It is probably the most asked question by the selling public when interviewing agents for the sale of their home. I think it is often misunderstood.

Each agent has a standard response to this question (it is usually some type of list) where they will tout all sorts of activities designed to impress the seller. Some are these actions are critical and some, well, not so much. As a matter of a fact, I once saw an agent that had broken down the home selling process into ‘113 Simple Steps’ (I kid you not.) I always wondered if skipping a step meant failure, but I honestly didn’t have the heart to ask.

While choosing an agent to represent you in the sale of your home is important, it is not simply about tasks (otherwise ‘Mr 113 Steps’ would win every time), it is about applying the correct tools to the correct situations.

Below you will find some questions to ask and a list of things we can do for you.

What Type of Sale is Required?

In theory, all housing is unique. In realty, much housing is very similar.

How an agent would approach a sale in Founder’s Bridge is largely the same as in Tarrington. That said, selling a condo in a historic warehouse will differ greatly from selling a home on 15 acres in Goochland. The key is knowing what works in which segment.

The geographic location, the time of year, the price of the home, the type of property, the buyer’s likely profile and the age of the home all drive the correct mix of techniques. A spring open house in the Museum District for a property priced below $400,000 might mean 100 people or more touring the property in a 2 hour period while an open house on the same day in rural Hanover County might not generate a single tour. Similarly, putting a vinyl sided colonial built in 1992 in Estates and Homes magazine is probably not money well spent.

Just know that the ‘one-size-fits-all’ technique employed by many agents is the wrong way to go about it. Find an agent with not only a big tool kit, but an understanding of when to use each.

To Team or Not To Team?

One of the trends in our industry over the last decade has been the rise of the real estate ‘Team.’ Teams named for the lead agent or for some esoteric concept have sprouted up everywhere. In my opinion, teams are a good thing.

The rise of the team is important because it acknowledges that at each level of real estate, increased specialization is beneficial. From pricing to marketing and syndication strategies to contract administration to understanding the nuanced requirements of selling in historic or mixed-use environments, the more specific knowledge a team can bring, the better the level of service for the client.

At the end of the day, the collective value brought by a team based approach is generally better than the ‘one agent island’ employed by the majority of agents in any given market.

How Important is Zillow to Selling a Home?

When Zillow was launched in the 2006 (and cousins Trulia and Realtor.com soon thereafter), it changed our industry. By bringing the home search process out from behind the MLS curtain and putting it on public display, it forever changed the public/Realtor dynamic.

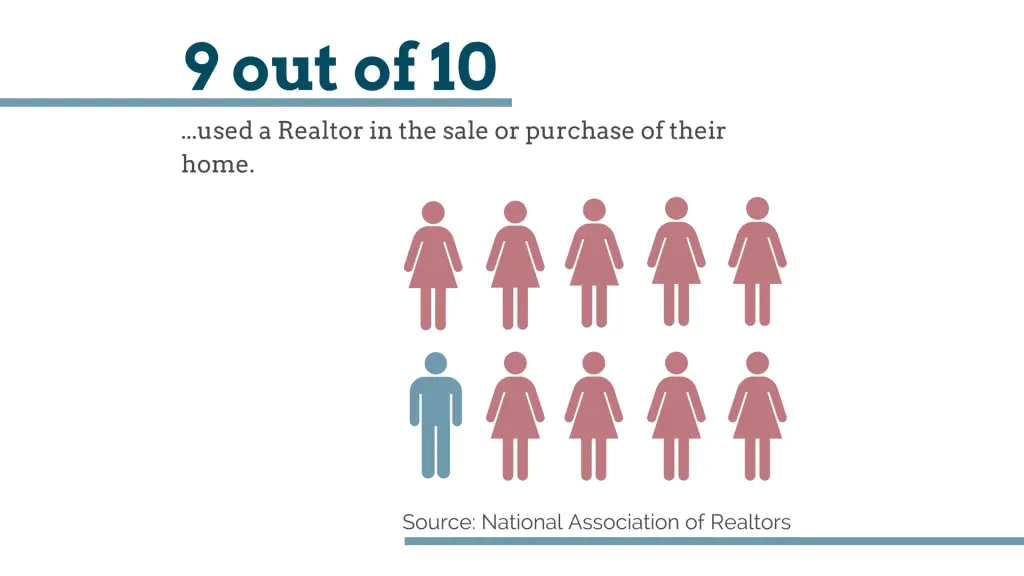

The narrative that Zillow, Trulia and Realtor would have you believe is that they disrupted the SALES process … which is, in fact, untrue. The percentage of For Sale By Owner is at its lowest point in history and the percentage of buyers employing a Buyer’s Agent is at its highest.

What Zillow changed is the SEARCH process … not the SALES process. It is a subtle, yet an important distinction.

This is the key takeaway – these platforms that allow Realtors to promote properties almost instantly across a network of websites have changed how we, as agents, acquire new clients, but it has not really changed how properties are sold. When we (Realtors) adopt an aggressive digital strategy that heavily leans on Z/T/R, the reality is that we benefit more than you do.

Be careful in mistaking an agent’s Zillow strategy as a marketing plan for your home – they are two different things.

So How Can You Tell the Professionals?

So How Can You Tell the Professionals?

When you know how to correctly apply the tools, your metrics improve.

We will put our metrics up against any other company in the Metro:

- Our marketing times are low

- The pricing to our sellers is above the Metro average in terms of price AND of ‘price per foot’

- And the ratio of the sold price to list price is nearly a full percentage point higher than the market average

You can read more about the way One South compares to our competition here…

Examining how well a brokerage performs on these metrics will go a long way in determining how well they know which tools work best for any given situation.

The List of Stuff We Do

All that said, if you just want a big giant list, here it is …

- The MULTIPLE LISTING SERVICE is a big part of our every day. Keeping the database current takes time and know that agents are fined or otherwise punished for non-complinace. Oh, Zillow and Trulia would not exist if it was not for the data contained in MLS.

- We spend an inordinate amount of time on the VALUATION of properties. We help sellers understand values and we help buyers understand values.

- We PROVIDE INSIGHT, GUIDANCE and PERSPECTIVE. Of all of the things we do, trying to explain how we are going to help you navigate an unforeseen issue before it arises is hard. Sometimes, problems are easy to predict (short sales are more likely to have title issues, old houses are more likely to have inspection issues, condos are more likely to have lending issues) but being able to handle the last minute issue that can derail closing is what we do every day.

- We hold OPEN HOUSES for our clients and we will often do OPEN HOUSES for the brokerage community to introduce new properties to the marketplace.

- One of the primary ways we raise awareness is via the E BLAST where we send new listings, price changes and other updates to the brokerage community.

- ZILLOW – see the section from above. Managing Zillow, as well as TRULIA, REALTOR.com and the hundreds of other sites vying for the public’s eyeballs takes a great deal of time and effort to do right.

- People still love a well done PRINT BROCHURE. Despite the digital movement and the ubiquity of online information, the public wants one … so we continue to create them.

- PROFESSIONAL PHOTOGRAPHY is a must. While cameras, cameraphones and a host of other ways to capture and improve images exist, when the pros shoot it, it just looks better. Use them.

- The LOCKBOX helps record who goes in when and reports a ton of information. We should place one on your front porch/door/railing to provide protection for your key.

- Often, on the sign, we will place an INFO BOX so that when someone walks/drives by, they can grab a shortened version of the brochure and find out some basic info on the house. The Zillows and Trulias of the world have largely rendered the need for the info box obsolete

- Some swear by the VIRTUAL TOUR while others are more ho-hum about it. Well done photography can often times be stitched together to create the VT, but nothing replaces an actual tour.

- Individual PROPERTY WEBSITES can be very important, especially when the property rises to a certain level. If the home is architecturally important or very specific details are required to tell the story, the a site dedicated to the property should be created. We do this in-house, typically.

- The rise of VIDEO in our industry is unmistakable. The problem is, well done video is hard, expensive and time consuming. In a market where properties are moving quickly, video may not be worth the effort. It depends on the goal.

- In any given day, especially in the spring, ANSWERING INQUIRIES thoughtfully and correctly has consumed the day. An agent’s job is to answer the inquiry (from both the public and peers) in such a way that generates showings. It is an art.

- You would be surprised how much time is spent SCHEDULING. Life goes on despite a For Sale sign in the front yard and trying to coordinate everyone’s schedule (buyer, seller, agent, family, inspector, contractor, insurance agent, appraiser, running late, running early, need to reschedule) can be as time consuming as any activity we do.

- Any good agent is also adept at SHOWING. A typical showing will take close to 2 – 3 hours ‘all-in’ when you include preparing, printing, travel time, actual demonstration of the property, turning lights on (and off) and locking up. And often times, we show up, meet the client and show the property only to find out afterwards that they are already working with a Buyer’s Agent who they never called to show them the property.

- Obtaining FEEDBACK that is relevant and valuable is also an art. It takes time and you have to be diligent. Buyer’s Agents are busy and don’t normally have the time to stop what they are doing and tell you why their client did not like your home. Good listing agents are diligent about the feedback loop.

- We NEGOTIATE CONTRACTS and then we NEGOTIATE INSPECTIONS. Remember, contracts are combinations of a price AND terms. Many tend neglect the terms in exchange for price and it is a shame. So much seller benefit can be gained by focusing on the terms of a deal. Without going into too much detail and giving away all of our secrets, we firmly believe in negotiating with a plan in mind. Know where you stand. Know the market. Know your goals. Negotiate accordingly.

- Lenders/Loan Issues delay closings more than any other reason. COORDINATING WITH THE LENDER is the most critical thing we do while the home is under contract. Making sure the lender has copy of all of the paperwork, contract, addendum, pest report, necessary inspections, addenda, HOA Docs and every other piece of paper they need in order to get the loan underwritten and in the closing queue to make sure we do not miss a date. As a matter of a fact, One South views this piece as so critical, we have an entire staff dedicated to making sure that the lenders have what they need from us.

- COORDINATING WITH THE CLOSING ATTORNEY is as equally important. They need the same things as the lender (plus a few others) and with the volume of sales flowing through the system right now, getting everything to the closing attorney promptly (or making sure the Buyer’s Agent did) is a big part of representing you client.

So How Can You Tell the Professionals?

So How Can You Tell the Professionals?

Selling and Buying at the Same Time

Selling and Buying at the Same Time Good loan officers will ask the right questions and determine which process is best for you, but since in many cases, you have no idea of the skill or experience of the person you may be talking to about Pre-Qualification or Pre-Approval, my desire to arm you with the information to know which one is best for your success. When in doubt…never be afraid to ask your loan officer and go over your situation. Also, always be up front and honest about your circumstances. Gone are the days where lenders will not find out about any financial skeletons. Your loan officer is working to help navigate you thru the right process and the ultimately the right mortgage. Full disclosure is critical to his or her ability to provide that service. Rule number 1 for any great loan officer…always put your borrowers in the best possible position to succeed with their purchase transaction and ultimately in homeownership!

Good loan officers will ask the right questions and determine which process is best for you, but since in many cases, you have no idea of the skill or experience of the person you may be talking to about Pre-Qualification or Pre-Approval, my desire to arm you with the information to know which one is best for your success. When in doubt…never be afraid to ask your loan officer and go over your situation. Also, always be up front and honest about your circumstances. Gone are the days where lenders will not find out about any financial skeletons. Your loan officer is working to help navigate you thru the right process and the ultimately the right mortgage. Full disclosure is critical to his or her ability to provide that service. Rule number 1 for any great loan officer…always put your borrowers in the best possible position to succeed with their purchase transaction and ultimately in homeownership!

Typically lenders do not want to fill a pipeline full of active loans without real property addresses or fully ratified purchase agreements. It would force them to devote valuable human resources to borrowers who may or may not ultimately purchase a home or even use that lender for actual mortgage transaction once a purchase agreement is executed. It would raise lending costs due to the increased resources and slow the process down for “live” loan applications. Instead, they will tag you as “lead” or some other similar category, do all of the necessary ratio calculations, produce the Pre-Qualification letter and move on to the next call or email while you are completing your home search and /or negotiating your transaction.

Typically lenders do not want to fill a pipeline full of active loans without real property addresses or fully ratified purchase agreements. It would force them to devote valuable human resources to borrowers who may or may not ultimately purchase a home or even use that lender for actual mortgage transaction once a purchase agreement is executed. It would raise lending costs due to the increased resources and slow the process down for “live” loan applications. Instead, they will tag you as “lead” or some other similar category, do all of the necessary ratio calculations, produce the Pre-Qualification letter and move on to the next call or email while you are completing your home search and /or negotiating your transaction.