Dear Property Owners,

The entire real estate world is doing you a disservice.

Sincerely,

Past Sales

Our industry is set up to determine values of homes based on the sale of other homes considered to be ‘similar.’

The determination of what is similar is largely based on location, size, features as well as timing. Sales occurring in the recent past are weighted more heavily than those in the distant past. This method (commonly referred to as the ‘Comparable Sale Method’ or using ‘COMPS’) is the primary basis upon which home values are estimated.

What is a Comp?

The logic behind the use of the COMP goes something like this – if House A sold for $X, House B sold for $Y, and House C sold for $Z, then your house should sell for some weighted average of the three, provided the COMPS used are the most appropriate ones available.

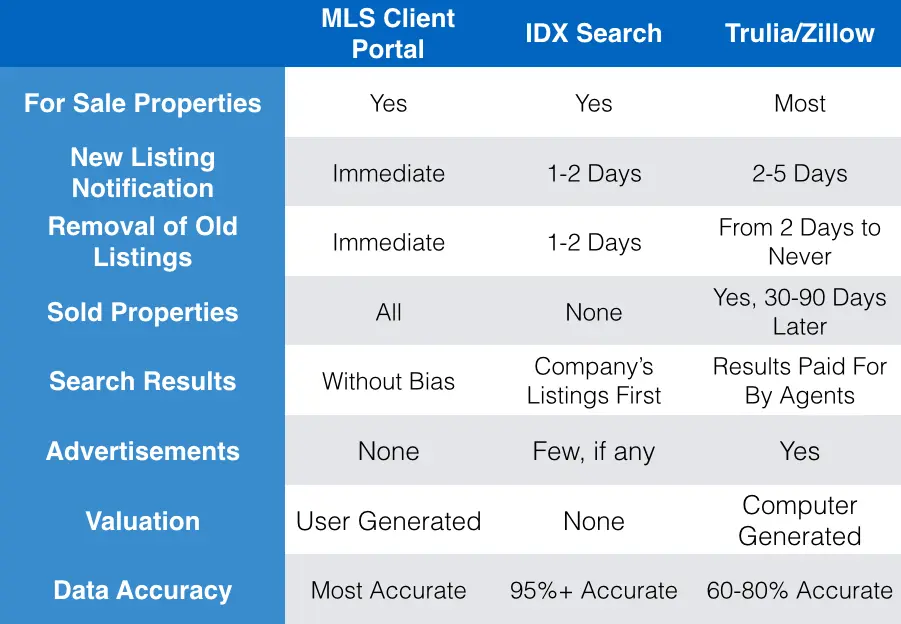

The Competitive Market Analysis (or CMA) that a Realtor performs to determine pricing uses this ‘COMP-based’ method, as does the formal appraisal performed by your bank to determine loan conditions. The Assessor’s office uses a similar method when it assesses your home for tax purposes (they look at neighborhood sales) and Trulia and Zillow use a combination of COMPS and assessments to (incorrectly, usually) arrive at their estimate of the value for your home.

But is this the best method?

The Future or the Past?

Lets ask this – Do you drive a car by looking in the rear view mirror? The answer is obviously ‘No’ as most of us spend most of their time looking out the FRONT window (or looking down at their cell phones, but that is a different issue.) We look out of the front window because we are concerned with where we are going and the dangers our journey presents. Stated simply, we are more concerned with future events than past ones.

We (Realtors, Sellers, Buyers, Bankers, Appraisers, Homebuilders) have all been trained for so long to look at the COMPS for guidance and COMPS are events which have occurred in the past.

Take a look at the chart below – it tracks the trailing 24 months of homes going under contract.

Do you notice any seasonality? Yeah, me too.

What happens if the three COMPS you used to price your house in June were from April? Or December? Do you think you have made a correct pricing decision?

Comps are Easy, Unfortunately …

The core issue is this – COMPS are easy to measure and thus prevalently used.

It is unfortunate.

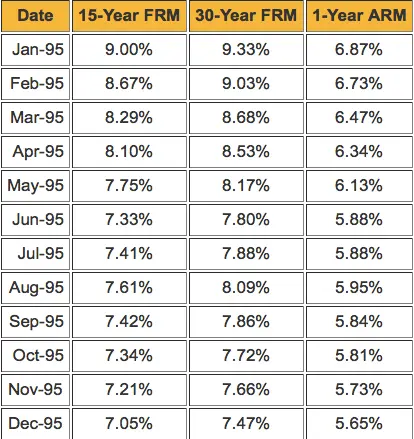

The COMP is not a fact, per se, it is a result. The reasons someone else paid a specific amount for a home at a point in the past is a combination of many complex inputs which do not lend themselves to easy analysis. Inventory levels, interest rates, consumer confidence, seasonality, the ‘Wealth Effect’ created by the DOW and NASDAQ, mortgage rules, Dodd-Frank, job growth (regionally/nationally/internationally), population trends … all combine to influence buyer behavior.

When you look at the number of pending sales generated in 2010 (chart below), do you think think that April did a good job of predicting May?

This is not to say that using COMPS to help price a home is without merit as understanding what has happened recently is a good place to start. If you can determine a point from which to begin your analysis, it is of great help. Establishing patterns in past behavior has value…it is just that using COMPS exclusively falls short, especially in a dynamic market. The quicker the market shifts, the less value any individual COMP has (see the example above.)

Pricing Should Look Both Directions

Ultimately, a pricing model is not complete without some projection of future events and relatively simple tools exist to help drive the analysis. While predicting the future is far more challenging, it is not impossible, especially given the almost universal access to information we all have. The tools we use for analysis are cheap and easy to use and some level of predictive intelligence is achievable in almost all situations.

Pricing any asset for sale SHOULD be undertaken with the mindset of ‘what behavior from our audience are we EXPECTING?’ and that can only be achieved by looking into the future, as murky as the view may be.

We have talked at length about building a new home in a series of posts.

We have talked at length about building a new home in a series of posts.