I will always have a soft spot in my heart for July.

My wife is a July baby.

My oldest daughter was born in July.

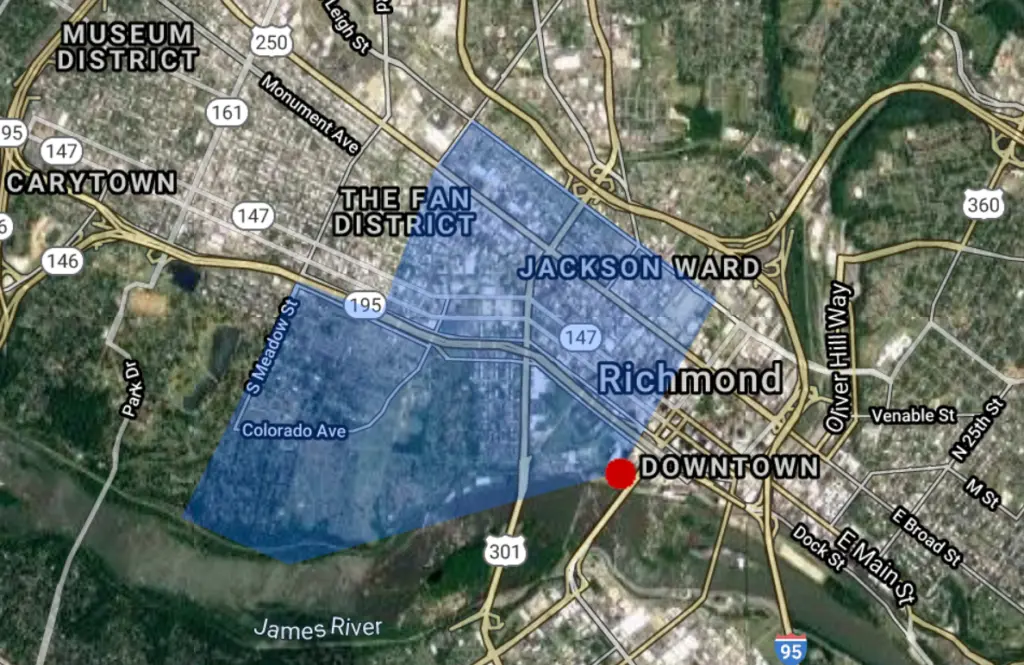

5 years ago, in July, we moved from our old office into our brand new renovated office in the Fan.

And ten years ago in July, we should have gone out of business.

Before the Bubble

In case you don’t remember, 2008 was the year everything changed for the real estate market. The economy that began to really gain speed in the early 2000’s still seemed to be robust, and though we were beginning to see some weakness at the upper price points, development was healthy and opportunities were all around us.

In the last half of 2007, we had made the decision to open One South. We saw an opportunity for a more progressive brokerage that had both a residential and commercial aspect to it. Everyone thought we were crazy. Perhaps we were; or perhaps just crazy enough to make it work.

We were actively recruiting, making hires, finalizing logos, and doing all of those tasks that you do when you are opening a company.

We were equal parts optimistic and oblivious.

One South is Born

So on January 2, 2008, we opened the doors and went to work. Our new signs went up on properties, our logo was proudly displayed on Main Street, and the Realtor community was asking ‘Who are these guys and where in the heck did they come from?!’

For the first 6 months of the year, we went gangbusters. We had convinced some really great agents to come over and were making a bigger splash faster than I would ever dreamed possible.

We represented numerous redevelopment projects — The Emrick Flats, The Reserve, Tribeca Brownstones, the Cary Mews, and the Marshall Street Bakery — and had quickly developed a reputation as the go-to city development folks. It was a great position to be in.

And then it happened: we had a purchaser of one of our condo units get their loan denied for no real reason. It was 2008 and the middle of July. And for the first time, I sensed that something was bad was happening and it was bigger than we could imagine.

July of 2008

When you are a Realtor in the spring, you are busy.

When you are a Realtor in the spring trying to sell and recruit, manage, market, hire, and grow, you are really busy. And you are aren’t really paying attention to the nightly news and the reports of rising defaults in the subprime sections of mortgage.

So when, on July 30th of 2008, former President Bush signed the Housing and Economic Recovery Act that gave the Treasury Department the ability to prop up a collapsing banking industry, it was the first inkling that this wasn’t a blip on the radar but rather, a long and cold winter was coming.

For a company as small as ours, with no history and little working capital, we had big problems on our hands.

We Were Lucky, and Good

Maybe it was fate, maybe it was intelligence, or maybe a little of both, but we had aligned ourselves with smart people and smart bankers. We all recognized that we needed to figure out the best way to get our collective exposure down and get the unsold units we were marketing sold and sold fast. And if Fannie Mae and Freddie Mac were not going to make loans, we needed to figure out a way.

We worked together. Price adjustments, creative incentives, some good hard nosed selling, and a dogged determination to succeed got us through and even earned us several new engagements. We developed a bit of a playbook for solving problematic projects (that we still use today) and earned the equivalent of a PhD in mortgage finance.

Slowly but surely, we managed to maintain growth despite a market that lost 30-50% of its value and a Realtor population that dropped by nearly the same amount by the end of 2011.

July of 2013

But by 2012, we could feel the change coming.

Inventory levels were falling. Prices were leveling out. Banks were coming out of receivership.

We decided to double down on ourselves and started looking for our next home. In December of 2012, we were able to secure 2314 W Main Street, the old Kicker’s HQ, known to all for the soccer player murals on the side of the building and construction began.

7 months later, in July of 2013, the renovation was complete and we took possession of a 8,000 SF mixed use industrial chic renovation in Richmond’s Fan District.

It was a proud moment and a testament to how far we had come.

July of 2018

We recently had an event in our space to celebrate One South’s 10th birthday. We invited many of our architect, contractor and developer clients who had allowed us to help them dream and execute their vision through the creation of new housing.

- We opened with 5 agents and 1 staff member. We now are basically 100 agents and staff in two locations.

- We sold a little over $20M in real estate in our first year. Last year we sold over $200M in real estate.

- When we opened, we had 4 projects we represented. That count now exceeds 30.

- Maybe 5% of our business came from the commercial side in 2008. We now have about 35% of our business come from our rapidly growing commercial team, including two $20M+ sales this year.

- And finally, we have been named in Richmond Biz Sense’s RVA 25 for the past two consecutive years as one of Richmond’s fastest growing firms (the only real estate brokerage to make it back to back!)

July of 2028

So as we prepare for fall of 2018 (is it really August already?) and continue to fight the inventory shortage, we are full steam ahead.

We continue to work on creating a better experience for our clients and our agents, and to grow our own knowledge and capabilities. The real estate market is ever changing and the minute you think you have it figured out, you find yourself playing catch up.

We can’t wait to write the July update in 2028.

Want us to do a special study for your preferred area or neighborhood? E Mail us today at

Want us to do a special study for your preferred area or neighborhood? E Mail us today at