Editor’s note – as this article goes to press (January 20), market activity (the RATE of sales) is trending about 15% above last January’s pace per MLS statistics. According to our own anecdotal evidence, we are feeling the same exact thing having already participated in several bidding wars/competing offers and seeing extremely tight inventory conditions. We touched on the likelihood of a robust spring in our 2016 Outlook post.

So the calendar now says January.

The parties are over. The kids are back in school. The scale is your enemy and your New Year’s Resolutions are still taped to the mirror. One of the goals for 2016 is to find a new home and while the spring seems far away when it is 27° outside, May is not as far away as it seems.

When?

So the question everyone always wants to know the answer to is ‘when?’ As in:

- When does the spring market begin? (sooner than you think)

- When should we start looking? (now)

- When do the bidding wars start? (soon)

- When do we start going to open houses? (now)

- When do we make contact with an agent? (now)

- When should I talk to the mortgage people? (now)

Yes, ‘now’ and ‘soon’ are self-serving answers, but also true, and here is why – the best decisions are made when time is ample and surprises are few.

Time Pressure

Making decisions under pressure is no fun. If the spring of 2016 is anything like 2014 and 2015, you will probably be involved in a bidding war to buy the house you want, (or at least the threat of one) especially in the under-supplied markets. If you don’t believe me, ask one of your buddies who bought last March or April and see what they say.

Overpaying for a home or offering terms that are uncomfortable in order to win a bid happens more often when you are in a time crunch. When your lease is about to expire or you have to be out of your house in 30 days because it has sold, your options decrease.

Early > Late

So how do you combat time pressure? You guessed it – get started early. Getting started early offers you several distinct advantages.

First and foremost is benefit of market knowledge – knowing what is a good deal, and what is not, comes from paying attention to what sells quickly as well as what doesn’t. Watching the market for a few weeks is not nearly the same as watching it for several months. Along with the benefit of superior knowledge, being able to offer ‘rent-backs,’ flexible closing windows or other ‘bidding war friendly’ terms comes when time is your partner and not your adversary.

And for those sellers, ask yourself this question – how long would it take you to get your home on the market if you found the perfect place to buy? If your answer is measured in weeks, then you are probably going to miss that perfect opportunity.

The Numbers Tell the Story …

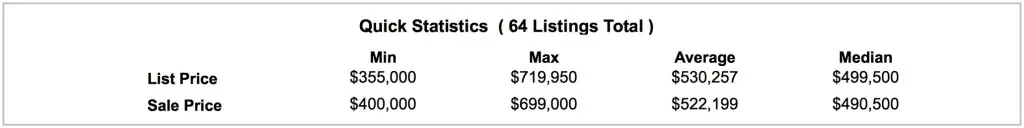

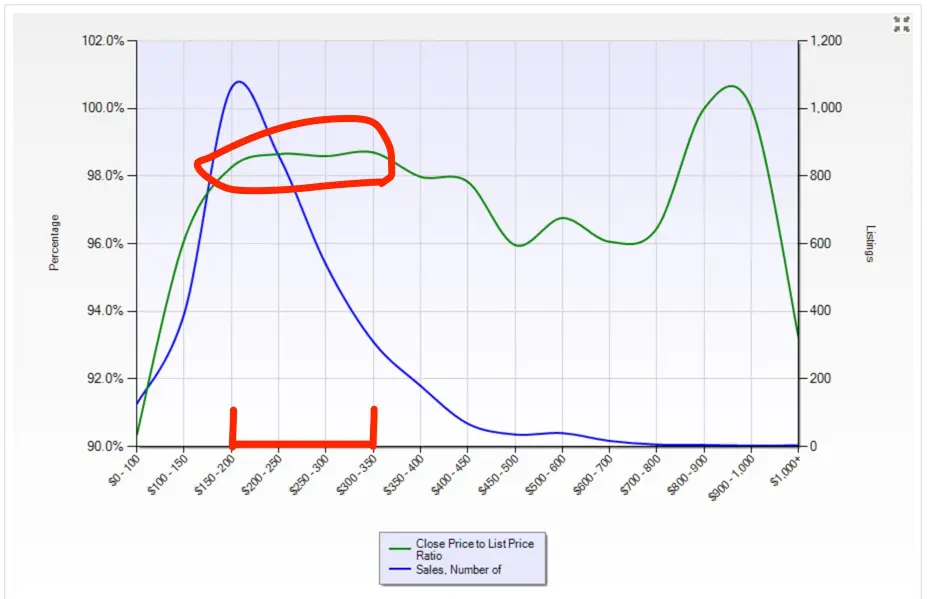

Take a look at the chart below that show the number of NEW PENDING sales (it measures the time when houses go under contract):

Look at the rate of increase from December to May each year – the rate of sales basically increases by 100%. Not 20% … not 50% … ONE HUNDRED PERCENT INCREASE!

Time On Your Side

So as you can see, once the calendar turns to 1/1/16, the real estate world starts to change and things begin to accelerate … and accelerate rapidly. And while you may not be ready to move just yet, getting started early allows you take your time, watch the market and get your financial ducks in a row. Give yourself time to make the best decision possible and on your optimal schedule.

So does it mean you have to buy a home on January 1? No. It means you need to get started early and begin to do the things that put you in the best position to win when the opportunity presents itself … even if the perfect time isn’t until March, April or May.

Getting started 5 minutes too early is far better than getting started 5 minutes too late. Buying a home can be pressure-filled under the best of circumstances, so don’t make it harder on yourself by making time your enemy.

All industries have jargon … real estate is no different.

All industries have jargon … real estate is no different.

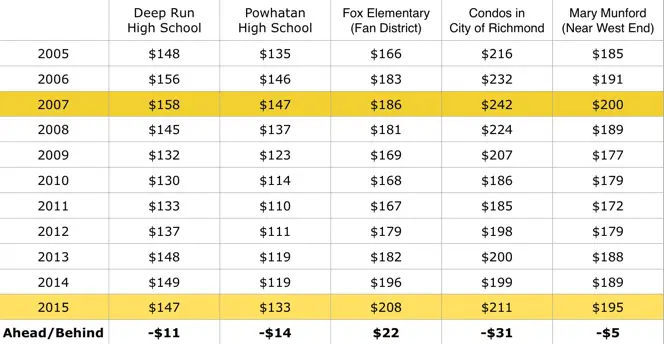

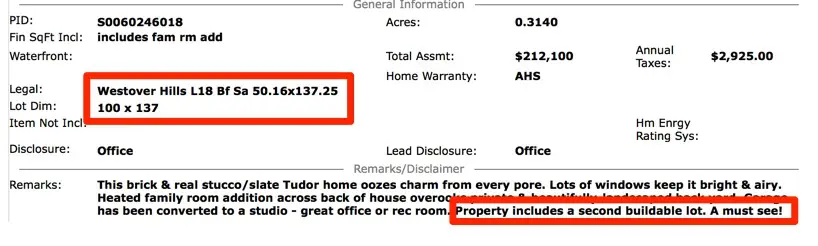

Micro or macro?

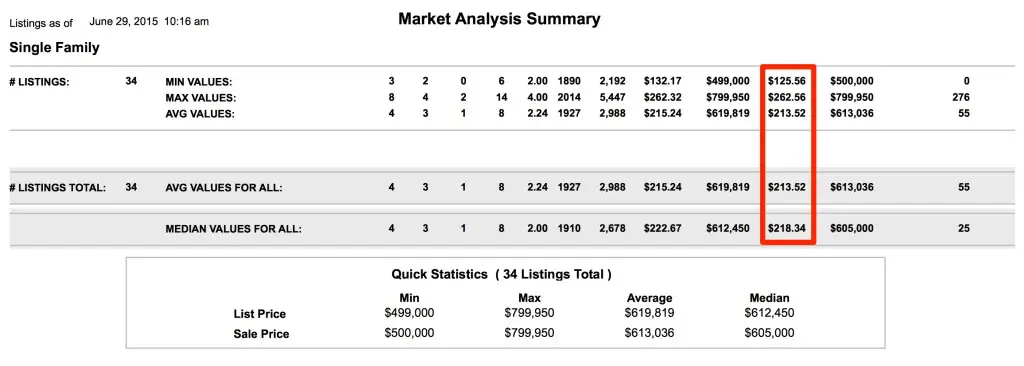

Micro or macro? ‘How much a foot?’

‘How much a foot?’