The Escalator Clause

A quick market update –– As I write this in January, we have already been involved in several multiple bid situations with not just our buyer clients, but with one of our listings, too.

So to repeat, it’s January … of 2019, and the market seems to think it is April … of 2017.

To quote the great Roger Daltry, “Meet the new boss. Same as the old boss.”

The Who’s Don’t Get Fooled Again still resonates 40 years after its release, doesn’t it?

When the market is tight and demand exceeds the number of houses that are available, prices tend to rise. And when inventory conditions are extremely tight and multiple buyers want the same home, many buyers will employ a clause that will raise the price of their offer based on what the next most competitive offer states.

This additional contract language is called (in most circles) the Escalator Clause.

What is an Escalator Clause (or EC)?

An EC basically states that a purchaser will, under a specific set of circumstances, increase (or escalate) their offering price based on what the highest competitive offer says.

Pro’s Tip –– The best way to win a bidding war is to not get in a bidding war. When you are in a highly competitive market, act decisively early. When you take your time to go see that new listing, or let negotiations drag, the likelihood of another buyer submitting a competitive offer increases. When two buyers want the same house, the seller alwasy wins …

Instead of simply offering a higher fixed price, the EC creates a conditional offer that can automatically increase based on the price and terms offered by the other offer(s).

Clear as mud, right?

Well let’s explore the EC, step by step.

The Contract Price

In the large majority of purchase offers, the buyer will offer a contract to the seller that states:

- the price they are willing to pay

- the terms under which they are willing to pay it

- the condition of the home that they are willing to accept

at settlement - the targeted date upon which settlement will occur

These elements, plus many others that are not particularly important to this discussion, are included in any contract offer to purchase a home.

Disclaimer: No two contact situations are the same and thus it is impossible to discuss every possible combination of scenarios. The scenario described below is somewhat typical, but competing offers can vary by price, escalation language, finance types, closing dates, inspection caps and a

In cases where your offer is the ONLY offer made on the property, a few rounds of back and forth between the two sides are typically required to get the remainder of the terms worked out to each side’s satisfaction –– and an EC isn’t required.

But what happens when two (or more) offers come in on a property? That is when one side (or sometimes both sides) may employ an EC.

Pro’s Tip –– We wrote about bidding wars from the seller’s perspective here in ‘How to Start a Bidding War.’

The EC Contract Price

So while the contract includes a firm price, the EC makes the offer price conditional on several factors

- what the next best (competitive) offer is

- what the maximum offer

is how much the offer will exceed the competitive offer by

Let’s use real numbers.

So let’s say the home is listed for $300,000 and the seller receives two offers.

- Offer A states that the purchasers will pay $300,000 for the home. It does not contain an escalator clause.

- Offer B states that the purchasers will pay $295,000 for the home but it contains an EC that states that, in the event that a bonafide competitive offer is also submitted, Offer B will escalate the price to $2,000 above the other offer, but not to exceed $310,000.

In this scenario, Offer B escalates to $302,000 under the terms of the EC.

Disclaimer –– Sellers are under no obligation to accept a higher offer. Furthermore, they do not have to supply a reason why they accepted the offer they did. So even if you escalate your offer to an amount greater than the other offer, a seller may still choose to accept the lower one. While it is not typical to take less, it is probably more common than you think and can be incredibly frustrating.

The Maximum (or Walkaway) Price

Note in the prior example that the EC stated that their offer will not exceed $310,000.

So in effect, regardless of the other offer, in no case will Offer B go above $310,000. This basically puts a cap on the escalated offer so that the purchaser is protected and insanity doesn’t ensue.

This maximum (

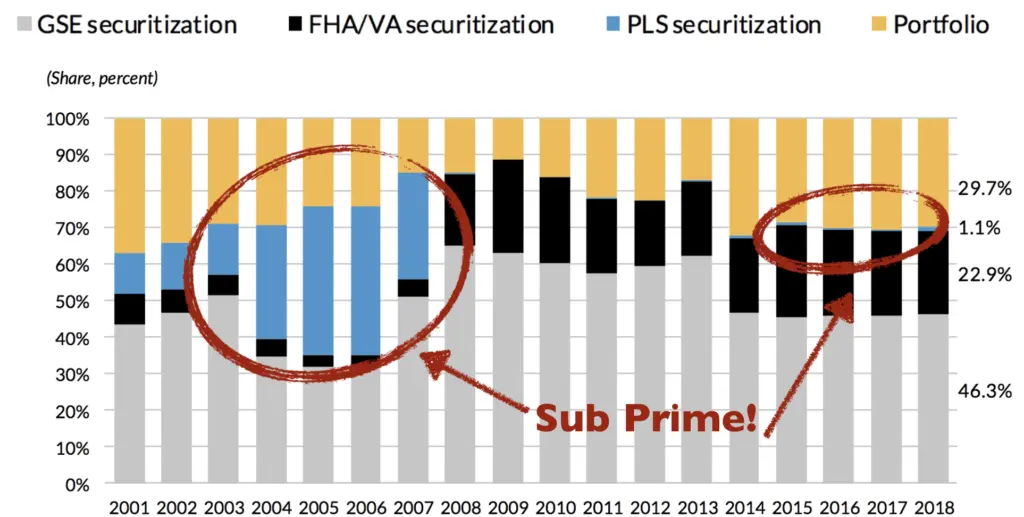

In cases where the purchaser is using a low down payment loan, an offer that escalates the contract price well in excess of the asking price may introduce a scenario where the appraisal will be lower than the contract price. If the purchaser has insufficient funds to cover the difference, the loan will likely be denied and the purchaser could find themselves in a pickle.

Pro’s

Tip –– In especially hot market segments, often times two or more offers contain escalation clauses. Winning in a ‘multiple-offer-with-escalators’ scenario requires a cool head and an experienced agent.

Another point to note is that losing a home by a small amount when you would have been willing to pay more is a tough pill to swallow. If you set your maximum at $310,000 and lose to an offer of $311,000 –– but would have paid $315,000 –– it stings. So we always counsel our clients to make the maximum offer the price that, if you lose to a higher offer, you walk away without a pang of remorse.

Sometimes, the other side just wants that house more than you do and there is nothing you can do but tip your hat to the winner and start the search process over again.

The ‘Beat It’ Number

This is key –– the ‘Beat It’ number is the amount by which you will make your offer exceed the competitive offer.

Using the above scenario, if Offer B’s EC said that they would exceed the other offer by $50, would that be enough to change the mind of the seller? Probably not, especially if the other offer contained a bigger down payment or other seller friendly terms.

But what if you exceeded the other offer by $100 –– would that do it? Or What about $1,000 –– is that enough? Or is $5,000 higher required to make the seller take your offer over another one?

Pro’s Tip –– Often times, you make an offer only to find out that during the negotiation process, another offer comes in. In this scenario, you can add an EC to your offer if you feel strongly about winning.

The answer is that no magic formula exists to tell you the correct answer. Just know that the amount by which your EC exceeds the next best offer is case specific and should take into account the strength of the other terms in your contract.

Choose the Beat It number carefully –– the amount by which you will exceed the other offer needs to be enough that the seller accepts yours, but not so much that you are throwing money away or placing yourself in financial distress.

Conclusion

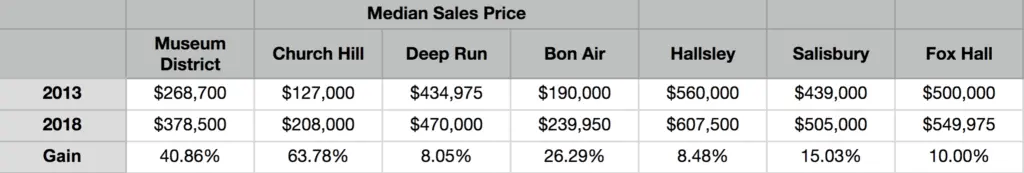

As we discussed in our last blog, the market is on the leading edge of a ‘return to normalcy’ where bidding wars and multiple offer scenarios will become less commonplace. That said, we aren’t there yet and many market segments (affordable/close-in) are still largely undersupplied. Expect to continue to see the need for the EC in these segments.

Furthermore, the use of the EC is not the only tactic a buyer (and their agent) can use to win competitive offers. We tell our clients that a contract dedicates two paragraphs to price, but another 10 pages (or more) to the remaining terms. Each one of those terms creates an opportunity for a shrewd buyer to offer the seller a concession that can improve the value of the contract.

So don’t feel that you always have to use an EC to win –– especially if you are a cash buyer or can offer other seller friendly terms.

At the end of the day, the EC is an advanced technique and if applied incorrectly, can cause a buyer to unnecessarily

So as 2018 comes to a close, be thinking about the fact that you will soon be getting a note from your management company notifying you of your new water temperature … errrr … rental rate for the coming year. If the landlord does their job right, the increase won’t make you leave –– it will be just enough to make you grumble, but stay.

So as 2018 comes to a close, be thinking about the fact that you will soon be getting a note from your management company notifying you of your new water temperature … errrr … rental rate for the coming year. If the landlord does their job right, the increase won’t make you leave –– it will be just enough to make you grumble, but stay. No, it isn’t a trick question. And no, I am not looking for a finance major to explain time value of money or fungibility or another economic argument about scarcity, risk, or inflation.

No, it isn’t a trick question. And no, I am not looking for a finance major to explain time value of money or fungibility or another economic argument about scarcity, risk, or inflation. Cost Doesn’t Equal Value

Cost Doesn’t Equal Value