What if I told you that it was going to be 72 degrees today in Richmond, would that give you a sense of what to expect when you walked outside? Of course, it would. You’ve been experiencing temperatures your whole life.

(scroll down to the end of the post to see the visualizations!)

What if I told you that it was going to be a ‘typical spring day in Richmond,’ would you know what to wear? If you have been in RVA for a spring or two then, yes, you would have a decent idea of what to expect.

Click to watch a quick tutorial of the Bidding War visualization

But what if I told you that it was going to be 22 degrees Celsius? Unless you had spent time in Europe (or maybe as a meteorologist,) then you might not know what to wear, would you?

You get the picture. Without context or experience, it becomes difficult to understand the relative meaning of anything.

Real Estate Context

So what if I told you that the inventory levels are currently at ‘one month’? Do you really know what that means?

Or what if I told you that the ‘median days on market’ is now 7? Or that the ’10 Year is at 1.7′?

Does those stats mean anything to you? Are they good? Bad? Has it changed?

Unless you are in the business, you probably don’t realize the significance of those measurements.

I think anyone who even remotely pays attention to real estate knows that the market is ‘hot’ and inventory is ‘low,’ but without having an anchoring point, (i.e.–– CONTEXT) does knowing that there are 397 resale single family homes available right now really overly helpful?

Not without something to compare it to.

Data Visualization is Key

As agents, we tend to assume that the public knows as much about the history of the market as we do.

For any agent who has been a part of the market for any period of time, they know what 2020 felt like, and 2019, and 2018 (and so on). But if you are a first-time buyer, or haven’t bought or sold in a decade, you probably don’t have a great feel for how much things have changed.

What seems so familiar to us as agents just isn’t nearly as so to our clients –– and thus the disconnect when it comes time to put in an offer, or choose the correct price when listing. Our clients just don’t have a sense of how much things have changed or how extreme the conditions have become.

So we decided to do something about it.

The Tools You Need

MLS has tons and tons of great information –– but it just isn’t designed to be a data visualization platform.

So we took matters in our own hands.

To better help our clients gain market perspective, we created a series of customizable digital visualizations that show not just the current market conditions, but allows us to travel back in time to see how much things have changed.

Furthermore, since even within markets, conditions can vary greatly from one side of town to another or from the upper end to the entry price points, our tools allow you to compare different areas and different price bands within our Metro to one another to gain perspective.

Happy visualizing!

#1 | Bidding Wars

The following visualization shows the number of sales that have occurred at, above, and below the asking price for any given period and MLS zone. It also shows the distribution of the sales so that you can gain a sense for how far above and below the accepted offers tend to be.

This tool is helpful for both buyers AND sellers in determining the best strategy in any transaction.

#2 | Availability Matrix

The availability matrix shows by the number of properties available by both MLS and $100K price range in order to gain a sense of how many opportunities exist in each area.

Note that you can toggle on/off townhomes, condos, and new homes in order to better understand the choices in each sub-area.

#3 | Months of Inventory

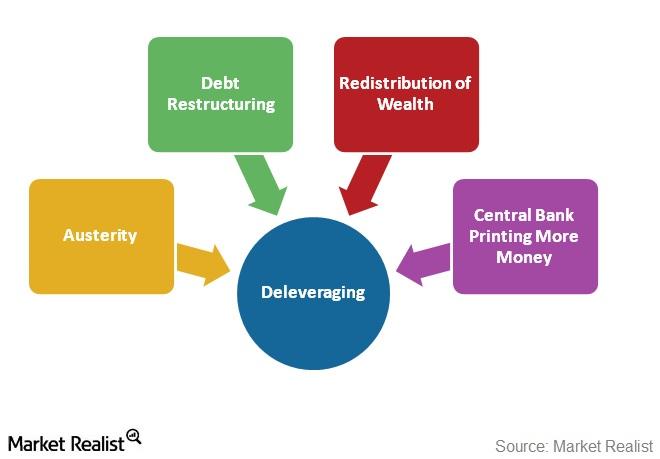

Inventory is a commonly used index to measure the housing supply.

It is dervied by looking at the previous period’s sales and dividing into the current number of available homes. If a 200 homes sold in the past 30 days, and the current number of available homes was 600, then there would be 3 months of inventory (200/600 = 3).

A market is said to be balanced if there is 5-7 months of inventory. Anything less is considered to be a ‘Seller’s Market.’ Anything more is considered to be a ‘Buyer’s Market.’

Summary

Yes, we actually have few others, too –– and even more on the way.

And of course, if there is anything that you would like to see, let us know and we will try to create the visualization for you!