Ever heard of iBuying? If you haven’t, you can say you heard about it here, first, because it is the newest trend in real estate sales and it is on the way to a market near you –– probably.

So what exactly is iBuying? Well, no one definition exists but generally speaking, iBuying is nothing more than a company (or fund) that buys houses from people directly –– at some amount of discount –– for cash, and typically with a quick closing.

iBuying, in effect, replaces the traditional method of an individual owner putting a sign in the yard and selling to an individual purchaser at a market price.

How Does it Work?

In most cases, the owner of a home will go to an iBuyer website, enter information about their home, and wait for the iBuyer to tell them what they would be willing to pay. The iBuyer company will look at its valuation algorithm and make the seller an offer.

Each iBuyer has a slightly different method, but typically, the offer comes with a mandatory site visit from some representative to verify the condition of the property and the features, size, etc. and to make sure that the information given by the seller is accurate.

If everything checks out, the offer can be accepted and closing will occur quickly and for cash.

Yes, it can be that simple.

The Premise (ok, ‘The Catch’)

The catch is this –- the offers come with a discount.

The iBuyer will use an algorithm that establishes likely market value, but then subtracts the cost of commissions, any required repair money, some carrying cost, and a little bit for profit.

But even if the offers are discounted, they are all cash and come with a quick closing.

The thought is that the offer will be close enough to what a typical seller would net on the sale of their home and, thus, the seller take less to avoid the hassle of the selling process –– and to have the certainty of knowing their home is sold.

In effect, if the seller believes the ‘hassle to discount’ ratio is in their favor, then they should (in theory) accept the offer. If not, then they can sell via the traditional process.

It is a fascinating idea and one that is taking hold in several markets.

The Players

There are several national players who are attempting to scale this business as we speak –– Zillow Offers being the most notable, but there are others. Knock, OfferPad and OpenDoor are making a lot of noise, while Redfin and a few other brokerages have either launched or are launching their own version of an iBuying program.

And aside from the behemoths mentioned above, local franchised versions also exist –– ’We Buy Ugly Houses’ and Homvestors are forms of iBuying as well, although couched in a more of an opportunistic wrapper.

Heck, even some local investors (typically tied to a local brokerage) have established funds to do roughly the same thing.

The Game

Ok, before you go out and rejoice, thinking that you can trick a computer into making you an above-market offer on your 7 bedroom 1 bath Elvis Pressly themed home that is in need of $50,000 of siding and roof repair, that is not how it works.

The national iBuyers have what is called a ‘Buy Box’ to determine which properties qualify to be purchased. Typically, the ‘Buy Box’ will only include properties that their algorithms can value with a high degree of confidence –– and shy away from the ones that they cannot.

iBuyers will also tend to shy away from thin market segments (i.e. luxury housing) where pricing means fewer buyers and longer marketing times.

So the typical Buy Box will include properties that are newer, more homogenous, less expensive, and otherwise easier to peg a value accurately. Properties that are older, historic, have unique features, are expensive, in need of massive repairs, or are otherwise difficult to determine a fair value for will fall outside of the Buy Box and not qualify for an offer.

So don’t get too excited about an iBuyer coming in and taking your problem property off of your hands at a premium –– they won’t.

Uses and Models

iBuying has applications for sure –– mostly for cases where ‘certainty’ is required or where other factors prevent the home from transferring via conventional means.

- If you are a contingent buyer trying to upgrade into a hot market segment, it might make sense to use an iBuyer to sell your home so that you can qualify for the next one

- If showing your home repeatedly is burdensome, then selling to an iBuyer makes sense

- If you are in need of selling quickly to take a new job, or move to another market, iBuying might also make sense

But in cases where the seller can wait, or where bidding wars are likely to occur, an iBuyer really isn’t necessary.

The Real Uses

So do you know why Zillow really wants to have an iBuyer platform? And Redfin? And the others?

Leads.

A seller inquiring about the value of their home is nothing more than a potential seller raising their hand and identifying themselves as a potential client –– and for any brokerage, that has tremendous value.

So even if the offer is rejected, the lead can still be referred to an agent in the iBuyer network for a referral fee.

Kinda brilliant, isn’t it? You bet it is.

Successful?

The iBuying idea is still rather new and thus, the concepts have not been fully developed and the numbers being reported are not vetted.

A recent article claimed that iBuying represented as much as 3% of the accepted offers in markets where they were operating, but that is largely a self-reported number (as well as a self-serving one) so it remains to be seen.

But even if the iBuyer does not buy in a large number of homes, the leads generated are still of great value to the Realtor community. So for iBuying to be successful, it doesn’t have to just monetize the homes they purchase –– it has to monetize the leads it generates.

Richmond and iBuying

The big players aren’t in Richmond in force, but they are somewhat close (Raleigh, NC) and in some parts of Charlotte.

Some locals are playing in the space here locally, but no one of any real scale.

And since Richmond is an old city with aged housing stock, the likelihood that any iBuying platform would identify Richmond as a target-rich market is low. When you look at the map above, you see no iBuyer presence in the older housing markets of the northeast.

But that said, at some point, we will see some version of the iBuying model enter our market.

Questions Abound

So stay tuned, there are still many questions to be answered.

- One of the biggest is ‘what will iBuyers do with the homes they buy?’ Some will simply resell them and others will employ a buy and hold strategy. If that happens, will it put even more pressure on inventory?

- The other question is how will iBuying impact appraisals? If the nearest and most recent comparable sale was an iBuyer sale at a 10% discount, will that impact the value of the surrounding properties?

- What happens when iBuyers compete with one another? Will the competition between iBuyers squeeze the profits out of the model to such a point that they exit the market?

- What if an iBuyer ends up with enough inventory that it can act like CarMax and offer trade-in options? Supposedly, that idea is being discussed.

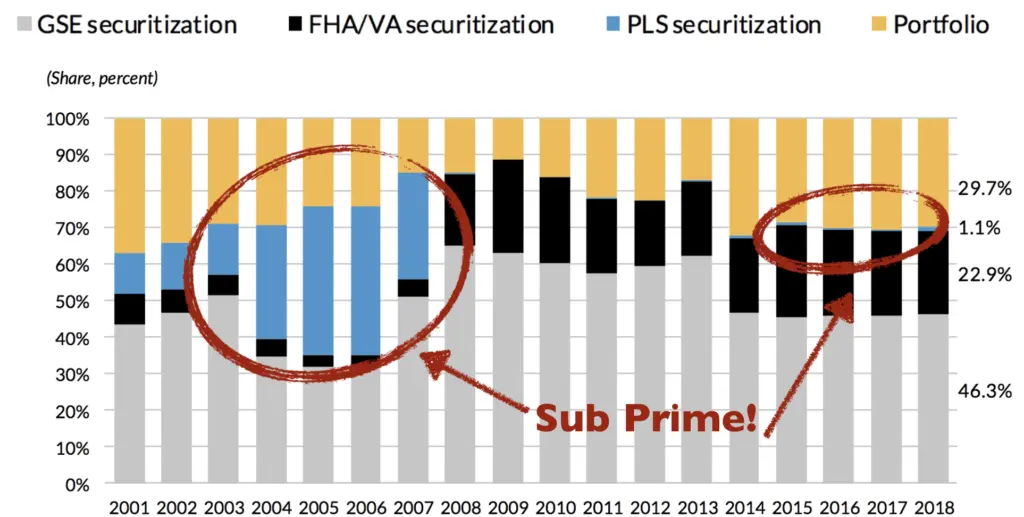

- Lastly, if and when the market goes through an adjustment, are iBuyers going to be willing to purchase assets that are declining in value? Just ask developers and builders what happened to their balance sheets in 2008 – 2012 and how much fun it was to hold onto housing when it was going down in value by 10% a year for 3 straight years? Hopefully, that adjustment is nowhere near, but most felt that way in the years leading up to the recession, too.

I don’t think anyone has the answers yet.

Summary

The iBuying idea has merit, but there is a lot still to be determined.

That said, the key point is that there is a lot of money backing these firms so the iBuying model is going to be here until someone figures it out.

Like a hammer or a lawnmower, iBuying is nothing more than a tool and it has its specific uses. Learning how to use the tool properly will come with time and practice for all involved.

Having a choice is never a bad thing for the consumer and iBuying will provide the public options that they didn’t have before.

So as 2018 comes to a close, be thinking about the fact that you will soon be getting a note from your management company notifying you of your new water temperature … errrr … rental rate for the coming year. If the landlord does their job right, the increase won’t make you leave –– it will be just enough to make you grumble, but stay.

So as 2018 comes to a close, be thinking about the fact that you will soon be getting a note from your management company notifying you of your new water temperature … errrr … rental rate for the coming year. If the landlord does their job right, the increase won’t make you leave –– it will be just enough to make you grumble, but stay. But sometime around 2003, things began to change. It was barely perceptible at first – just a sense that selling a home seemed easier. Pricing seemed to be inching up a bit more quickly, and homes seemed to sell in less time than in years prior.

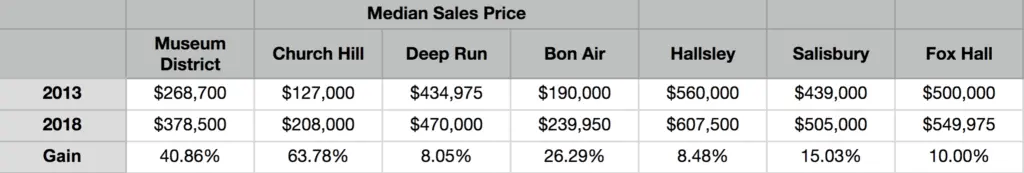

But sometime around 2003, things began to change. It was barely perceptible at first – just a sense that selling a home seemed easier. Pricing seemed to be inching up a bit more quickly, and homes seemed to sell in less time than in years prior. Our urban cores are rapidly revitalizing and the abandoned properties of yesteryear are being repurposed into vibrant living and working spaces. Suburbia now has competition for the next generation of home buyers.

Our urban cores are rapidly revitalizing and the abandoned properties of yesteryear are being repurposed into vibrant living and working spaces. Suburbia now has competition for the next generation of home buyers. But at the same time, don’t lose focus on the new inputs to the housing market, either. The way the next generation feels about our cities is far different than the way the prior generations did. The under 40 crowd only knows Richmond as a city on the rise, with new options for culture, dining, transportation, and entertainment emerging on a daily basis.

But at the same time, don’t lose focus on the new inputs to the housing market, either. The way the next generation feels about our cities is far different than the way the prior generations did. The under 40 crowd only knows Richmond as a city on the rise, with new options for culture, dining, transportation, and entertainment emerging on a daily basis.