In the real estate business, the focus of almost every conversation is price.

‘How much are they asking for their house?’

‘What is the assessment?’

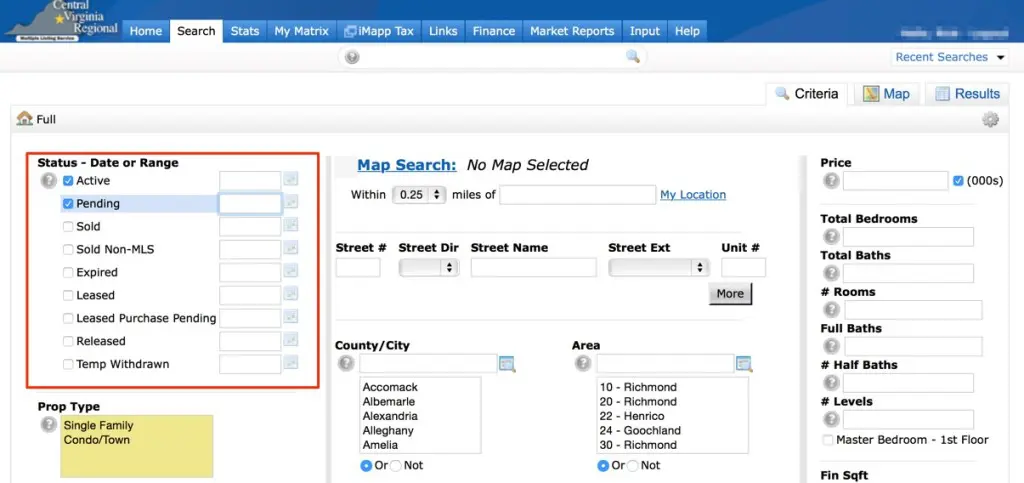

‘What does Zillow say it is worth?’

‘They paid WHAT?!?’

‘The offer is for HOW MUCH?!?!’

You never hear:

‘I can’t believe the rent back was for 3 days!’

‘The due diligence request was TOTALLY reasonable and allowed for the correct framework for agreement.’

‘Wow! What a shrewdly written escalator clause!’

Listen, the price a property transfers for is obviously important, but it is not the only part of making a good deal. Many other factors contribute to the making of a really great deal, other than what someone paid.

Price or Terms, You Decide

A real estate contract is made up of two things – the PRICE for the property and TERMS under which both sides must abide. It is the former that garners all of the attention but it is the latter that matters more in many cases.

Look at it this way – how much space in the contract is dedicated to each aspect?

In Section 4 of Page 1 of the Richmond Association of Realtors Residential Purchase Agreement, you will find the following language discussing price:

“The purchase price of the property is __________, which shall be paid to the seller at settlement, subject to the prorations described herein…

The standard contract then goes on for another 8 pages to cover the other items that go along with the purchase of a home!

Just to clarify – the purchase price is handled with one sentence yet the rest of the contract is 8 pages long. And just so you realize, the contract is 8 pages BEFORE adding the required disclosures and any addenda.

Does that tell you anything?

Did you realize the ‘Standard Provisions’ alone run from A through K? Did you realize that Section #21 is labelled ‘Other Terms’ and is blank? Did you realize we can add as many addenda to the contract as we need to?

Wow.

Terms

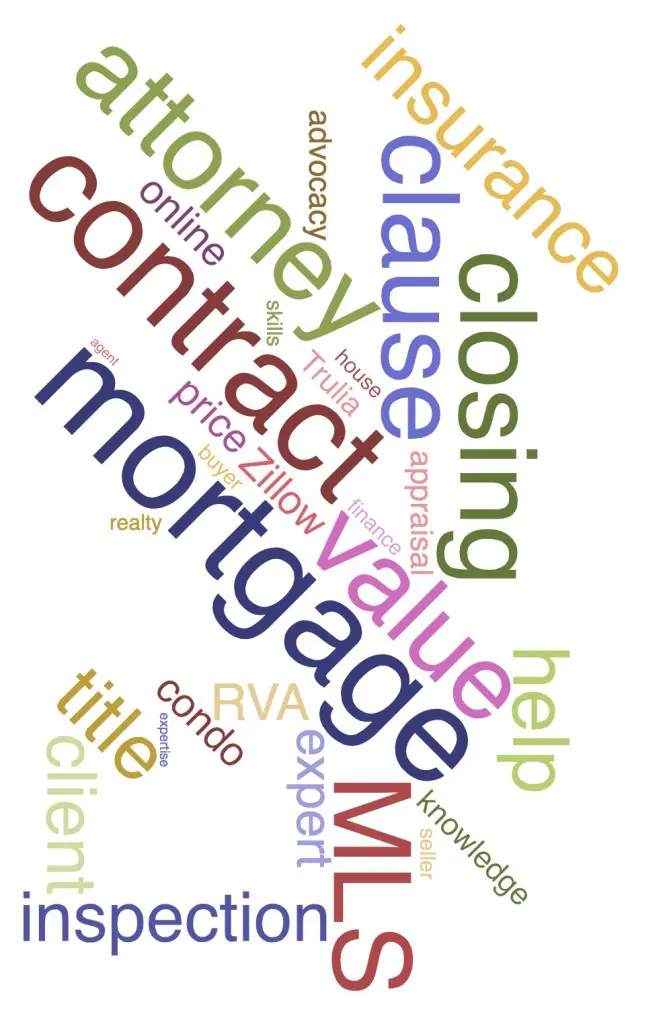

The contract cover numerous bases:

- Financing

- Inspections

- Title

- Numerous Disclosures

- Closing

- Fees

- Representation

- Default

While it is not standard practice to negotiate each of these individual points in a standard residential contract, there is room to push and pull in order to either create wiggle room or close some outs (depending on which side you are on.) When you begin to examine other types of real estate contracts (commercial property, leases, options, land, new homes) then you introduce elements that fall outside of the generally accepted norms.

At One South, we pride ourselves on having a great deal of exposure to contract structures and practices due to our experience in many different arenas. Here are some things to think about.

Know Your Outs

Getting into a contract is easy but getting out can be hard, expensive, or worse – both!

Knowing on the way in, how you can get out, is important. And while you should not enter into a contract with someone for anything if your expectation is to get out later, if circumstances change and a seller is not in a giving mood, you may have to exercise an out.

In any contract, there are points where contracts can be far more easily ‘blown up’ than other points. Likewise, the closer you get to the settlement date the harder (and more expensive) it becomes. Understand the potential points in a contract where you can extricate yourself without penalty (or even lawsuit) before signing on the dotted line.

Know What Matters to Both Parties

This was an actual event — while driving home from vacation, my middle daughter in the front seat turned to my eldest in the back seat and said, ‘My sunglasses are in my bag in the back. If you get them for me, you can borrow my headphones.’ My eldest reached into the back and, without incident, got both the sunglasses and headphones. This NEVER happens in my house. NEVER. Any request made by one daughter to the other is generates a heated negotiation that usually involves me either turning up the TV or leaving the room.

This time, for reasons I am still unsure as to why they happened, it was different. My younger led with an offer of value to receive value. It was a stunning display of WIN – WIN. As a Realtor, I had never been so proud of my young negotiator.

The lesson is as follows — we all value things differently. My middle daughter does not hate my choice in music nearly as bad as her sister so her headphones were of far more value to the elder one. But since she was sitting in the front seat and we were driving west in the afternoon, sunglasses were important. It was a perfect trade.

For someone who is attempting to sell a home and buy another one, time and flexibility matter. Allowing a seller not only the time, but the certainty to go out a buy their next home is HUGELY important to them. The use of a ‘Rent Back’ agreement is appropriate.

I once saw a seller of a large lot home toss in the John Deer tractor for free … and the purchasing suburbanite with a push mower ate it up! The ‘Bill of Sale’ is the correct tool in this scenario.

Being able to pay in a currency that matters more to them than you is always smart.

Understand Contract Structures

A contract is a flexible and malleable instrument … it can do a lot of things. Having been exposed to not only the common practices in the residential market, but the commercial and development market has given us insight into a wide range of techniques.

In the recent spring markets, multiple offers were far too common. Securing the winning offer when 3 or more people are bidding is hard. Most offers in a competitive situation include escalation clauses. Writing an escalation clause that secures the property while simultaneously paying as little as possible is an art.

Another example might be a using study period (in lieu of property inspections) and/or other phraseology to limit exposure for both parties. Often times, limiting both upside and downside is a technique that can provide a framework for a buyer and seller to reach an agreement.

Lastly, when working with buyers that need to sell a property before they qualify for another, the ‘Contingent Upon Sale’ and/or ‘Right of First Refusal’ contract is often required. It is critical to not only understand the differences, but the correct application of these contracts to best serve the client.

I shudder to think of the number of times a bid was lost or a price was escalated unnecessarily from faulty structure or from not understanding contract options.

At the end of the day, trade price for terms and you will win far more than you lose.

Conclusion

This post could have been faaaaaaarrrrrrr longer.

It is hard to say demonstrate competent contract writing in blog form as each set of circumstances is unique. The subtleties and nuanced structures should vary by the parties involved, marketplace conditions and each individual’s goals.

And while expressing what we know succinctly is challenging, I think it is fair to highlight some of deals we have negotiated to give you a sense of the depth of our experience:

- 176 unit apartment to condo conversion

- Both the site acquisition and subsequent sales of new infill homes in Richmond’s Fan District sold prior to construction

- 100 acre land sale and rezoning from agricultural to commercial that involved parties from multiple markets

- Using a 1031 tax exchange construct to acquire a single vacation home by liquidating a 22 property portfolio

- Acquisition of several warehouses to be rezoned and subsequently renovated into Historic Tax Credit based mixed-use properties

- Lease purchase of a single family home in suburban Richmond

- Multiple new home sales as both listing agent an buyer’s agent

- A non-warrantable warehouse condo with partial seller financing

- Multiple acquisition/renovation and subsequent lot split in an urban neighborhood

- Thousands of single family homes sales as either agent or brokerage

We know a thing or two about using the contract to our client’s advantage.

So How Can You Tell the Professionals?

So How Can You Tell the Professionals?

Selling and Buying at the Same Time

Selling and Buying at the Same Time