Has anyone seen the Rocket Mortgage ad that debuted during the Super Bowl (sorry, we’re making you think way back today)? The one where Keegan-Michael Key (of Key and Peele) translates for people? I have to admit, it had me chuckling, especially when he was translating the bios on the dating site.

But did you catch the part with the couple talking to the Realtor? The couple is in the home and the Realtor is talking about mutliple offers and discussing the type of financing (which a Realtor would NEVER do) and the couple looks confused. Then, the narrator (Michael Key) pops up to “translate”, hands them a phone, and says, ‘Press this button.’

Yeah, that is pretty upsetting to those of us in the real estate community.

Push a Button and You Don’t Have to Think

The messaging is subtle, but undeniable. Rocket is saying, ‘Don’t listen to them, listen to us. We have taken all of the thinking out of the process, just push here and everything will be ok.’

In effect, they are telling the public that an experienced loan officer, who is trying educate them about one of the most complex financial instruments they will ever employ, is completely unnecessary.

Furthermore, they are saying that pushing a button on the internet is somehow a better option than having someone explain how things work.

And lastly, they are saying that shopping for the best rate, as well as the best terms, is not needed since they handle everything for you.

It is absurd.

If Knowledge is Power, What is Lack of Knowledge?

In 2007, the market crashed largely because the consumer knew nothing about the complex financial instruments that they were using to purchase homes. Unsuspecting buyers willingly accepted intentionally deceptive lending products to acquire overpriced housing that they could barely afford on Day 1, much less once the rates began to adjust upwards and prices began to fall.

Rocket, with its massive advertising budget and slick technology, is now taking the practice to an industrial scale.

By sending the message that pushing a button is the best way to get a loan, Rocket is basically telling the market that understanding your options is unnecessary. Don’t waste your time learning, just push here.

Pushing a button to order milk, movie tickets, or even a new iPhone is perfectly ok. But pushing a button to order a financial instrument that can cost you hundreds of thousands of dollars over time is unacceptable.

Don’t mistake pushing a button for thinking.

Jarvis Grandchildren: ‘Grandpa, please tell us a story about the way real estate used to be!’

Jarvis Grandchildren: ‘Grandpa, please tell us a story about the way real estate used to be!’

So what happens if you spend $20,000 improving your home? Do you improve your value by $20,000? More? Less? It depends.

So what happens if you spend $20,000 improving your home? Do you improve your value by $20,000? More? Less? It depends.

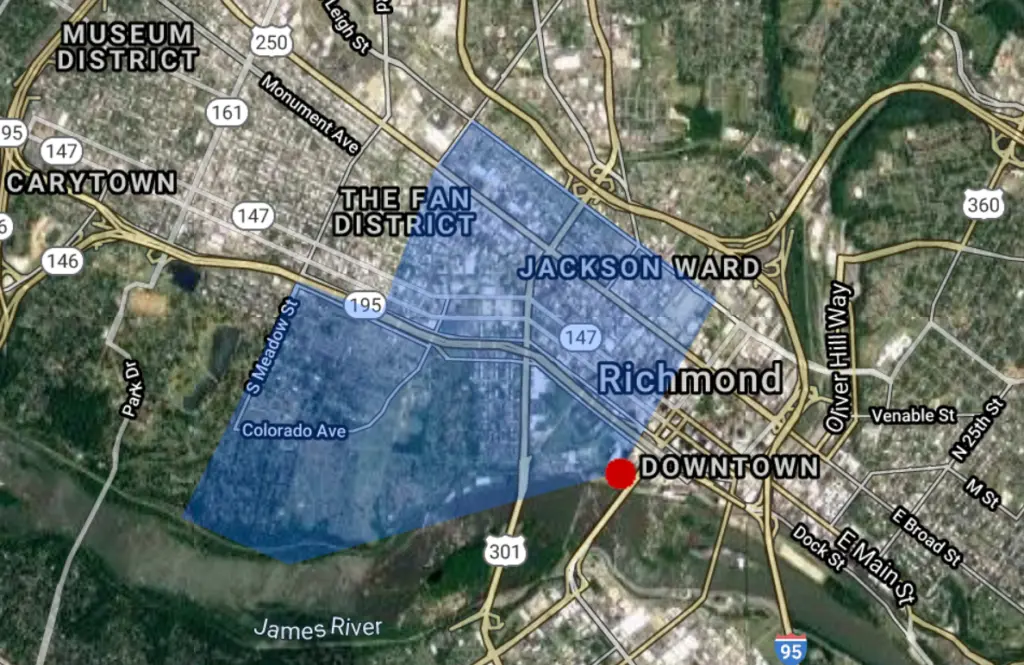

Want us to do a special study for your preferred area or neighborhood? E Mail us today at

Want us to do a special study for your preferred area or neighborhood? E Mail us today at