I am sure you have heard a Realtor say it –– ‘It’s a great time to buy or sell real estate!’

Yeah, it is rather obnoxious.

Admittedly, I don’t like the statement either, it feels not only very self-serving, but very thoughtless. It really isn’t saying anything at all –– just a recommendation to do something –– which flies in the face of legitimate thoughtful advocacy (but I digress …)

That said, it does beg an interesting question, what is YOUR Realtor doing? Are Realtors buying right now with prices as high as they are? Are they dumping everything they own thinking the market is about to tank? Are they telling you to buy but others to sell? Are they recommending what is good for you, or for them?

The bottom line is: Does their advice match their behavior?

Let’s discuss.

The ‘Agency’ Problem

The ‘agency’ problem is basically defined as follows –– it is when the representative for an individual (Realtor, stock broker, attorney, etc.) makes money regardless of whether the deal works out for the individual represented.

Don’t tell me what you think, tell me what is in your portfolio.”

Nassim Taleb –– Skin in the Game

In other words, if you buy a stock, or home, or car, and the value goes down, does the representative that recommended you buy it (the agent) feel the same financial pain? If they do not, then you (probably) have an agency problem –– one where the only the client suffers from the bad advice, not the agent.

As a very much younger version of myself, I remember a sage developer once telling me that he would be more than happy to build what I said he should, provided I covered his losses if it didn’t work out. And while I was taken aback by the statement initially, I quickly came around to understand what he meant.

If he followed my advice and I was wrong, he was the one who lost –– not me. It was simply a way of saying, ‘Put your money where your mouth is.’

I never forgot the lesson.

Are We Buyers or Sellers?

So it begs the question, are agents buying or selling right now? And being even more specific, are WE buying or selling right now?

The answer is, yes, we are.

Wait, what, you said ‘yes’ to both. Are you buying OR are you selling?

The answer is more specifically, yes, we are doing both.

When We Are Sellers

We are selling a few things in our portfolio for various reasons, but they are not related to an expectation of a market crash.

We are doing what is best for our portfolio.

The Beach House

We recently sold a vacation home we had owned for many, many years (in full disclosure, I LOVED the place, but it was time to let it go.)

Why did we sell it? For two reasons:

- We had a floating rate mortgage on the home, and due to the nature of vacation (2nd) homes, refinancing the property into a fixed rate mortgage was not feasible. We saw indicators that mortgage rates we due to rise and we didn’t want the exposure to an increased mortgage payment, regardless of the appreciation potential (or sunset!)

- The home was due for many deferred maintenance items that would have required significant capital investment. In other words, we had some expensive repairs on the horizon that would have required a lot of cash that we did not want to lose access to.

And so we sold it –– in a weekend.

Replacement and the 1031 Exchange

We then used a 1031 tax-deferred exchange technique to shelter the gains, and then bought both an office property (near Willow Lawn) AND a single family rental home in Kilmarnock (near the River) –– and we were able to secure long term fixed-rate financing at a very low rate.

From a strategic standpoint, we were able to remove a poorly financed property from our portfolio (that also was extremely unpredictable in its yearly maintenance costs) and replace it with two low maintenance properties financed at a 3.1% fixed rate.

And did I mention we actually upped the cash flows at the same time?

Great outcome.

So, yes, we technically sold one property (which made us a seller) but subsequently purchased two others to replace it (which made us buyers.) And we did so to reduce the risk in our property portfolio for reasons relating to mortgage finance, cash management, and tax impact –– not for fear of a market crash.

The Family Rental

In addition to the sale / purchase referenced above, we are also considering selling a property that we had owned for years as a single family rental (it is currently under contract.)

The reasons we are doing so have less to do with a bet on the market dropping (we will simply go and buy something else similar with the proceeds, so we are still betting on appreciation) but more for a reason related to family. The home was leased by a family member and when they moved out, it felt better for all parties involved to find a new owner.

So the reason we are selling is not to take money off the table in fear of a market collapse, it is due to a what is best described as a ‘non-economic’ reason.

The fact that we will be purchasing a home to replace it indicates our belief.

We are Naked Buyers, Too

OK, not actually naked per se –– I mean we are also buyers even we when don’t have things to sell.

In the past few years, we have added to our portfolio, over and above replacing the properties we sell.

Specifically, we have purchased a home with each of our eldest children, and are actively seeking to purchase more for investment purposes.

What did we buy, you ask? One is located in the ‘VCU Bubble’ and will always rent well (so the downside is extremely limited,) and the other is a super cute brick cape cod in the near west end (again, location and size make it very low risk.)

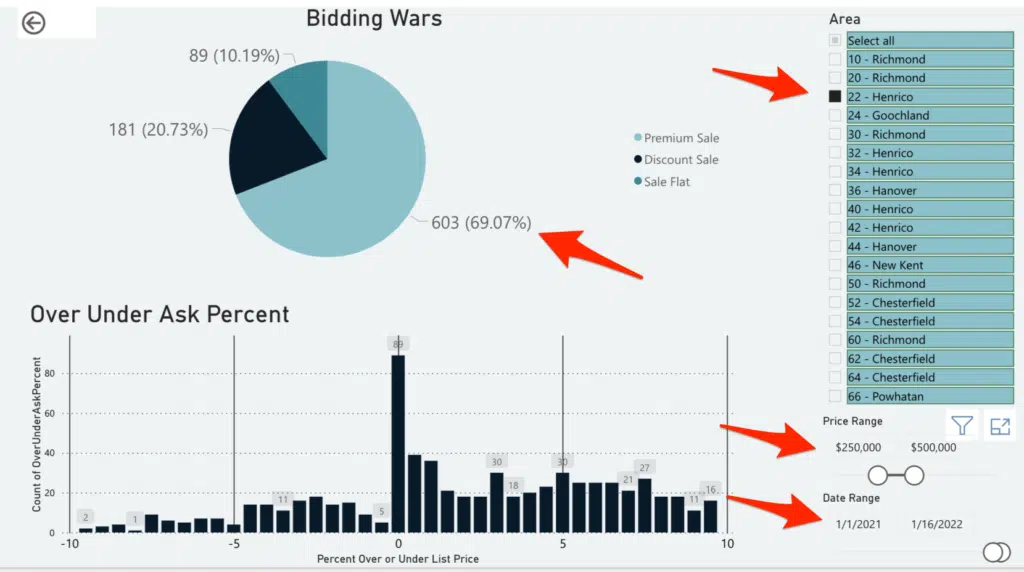

And yes, just like our clients, we had to win a bidding war ($40K over ask, btw) with a waived inspection clause in order to secure it –– what is good for the goose is good for the gander, right? We get the pain and uncertainty of the process.

Why put ourselves through the pain of a bidding war and the risk of potentially buying something with a lot of repairs in a market that seems overpriced? Because we are bullish on housing and we wanted to make sure that our kids had a chance at ownership in the same way that we did when we were their age.

So, yes, we are putting our money where our mouth is and we are making the same bet with our own children that we are asking our clients to make.

Other Strategies

We are also actively seeking land to develop or properties in need of renovations.

Buying housing does not scare us.

In addition to residential property, we are also looking for small office properties where we can find ‘value-add’ opportunities such as building on more space, carving off lots for development, and / or undertaking aesthetic upgrades.

We are lucky in that we have the benefit of experience to see how all forms of properties can be improved and thus our search box is bigger than most, but we are still buyers –– regardless of the asset class.

Again, we see demand well outstripping supply for the foreseeable future and nearly all forms of ownership (especially when financed at today’s rates even though they are up 25% from last year) are still a phenomenally safe play.

The Bet We ARE Making

So to answer the question above, are WE buying or selling? The answer is that we are only sellers when we can replace what we sell.

And when we do sell, we are selling for reasons NOT related to a market crash, but rather for other strategic reasons, and we are replacing what we sell using the 1031 tax deferred exchange provision in our tax code.

In other words, we don’t want to relinquish property at this juncture and give up the potential appreciation on any portion of it because we see more upwards pressure on pricing than we do the opposite.

As a matter of fact, with inventory levels hovering where they are currently, the monthly appreciation is expected to be 2-3% per month (and no, that is not a misprint.)

Furthermore, we see not just property values rising, but rental rates rising as well.

Focus on the Facts

Regardless of the events in Eastern Europe, or the interest rates, or inflation, or COVID –– the housing stock of our country is shockingly below where it needs to be and the 20 – 40 offers per listing indicates that demand is nowhere near abating (and yes, we track the number of offers, it is a phenomenal measuring stick for market momentum.)

As a matter of fact, since the beginning of 2022, the increase in interest rates has not impacted pricing whatsoever –– despite the predictions otherwise.

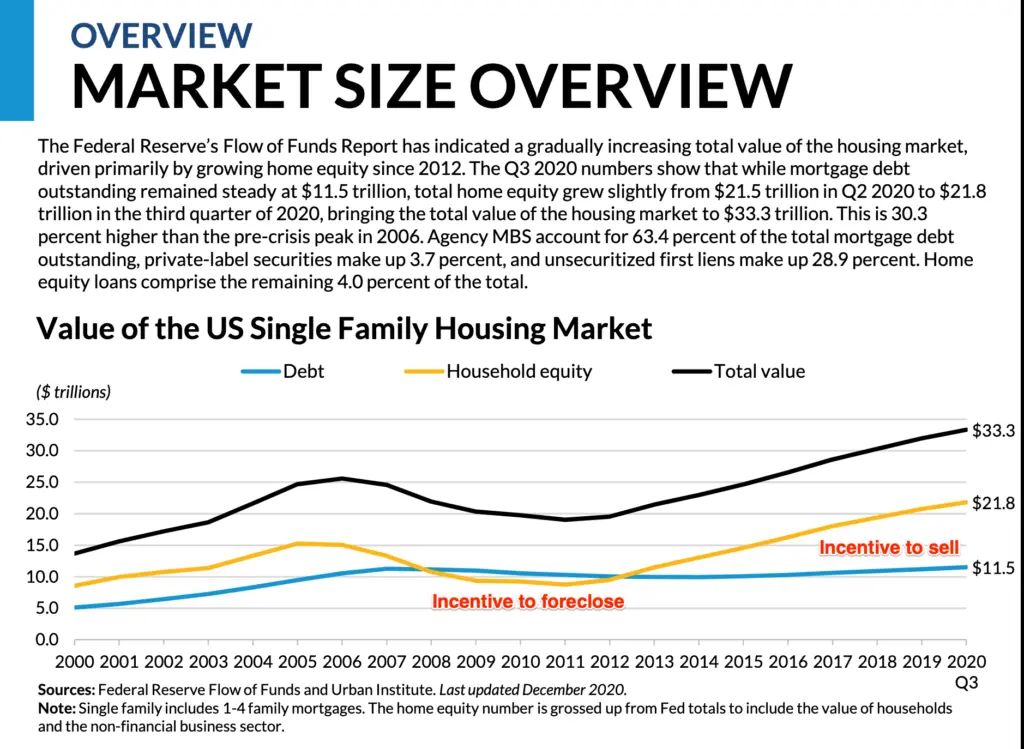

Am I being myopic and ignoring market crash indicators that will become obvious after the fact? Perhaps, but having lived through 2008, I am acutely aware of the conditions that caused that market to crash last time and none of those conditions exist today.

When your market is 5M houses undersupplied, it is hard to see how things change.

The bottom line is that we see pricing continuing to escalate, with only a soft landing and flattening when the market returns to balance sometime in 2026 or 27 if we are lucky –– not the 30% drop of 2008. The lack of inventory makes a huge adjustment highly unlikely.

So just to reiterate, my money and my mouth are in the same place –– and we lived through 2008.

Have? Have Not?

The bottom line is that property ownership is increasingly becoming the dividing line between haves and have nots.

It isn’t fair, but it is an unfortunate reality (you can read more about my opinions here.)

The policies and decisions that led us to this predicament are long standing and incredibly tough to reverse. And even if they are ever reversed, the time required to build enough homes to satiate the demand is well over the horizon –– especially at the market’s entry price points.

Housing has never really been, nor should it ever be, a short term thing –– like 1,000 shares of Apple or Bitcoin. You buy housing to own it for a years.

So yes, we are both buyers and strategic sellers –– but more than anything, we are owners and will continue to be so for the long haul.