“I want to invest in rental property.”

“I want to flip houses.”

“I am thinking about owning some apartments … what the deal with those?”

We hear this constantly. And we love it because it means someone else is in the nascent stages of realizing what many have known for years – owning property is a fabulous way to build wealth.

Here are some things to consider.

Toilets Never (OK, Rarely) Break at 2:30 in the Morning …

It is amazing how many people have a fear of rental property and summarize their fear by saying, ‘I don’t want to be fixing a toilet at 2 in the morning.’ A quick secret – I have owned rental property for well over 20 years and I have yet to have a toilet break at 2 in the morning (and yes, I realize how badly I am jinxing myself). Have I had inconvenient timing on repairs? Of course. I even had a fire destroy a building (and no one was hurt, thankfully) but the unforeseen is the reason you buy insurance.

At the end of the day, the benefits of ownership far outweigh the cost of maintenance. When you grow your portfolio to a certain point, then you hire a management company and download the burden of maintenance to someone else.

Credit Reports Tell All

If you take nothing else from this article, please take this away – understanding what a credit report is telling you is the number one way to eliminate unnecessary work from your portfolio. While a busted pipe under the house is an annoyance, its impact is minimal when compared to a habitually late tenant or one who requires eviction.

Every time I found myself in front of a judge filing a ‘Pay or Quit’ notice or Unlawful Detainer, it was because I ignored my inner voice and took a flyer on someone with a marginal credit profile. All credit is not created equally … you need to understand what cause credit scores to fall and more importantly, why. I would far rather lease to someone with a bankruptcy or foreclosure than someone with a judgement from a landlord and utility company.

What Feels Comfortable?

I don’t have a great understanding of the retail market and thus, I own no retail space. I am also not familiar with executive rentals, so I don’t have high end residential properties for lease. I have a far better feel for 1 and 2 bedroom apartment rents, suburban and urban office rents and 3 bedroom house rents in good school districts. So guess what I own? Yep, apartments, some office and several single family homes in good school districts.

If you are going to invest in property, buy what feels comfortable to you. You will inherently have a better feel for the market and you will worry far less.

Know Finance

The best property owners do one thing extremely well – they correctly finance their properties.

Securing the lowest interest rate for the longest period is important, but sometimes flexibility can be important, too. Partial releases, renewal options, penalty-free payoffs, floating rates, caps and assumption clauses can all impact finance, too. Typically, if just a single family home, the Fannie Mae/Freddie Mac investment products will suffice, but when you begin to look into multi-unit properties or acquisition/rehab strategies, finance changes.

Correctly financing your property minimizes risk and increases cash flows.

Management Companies and Tenants

I like to think that there are two kinds of renters – future buyers and habitual tenants – and you need to treat each differently. Management companies, like Realtors, attorneys, architects, Doctors or accountants, do different things well. Don’t assume that a management company is good at managing all types of properties. Know who will best manage your property.

In Richmond, for example, the Downtown market can have student apartments, young professional apartments, ‘work force’ apartments and ‘affordable’ housing in close proximity. Each of these properties should be managed differently and often times, those who are good at one type are not as accomplished at the other.

Exit Strategy

Buying investment property can be easy relative to the sale investment property. The number of buyers for a single family home in (say) Brandermill is far greater than the number of buyers for a 12 unit apartment property in Jackson Ward. It does not mean that you should or should not buy one or the other, it just simply means that it may be easier to quickly unload a single family home than a 12 unit (or more) property.

Likewise, the way you sell each is different, too. A single family home rental offered for sale should be vacated, cleaned up and renovated to achieve maximum value while an apartment property should be sold while fully leased. Make sure to manage the leasing of the property well in advance of the sale to give yourself the best chance to maximize the contract price and minimize marketing time.

Summary

I highly recommend ownership of property as a vehicle to wealth accumulation.

Despite the ups and downs of the for sale markets in the last decade, rents have increased substantially and are currently as historically high levels. Having someone living in your property, making the payment to the bank through the rents they pay and hopefully putting a few dollars in your pocket along the way is one of the most risk free and time tested way of creating wealth over time.

And if your toilet breaks at 2 am you can call me to complain …

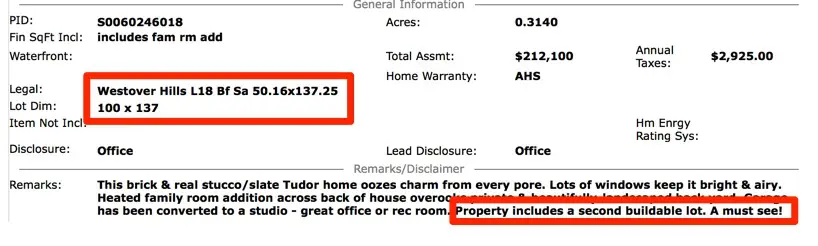

‘How much a foot?’

‘How much a foot?’