‘Why do we need a Realtor?’

In my early years, I used to get offended by that question. Probably the main reason was that I didn’t really have a good answer. Uhhh … contract … MLS …. Lockbox … you need us!

But as I have aged in this industry, I actually have come to enjoy being asked the question. Why? Because it gives me a chance to educate the clients as to our role and the value we add.

I can cook, but I am no chef…

Sometime in the late 1990’s, as a thank you gift from a client, a personal chef came to our house and cooked a meal for us. It was the first time I met Ellie Basch.

Now, for those who have ever been on the receiving end of a Jarvis-prepared feast, we are pretty good cooks. I am not saying we are ready to compete on any cooking shows, but you will not feel cheated if you get to eat at Chez Jarvis. My wife’s tenderloin is restaurant quality and I am pretty adept anything grill related. So, as competitive as I am, I could not wait to see if the personal chef (Ellie) was that much better than we were.

Long story short, she was.

Ellie not only made us an absolutely awesome meal (and it was so awesome that we still use her for the One South holiday party some 10+ years later,) it was how she went about making it that was equally impressive. She made it in a stranger’s kitchen, wasted no food, created about 1/10 of the mess we would have and brought it all together at not only the exact same instant, but at the perfect temperature. Lastly, she did what would have taken us several hours and did it 30 minutes, tops.

In all honesty, it was not only fun to watch, it was a great life lesson about being an amateur and being a pro.

You can putt on my lawn, but it won’t be any fun…

I have another good friend who is the superintendent at an upscale golf course. Now, as he will readily admit, growing grass is perhaps the simplest form of agriculture imaginable. Everyone, at some level, can grow grass – seed + water + dirt + waiting – it is not that hard.

But just know this – golf courses, when at their best, are being pushed to their limits of health in order to create conditions most desirable to the golfing community. In key parts of the season, particularly the summer months, it his job to take the grass to the edge without killing it.

So imagine managing 200 acres to its limits each and every day, with multiple types of grasses growing in varied soils, varied shade conditions, highly varied air circulation conditions and varied moisture conditions all while trying to anticipate Virginia’s schizophrenic climate. If the National Weather Service gets it wrong by 5 degrees, especially during the peak summertime, you can kill an entire golf course.

Talk about pressure …

The short version is that my friend is equal parts scientist and artist. He takes what are an infinite number of variables (nature) and makes sense of them all. He not only has to answer to himself, he answers to those who only see the results but rarely understand the constraints. His work is so good it is considered elite not just here locally, but at a national level.

And you know what else? He makes it look easy.

But real estate is easy …

For anyone who has even been through a real estate transaction, it can appear easy, especially if the agent you are working with is an accomplished pro. Realize that the biggest part of the reason the transaction is easy is the advice they are providing and the work they are doing that you never see.

Doctors, mechanics, accountants, stylists, PR people, architects, graphic artists … and yes, chefs, golf superintendents and Realtors … we all do things that the public rarely sees and consequently doesn’t fully appreciate. Yet thanks to HGTV, Zillow, Trulia, Houzz and Pinterest, the myth that real estate is a D-I-Y endeavor is perpetuated.

It is unfortunate because it is just not that easy.

So you can be your own Realtor, but should you?

It didn’t take Ellie 30 minutes to make my meal, it took her 10 years and 30 minutes to make my meal.

It didn’t take my golf buddy a few hours to lay out the protocol for maintaining green speeds on 97 degree days, it took him 15 years and few hours to lay out that protocol.

And guess what else, despite how it sometimes seems, it didn’t take me (or any other Realtor) a few hours to sell your home or find you the perfect home – it took us far longer.

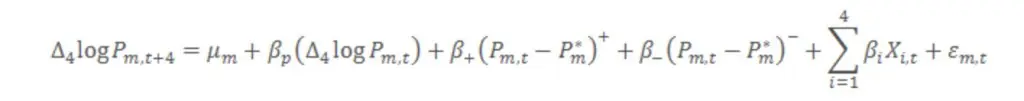

The information and knowledge that we convey to our clients each and every day may seem like we just went to MLS and pushed the ‘meaningful statistic’ button … we didn’t. Odds are the analysis we did was pulled from the latest market data and created exclusively for you.

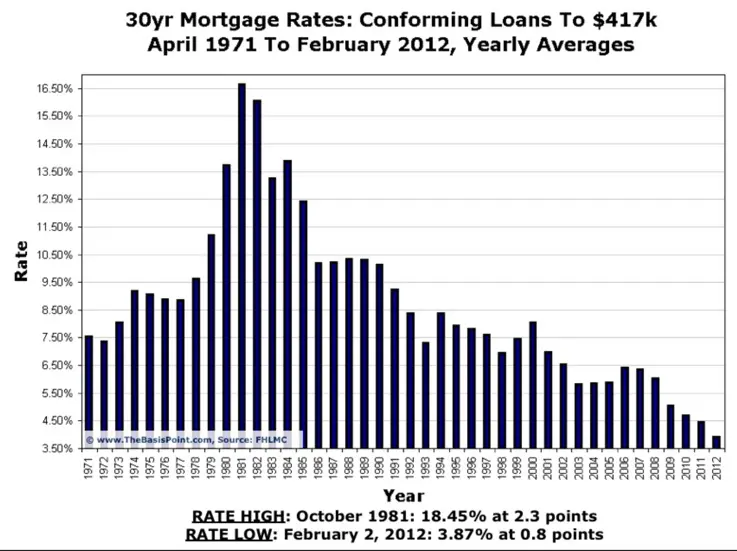

While getting a real estate license is relatively easy, becoming a true pro is not. A good pro agent has a feel for values, trends, appraisals, incentives, geography, contract structure, marketing, data, analysis, competition, human nature, staging, design, construction, schools, zoning, finance, rental rates, law and negotiations (and yes, this is an abbreviated list.) We also have to keep up with changes in technology, continuing education, both local and national development and what goes on in Washington, DC. It is not easy.

When a good agent makes a recommendation, it is based on far more than you can find on one of the thousands of websites dedicate to D-I-Y real estate.

Hire a pro. You will be happy.

Micro or macro?

Micro or macro?

At the end of the day, helping clients understand where they stand in the market means impacting their financial health in the greatest of ways. How you market your listings matters … the same way understanding deeds, inspections, RESPA, Fair Housing, construction materials and zoning matters. But if you don’t understand the underlying value of what you are buying and selling, then the rest of it matters far less (and if you read any of our blog posts with any regularity, you know we spend a lot of time

At the end of the day, helping clients understand where they stand in the market means impacting their financial health in the greatest of ways. How you market your listings matters … the same way understanding deeds, inspections, RESPA, Fair Housing, construction materials and zoning matters. But if you don’t understand the underlying value of what you are buying and selling, then the rest of it matters far less (and if you read any of our blog posts with any regularity, you know we spend a lot of time