

Don’t.

Why?

Because the Appraisal is not Fair Market Value!!!

Yes, appraisals set the loan amount and when the appraisal comes in low the buyer needs to make up the difference in cash –– but remember, appraisals are really about the financing and not FMV!

I cannot overstate this enough –– the fair market value of the home and the appraised value are not the same thing.

Things to Note About Appraisals

A few things to remember about the appraisal:

- Appraisers never go through the houses they use as comps

- Appraisers never talk to the purchaser, seller, lender, or (rarely) Realtors about the price

- Appraisers cannot use PENDING sales in their analysis

- Appraisers never visit the houses you didn’t purchase

- Appraisers (typically) don’t how many offers were made on a house

I am not throwing appraisers under the bus, only pointing out the differences between purchasing a house and appraising one –– as well as the different set of rules appraisers must follow.

The bottom line is that no one knows as much about the decision as you do.

Appraisers Are People

If you really want to have some fun, pick any home and take a look at the value that Zillow, Trulia, Realtor.com, Movoto, Realist, and/or the tax assessment assigned to it. I guarantee that each one is different –– sometimes shockingly so.

Appraisers are no different.

In the same way that Zillow (et al.) have different algorithms, so do people. Yes, the form that appraisers use is the same, but the comps they choose and the adjustment they make are subjective.

If you assigned 5 different appraisers to value the same home, odds are each one will arrive at a different value.

It’s unfortunate, but it’s true.

Summary

Remember, appraisals, while important, are not gospel. They are just someone else’s opinion of value of a unique asset who did not see the other homes you did, who does not have your motivations, and who does not have your likes and dislikes.

Your opinion of your decision is what matters –– not the appraiser’s.

When markets are moving as quickly as this one is, don’t worry about the appraisal as it relates to the VALUE of the home you are buying. If you have done your homework and have made the best decision for your situation, then the appraisal is not what matters in the long run.

Trust your own gut and don’t sweat the appraisal.