I am beginning to hear a lot of chatter about foreclosure right now.

Spoiler alert –– don’t worry.

One of Biden’s first acts as President was to extend protection to homeowners experiencing hardship due to COVD

As we transition from one administration to the next, we are beginning to see where this administration stands on many issues –– and being someone who makes a living in real estate, Biden’s housing-related policies are of particular interest.

Unsurprisingly, in one of his first acts as President, Biden extended both COVID-related forbearance protection and the foreclosure moratorium in an attempt to keep those who lost jobs from being unceremoniously tossed out into the street for non-payment of their mortgage.

The System Shock

When COVID hit and we went into lockdown, it cost a lot of people their jobs.

For a slew of others, COVID may not have cost them their jobs, but their pay decreased sharply when their industries were decimated.

The spike in initial jobless claims (March 2020) still blows me away in its severity

When you have that many people become unemployed (or underemployed) as rapidly we did (see the unreal spike in the chart above), everything is impacted –– and housing was, of course, not spared.

In the period immediately following the lockdowns, people started to make tough decisions about how to allocate their savings into an extremely uncertain future –– and not making a house payment became a choice many had to make.

Enter ‘forbearance.’

Forbearance

COVID has forced us to learn so many new terms –– ‘flatten the curve,’ ‘herd immunity,’ ‘mRNA,’ and ‘contact tracing’ to name a few. ‘Forbearance’ is yet another one and now at the front and center of COVID housing news.

Without getting too deep in the weeds, mortgage forbearance is basically the ability for a homeowner to (legally) stop making payments to the mortgage servicer for a period of time without fear of losing the home in foreclosure.

Forbearance does not absolve the borrower of the debt, it just basically says ‘We both know that I can’t pay you right now because of COVID, but I will start paying you again when I have a job and we will work out how to make up the payments I missed.’

Right now, those who report the news are acting as if the two are one and the same.

It is as unfortunate as it is uninformed.

Foreclosure (vs. Forbearance)

While the words sound similar, they mean different things in the same way that ‘lose your house’ means something way different than ‘mortgage relief.’

Forbearance is temporary relief in making your mortgage payment –– foreclosure is the legal process that a lender must go through in order to seize your home for non-payment of your mortgage.

When you are (legally) in forbearance, you don’t have to pay the bank, but you cannot have your home taken through foreclosure. If you stop making your mortgage payments but are not protected by some type of forbearance agreement, then the bank can take the home from you.

Note –– forbearance does not mean the same thing as mortgage delinquency or pre-foreclosure. Just because a borrower is in forbearance does not mean foreclosure is immenent.

Asset–Based Lending

2008 notwithstanding, lending money against an asset like housing is one of the safest forms of lending imaginable.

Why?

Borrowers tend to pay their mortgage above all other types of debts (credit cards, medical bills, student loans, boats and other do-dads, or other non-essential expenses) because being homeless sucks and foreclosure eviscerates your credit.

Thus, banks love to loan money against REAL assets –– and a house is a real asset (think REAL estate.)

Besides the fact that borrowers tend to make mortgage payments come hell or high water, there is an asset securing the loan:

- If I, as a bank, extend you credit to buy a home and you don’t pay me, I can take your home and resell it to get my money back.

- If I, as a bank, extend you credit to pay household expenses or Netflix (i.e. –– a credit card) and you don’t pay me, I can’t really take the food you have eaten or the movies you have watched and sell them to get my money back.

And thus the reason that loans secured by assets are at lower rates than loads not secured by assets.

Appreciation = Protection

So not only are houses real assets –– houses tend to appreciate in value.

Yes, 2008 showed us that houses don’t ALWAYS go up in value, but for the large majority of history (including every year for the past 10 years,) housing values have marched forward in a stable, if not spectacular, manner.

The equity created by the simultaneous reduction of debt and appreciation in the price creates additional value in the home –– and that is critical to understanding the real risk to the market we are in.

Forbearance is Up, Foreclosure Will Not Be

Right now, the message being delivered by news and media outlets is forbearances are up sharply (which is true) and that the moratorium on foreclosure has been extended by presidential decree (which is also true) –– which, for the person who doesn’t follow the market in great detail, sounds ominous.

It shouldn’t.

Foreclosures happen when TWO conditions occur:

- the owner cannot make the mortgage payment AND

- the house is worth less than the debt

Without both, foreclosure is unlikely.

If the debt owed > home value, the homeowner will have to write a check to the bank for the difference between the debt and the sales price when they sell it.

If the debt owed < home value, the homeowner will collect a check for the difference between the debt and the sales price when they sell it.

That is a massive difference.

Using real numbers:

- if a home is worth $400,000 and the debt is $500,000, then the owner is incentivized to allow foreclosure and stick the bank with $100,000 loss

- if a home is worth $400,000 and the debt on the home is $300,000, then the owner is incentivized to sell the home and pocket the $100,000

It is all about incentives.

Homeowner Equity

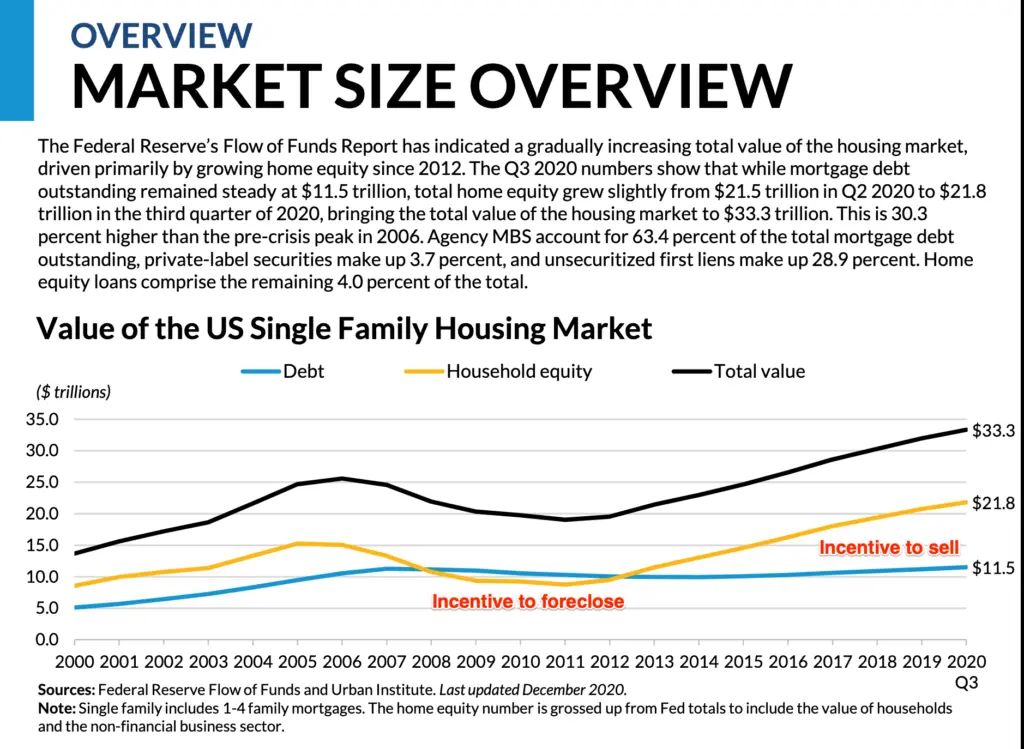

So if foreclosure happens when the home is worth less than the debt, where do we stand right now?

From the Urban Institute (urban.org)

Using the chart above, when the yellow line falls below the blue line (negative equity), people are far more likely to get foreclosed on. When the yellow line is above the blue line, then the owner will sell the home and pay off the mortgage.

Right now, there has never been more collective equity in the US home market.

Do you really think foreclosure is going to be an issue?

Summary

I get it, we are still paying for the debacle that was 2008. The public sentiment is that when prices rise fast, bad things are about to happen. People remember the pain, but they don’t understand the reasons.

2008 was bad for sure, but the conditions that created the housing crisis of 2008 DO NOT EXIST TODAY.

Depending on whose research you want to believe, the current available housing under-supply is as severe as the housing over-supply was in 2008-2010.

Does that put it in perspective?

In our last blog, we wrote about how pricing was not likely to head down anytime soon, and (good news) foreclosures tend to move inversely with home price appreciation.

Right now, the lack of housing is pushing pricing higher as rapidly as in any other time in history and as equity increases, delinquent homeowners sell in lieu of electing foreclosure –– and this condition is unlikely to change in any meaningful way for the foreseeable future.

Articles such as this disingenuously deceive the reader in an attempt to garner clicks.

Yes, events that are not easily predicted can bring rapid changes to any market –– and will always be a threat –– but the threat to today’s housing market is not too many foreclosures.

Will there be a few additional owners who end up losing their homes when forbearance ends? Yeah, perhaps. But you won’t notice.

Don’t let those who are uninformed frighten you about some coming wave of foreclosures.

They are –– in a word –– wrong.