I have never met someone who loves uncertainty.

Making decisions under pressure, not having the luxury of all of the facts, guessing about the future –– these are all unnerving feelings. But they are all a part of every real estate transaction.

Guess what I do for a living?

I am a broker of real estate. I am a purveyor of uncertainty.

Uncertainty is the Constant

Do you know the only guarantee that comes with buying a home? You own it. Most everything else is largely out of your control.

Your job could change.

Your health could change.

The economy could (ok, will) change.

The school district could change.

They could build an interstate in your backyard … or expand the airport nearby.

A parent might need to come live with you … or a child might move back in.

I could go on and on.

Yet, we ask ourselves to make one of the most important financial decisions of our lives when we really have no clue as to what tomorrow may look like.

Feels a little unsettling, doesn’t it?

So, if you are feeling overwhelmed by the sheer weight of the decision, here are some things to make you feel better.

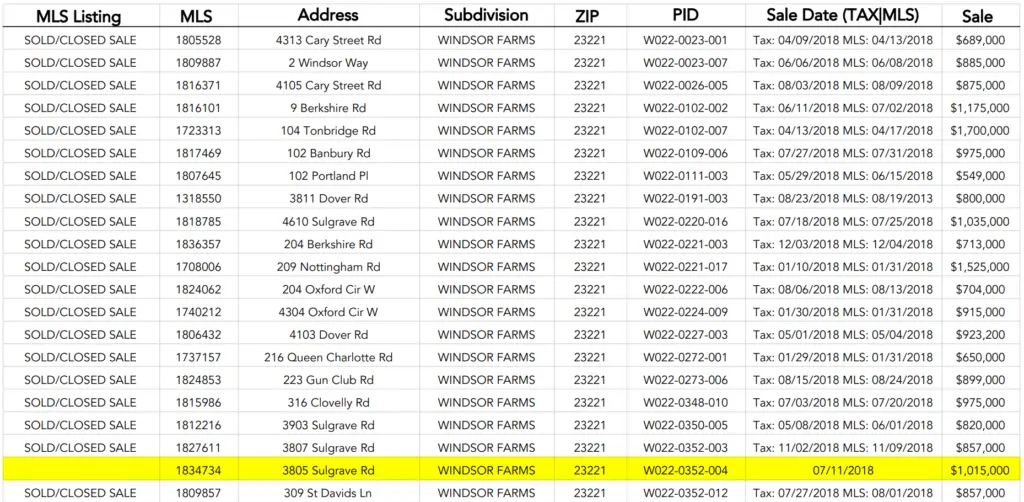

The Market Tends To Rise

With the exception of The Great Recession (‘08 to ‘11) and the Great Depression (‘29 to ‘35), home values, in the aggregate, have risen.

Has every neighborhood and every house gone up in value? Of course not, but when you look at the overall market, the answer is that in roughly 80 of the last 90 years, home values have gone up year over year.

That is pretty consistent performance.

And just so you realize –– there has not been a 10 year period where home pricing was lower overall.

Hopefully, that should make anyone who takes a long view of housing feel better.

2008 Is Unlikely to Repeat

Many buyers, especially those who are entering the market for the first time, only know the results of the cataclysmic financial crash of 2008, and not necessarily the cause(s). While the fear of it repeating seems only logical, the conditions that led to 2008’s crash are nothing like the conditions of today.

One of my favorite scenes, ever (NSFW tho). The Big Short is a must watch if you want to see the 2008 crash from the inside out. And RIP Anthony Bourdain…

2008’s crash was about ridiculously loose underwriting (i.e – the creation of unqualified buyers) and a corresponding massive overproduction of unnecessary housing to keep pace with the artificial demand, coupled with some extremely fraudulent practices by Wall Street. Right now, getting a mortgage is more difficult than it has ever been, housing inventory is still down by 60 to 70% and the Dodd-Frank regulations have taken steps to ensure the fraudulent activities of 2008 don’t happen again anytime soon.

Could another unforeseen event cause an economic calamity? Of course, but NOT owning a home isn’t the defense.

Owning is Risky. Renting is Riskier.

Ok, so my house value is probably safe (especially over the long term,) but what happens if I buy a bad house? What if I buy a home that is poorly built or poorly renovated and requires thousands of dollars in repairs? Like what if the AC goes bad the day after I move in and I have to replace the entire unit?

All of that could happen for sure (home inspections tend to mitigate this occurrence), but I would ask the question –– what happens if you don’t buy a home and keep renting? Something worse, that’s what.

The cost of renting is far greater than the cost of even some of the most expensive repairs. Renting now costs anywhere between $12,000 to $30,000 per year … and getting worse. And, with home pricing increasing at roughly 3-6% per year, the cost of waiting 12 months is arguably anywhere from $25,000 to 50,000 depending on your rent and the price of the home you are purchasing.

In my nearly 3 decades in this business, I have yet to see an unexpected $25,000 repair, much less a $50,000 one.

So the risk of ownership, while it isn’t $0, it is far less than being a renter. Don’t believe me, ask your landlord’s opinion.

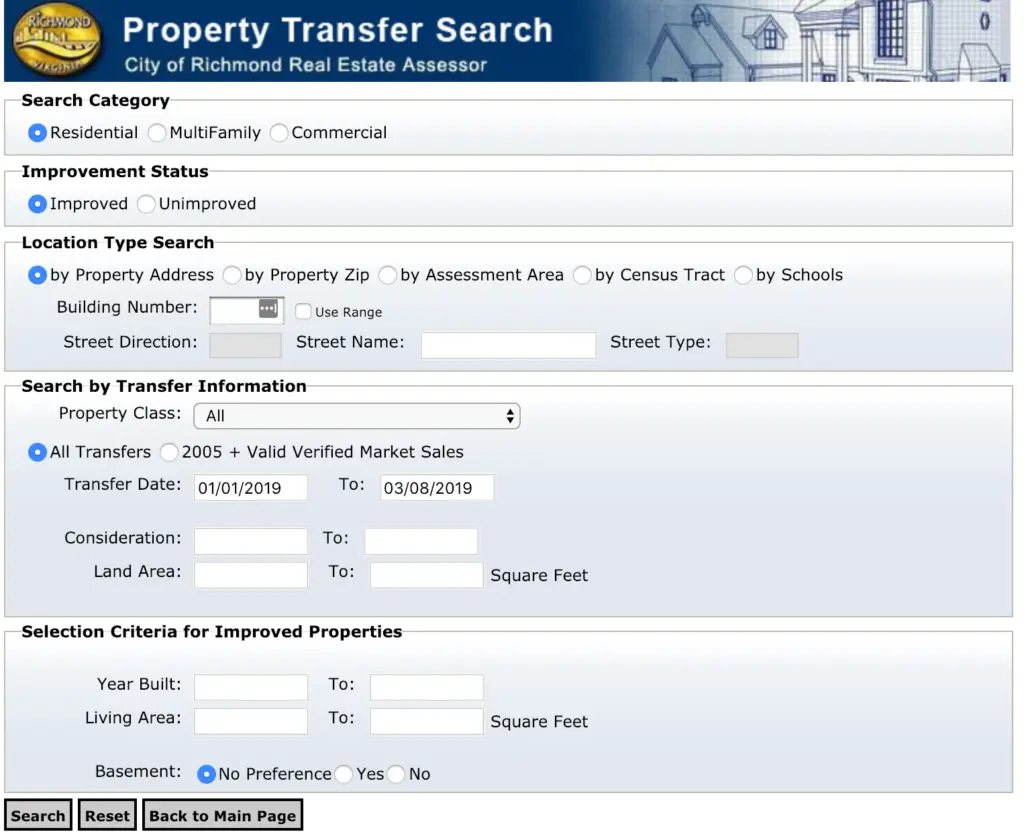

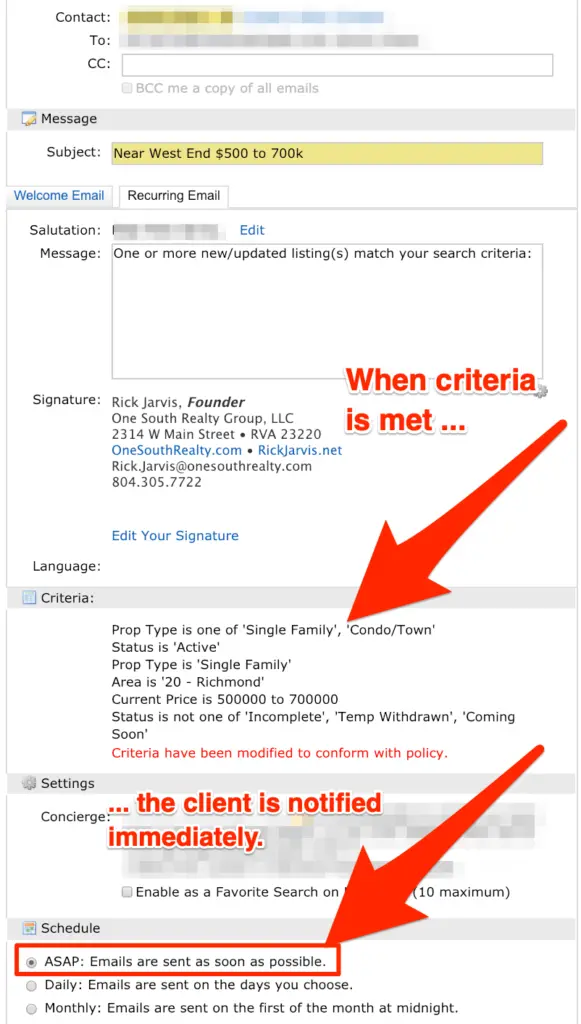

Perfect Information Simply Isn’t Available

Above, we only touched on the uncertainty of ownership and not the uncertainty inherent in the process.

Think about what goes through your head when you are involved in a transaction –– What is the right offer?? How many offers are they going to get?? Am I paying too much?? Will they accept less?? What if the market shifts?? What if my inspector misses something?? What if the appraisal comes in low?? What if my loan gets denied?? Is my escalator too high or not enough?? What if the perfect house comes out right after I go under contract??

While they are all legitimate questions, there are few concrete answers –– even after the fact. The lack of perfect information means never really knowing the answer for many of the questions we all wish we could answer. At the end of the day, you have to make peace with the vagary of the process and trust that making decisions without all of the facts is not as risky as it might feel.

Summary

While it is in our nature to want to avoid uncertainty, those who succeed the most in this world embrace the uncertainty around them and take advantage of it.

Knowing that everyone is uncertain somehow makes your own uncertainty far easier to accept. For every question you have, so does everyone else –– and this puts us all in the same boat.

Is ownership for everyone? No, of course not.

Does every transaction work out? Again, no.

And are past results a guarantee of future performance? Nope.

But, right now there is nearly $16 TRILLION in home equity in the US.

SIX-TEEN TRILLION DOLLARS!

That is $16,000,000,000,000 (if you would like to see it written in numeric form.)

$16T is a substantial number.

Owners get the benefit, renters do not.

So don’t overthink it. Acknowledge the uncertainty, do your homework, and take the long view. Good decisions in housing are surprisingly easier than you might think.