‘Overbuilding.’

‘The white elephant.’

All of these terms are a way of describing a home that somehow is out of place from a value perspective. Perhaps it is too nice or perhaps too big — but the home exceeds what the market would be willing to pay for it based on its location.

What is a Market Cap?

Imagine a neighborhood of modest vinyl sided 2,000 SF two story homes with 1 car garages whose average sales price is $300,000. And then imagine you see a 4,000 SF 5 bedroom home, made of brick, with exotic hard wood floors, central vacuum, pool and hot tub and a 3 car garage sitting right in the middle. Do you think that the brick home will sell for $600,000? I doubt it.

A market cap is nothing more than a price above which people are unwilling to pay in a certain area — regardless of how good the deal may appear or how many features the home may have. Generally, the egregious violations of the market cap concept are relatively easy to spot — as in the example above.

But finding market caps can become far more difficult when you are looking at infill opportunities or substantial renovations.

How Do You Find a Cap?

Finding market caps is as much art as it is science, but if you know how to look, spotting caps can become relatively easy.

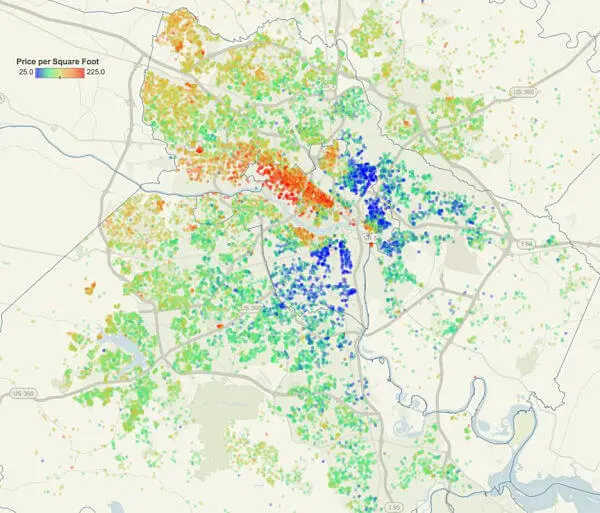

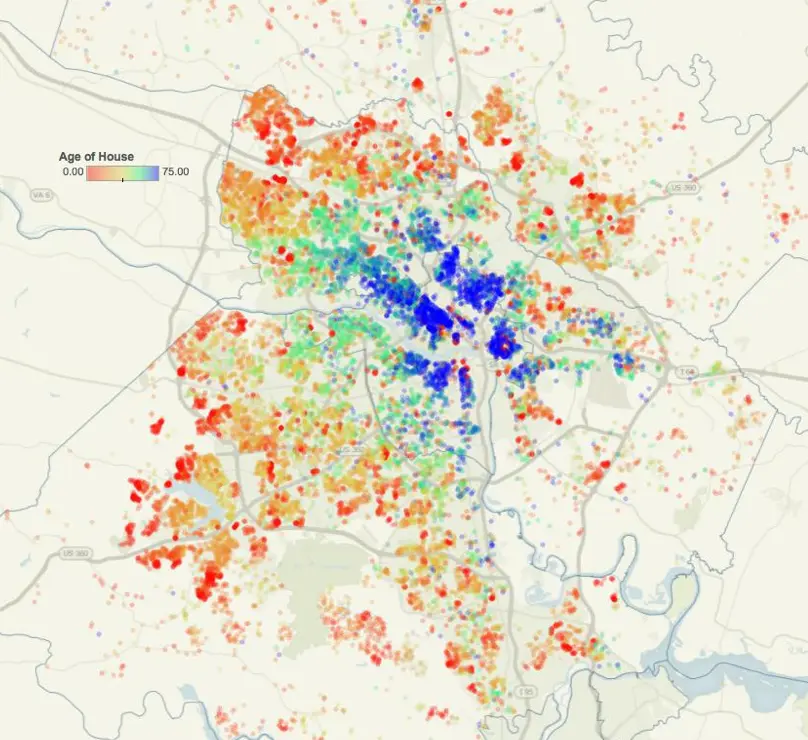

The Multiple Listing Service (MLS) tracks all sorts of statistics — from home size, age, features and materials to a tremendous amount of data about geography, prices and marketing times — and we can use the data to look for radical changes in behavior.

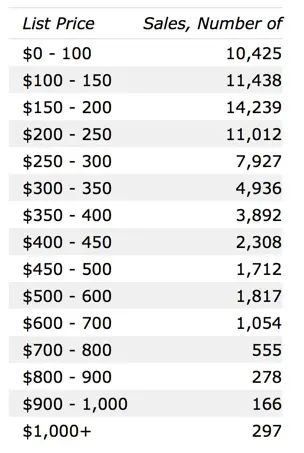

Take a look at the chart below — when you plot the marketing times for houses against the % of asking price that sellers receive in the Lee Davis High School District, you see radical changes in buyer behavior above $500,000. Both marketing times spike and % of ask plummet — effectively saying that the market is substantially less willing to pay more than $500,000 to live in this area of town. And when you creep above $600k, the resistance is even more pronounced.

Lets compare Lee Davis to Midlothian High School — you see a gradual softening in demand become far more pronounced in the middle $500’s.

And finally, to Deep Run High School — you see pretty consistent demand until you reach the $700k mark — at which point demand begins to soften.

As you can see, geography influences caps. Each area has a price above which buyers are hesitant to pay and it can be found by looking for sharp departures in market behavior.

Why Do Caps Matter?

Using the examples above —

- Would I buy a home for $800k in the Lee Davis HS District? Not if I knew I might need to sell it quickly or in the near future.

- Would I feel comfortable with spending $200,000 on a renovation on home in Salisbury (Midlothian) that I bought for $400,000? Probably …

- If I were a builder, would I build 10 new $1M speculative homes in the Deep Run HS District? Nope.

At the end of the day, we all need to be cognizant of where caps exist, if for no other reason than to protect our investment. Just because the home will appraise or just because the ‘per foot’ value seems to be in line does not mean the market will agree when it comes time to put the For Sale sign in the front yard.

Be aware.

If 2016 is anything like 2015, we are going to see home prices rise.

If 2016 is anything like 2015, we are going to see home prices rise.